Sioux Falls SD automobile insurance coverage could be a advanced subject, however figuring out the marketplace and your choices is a very powerful. This unique interview delves into the specifics, from commonplace coverage varieties and elements influencing charges to protection choices and guidelines for locating the most efficient offers. We will discover the panorama of insurance coverage suppliers in Sioux Falls, SD, and read about navigate the claims procedure.

We will additionally have a look at the have an effect on of using data, car sort, and private demographics on insurance coverage premiums, offering a transparent image of the standards that may have an effect on your prices. This complete information empowers you to make knowledgeable choices about your automobile insurance coverage wishes in Sioux Falls.

Evaluate of Sioux Falls SD Automobile Insurance coverage

The automobile insurance coverage marketplace in Sioux Falls, South Dakota, displays the nationwide developments whilst adapting to native stipulations. Premiums are influenced via elements like the realm’s demographics, site visitors patterns, and claims frequency. Figuring out those nuances is a very powerful for drivers in search of probably the most appropriate protection choices.The marketplace gives a lot of insurance policies to cater to numerous wishes and budgets.

From elementary legal responsibility protection to complete applications, drivers can in finding plans adapted to their person instances. Selecting the proper coverage comes to cautious attention of the extent of coverage and monetary implications.

Commonplace Kinds of Automobile Insurance coverage Insurance policies

Different types of automobile insurance coverage insurance policies are to be had in Sioux Falls, every offering various levels of coverage. Legal responsibility protection, probably the most elementary, protects in opposition to monetary accountability for damages to others. Collision protection will pay for damages for your car irrespective of who’s at fault. Complete protection covers damages for your automobile from perils instead of collisions, similar to vandalism, robbery, or climate occasions.

Uninsured/underinsured motorist protection supplies coverage in case you are fascinated by an coincidence with a driving force who lacks or has inadequate insurance coverage. Those choices supply a spectrum of coverage, permitting drivers to make a choice protection that aligns with their monetary capability and chance tolerance.

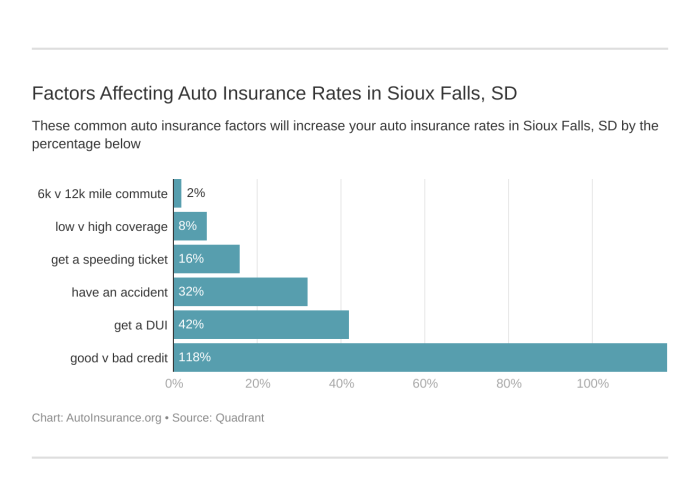

Components Influencing Automobile Insurance coverage Charges in Sioux Falls, SD

A number of elements give a contribution to automobile insurance coverage premiums in Sioux Falls. Using data, together with injuries and violations, considerably have an effect on charges. A blank file most often ends up in decrease premiums. Automobile sort and worth additionally affect premiums, with higher-value or dearer automobiles regularly wearing greater premiums. Age and site throughout the town too can play a task, with more youthful drivers and drivers in high-accident spaces most often going through greater charges.

In the end, the selected protection stage and deductibles have an effect on premiums, with greater protection ranges and decrease deductibles regularly main to raised premiums.

Conventional Protection Choices for Automobile Insurance coverage within the Area

Same old protection choices in Sioux Falls most often come with legal responsibility protection, which protects in opposition to monetary accountability for damages to different drivers or their assets. Collision protection protects your car in case of injuries, irrespective of fault. Complete protection gives coverage in opposition to damages because of occasions like vandalism, robbery, or climate harm. Uninsured/underinsured motorist protection is important within the tournament of an coincidence with a driving force missing enough insurance coverage.

Policyholders will have to moderately evaluate the protection choices and tailor their coverage to their wishes and monetary instances.

Comparability of Automobile Insurance coverage Suppliers in Sioux Falls, SD

| Supplier | Protection A (Legal responsibility) | Protection B (Collision) | Protection C (Complete) |

|---|---|---|---|

| Instance Supplier 1 | Aggressive charges, reductions to be had for excellent using data. | Same old protection choices, premiums range according to car main points. | Intensive protection, versatile deductibles. |

| Instance Supplier 2 | Aggressive charges, robust customer support recognition. | Aggressive pricing, more than one add-on choices to be had. | Superb claims dealing with, recognized for responsiveness. |

This desk supplies a elementary comparability of instance suppliers. Drivers will have to analysis and examine more than one suppliers, bearing in mind their explicit wishes and personal tastes. Components similar to customer support, claims dealing with, and to be had reductions will have to even be evaluated when opting for a supplier.

Components Affecting Automobile Insurance coverage Premiums in Sioux Falls

Automobile insurance coverage premiums in Sioux Falls, like somewhere else, are influenced via a posh interaction of things. Figuring out those components can lend a hand citizens make knowledgeable choices about protection and probably scale back prices. This phase delves into the precise variables that have an effect on automobile insurance coverage charges on this house.

Using Information and Insurance coverage Charges

Using data are a number one determinant of auto insurance coverage premiums in Sioux Falls, SD, and around the nation. A blank using file, marked via a loss of injuries and site visitors violations, most often results in decrease premiums. Conversely, drivers with a historical past of injuries or violations face considerably greater premiums. That is an instantaneous mirrored image of the danger review performed via insurance coverage firms.

Insurance coverage firms analyze using data to evaluate the chance of long run claims, which without delay impacts the premiums. As an example, a driving force with a contemporary dashing price ticket will most probably enjoy a price build up.

Automobile Kind and Price and Insurance coverage Premiums

The kind and worth of a car considerably have an effect on insurance coverage premiums. Luxurious automobiles and high-performance automobiles, regularly dearer to fix or change, most often command greater premiums in comparison to more cost effective fashions. This displays the upper possible charge of maintenance and substitute will have to an coincidence happen. In a similar fashion, older automobiles, even supposing well-maintained, can have greater premiums because of the possibility of dearer restore prices in comparison to more moderen fashions.

The worth of the car could also be a essential issue. A high-value car will normally have the next top class because of the larger possible monetary loss to the insurance coverage corporate in case of wear or robbery.

Age and Gender and Insurance coverage Prices

Age and gender also are vital elements in figuring out automobile insurance coverage premiums in Sioux Falls, SD. More youthful drivers, specifically the ones of their teenagers and early twenties, regularly have greater premiums than older drivers. That is because of the statistically greater coincidence price related to more youthful drivers. In a similar fashion, gender can play a task, even if that is much less pronounced than age.

Traditionally, insurance coverage firms have seen slight variations in using conduct and coincidence charges between genders, which will also be mirrored in top class diversifications. On the other hand, those variations are most often now not vital and are regularly outweighed via the have an effect on of age and using file.

Comparability of Insurance coverage Charges for Other Motive force Demographics

Insurance coverage charges range according to the motive force’s demographics. As an example, a tender, male driving force with a contemporary dashing price ticket in a high-value car can have considerably greater premiums in comparison to an older, feminine driving force with a blank file using a more economical car. This distinction in charges displays the danger review via insurance coverage firms according to the traits of the motive force and their car.

Affect of More than a few Components on Insurance coverage Premiums

| Issue | Description | Affect on Top class |

|---|---|---|

| Using Document | Selection of injuries, violations, and using historical past | Larger or diminished, relying at the severity and frequency of incidents. |

| Automobile Kind | Make, fashion, yr, and worth of the car | Larger or diminished, relying at the car’s perceived chance. |

| Age/Gender | Motive force’s age and gender | Larger or diminished, relying at the established statistical correlation of age and gender with coincidence charges. |

Automobile Insurance coverage Firms in Sioux Falls

Selecting the proper automobile insurance coverage corporate in Sioux Falls, SD is a very powerful for securing monetary coverage and peace of thoughts. Figuring out the more than a few suppliers, their reputations, and their strengths and weaknesses can empower customers to make knowledgeable choices. This phase delves into the key gamers within the Sioux Falls insurance coverage marketplace, inspecting their histories, customer support, monetary steadiness, and general cost proposition.

Main Automobile Insurance coverage Suppliers in Sioux Falls

A number of well-established and respected insurance coverage firms be offering automobile insurance coverage products and services in Sioux Falls. Figuring out the ancient presence and operational scope of those suppliers is important for customers in search of the most efficient conceivable protection. Main suppliers within the Sioux Falls area most often have in depth networks of brokers and repair facilities to house the native inhabitants’s wishes.

- State Farm: A national insurance coverage massive, State Farm has a long-standing presence in Sioux Falls. Their in depth community and established recognition regularly translate to available customer support and readily to be had improve. They’re recognized for a variety of insurance coverage merchandise and a huge geographic protection house, together with Sioux Falls. A considerable marketplace proportion and robust group ties are signs in their significance to the native insurance coverage panorama.

- Innovative: Recognized for its cutting edge solution to insurance coverage, Innovative operates around the nation, together with Sioux Falls. They’re recognized for his or her aggressive pricing methods, steadily providing reductions and promotions. Their virtual platform is every other side that has garnered recognition.

- Allstate: A big nationwide insurance coverage corporate, Allstate is found in Sioux Falls and boasts an important marketplace proportion within the house. Allstate’s presence, mixed with their well-established recognition, regularly interprets to a broader vary of protection choices for citizens. Their native presence supplies ease of get right of entry to to brokers and products and services.

- Geico: A significant participant within the nationwide insurance coverage marketplace, Geico maintains a presence in Sioux Falls, recognized for aggressive pricing and a customer-centric solution to products and services. Their advertising methods regularly focal point on highlighting inexpensive choices for more than a few insurance coverage wishes.

- Farmers Insurance coverage: Farmers Insurance coverage is every other distinguished participant within the Sioux Falls marketplace, providing a complete vary of insurance coverage answers, together with automobile insurance coverage. Their deep roots within the agricultural communities prolong to offering products and services throughout all of the state. They regularly cater to a lot of explicit wishes, together with the ones distinctive to the rural and rural communities.

Buyer Carrier Rankings and Monetary Balance

Customer support rankings and monetary steadiness are essential elements when opting for an insurance coverage supplier. Assessing those elements can lend a hand customers make knowledgeable choices that align with their explicit wishes and chance tolerance. Insurance coverage firms with greater rankings regularly mirror a dedication to visitor delight and dependable provider supply.

- Customer support rankings can range considerably throughout insurance coverage firms, regularly influenced via elements similar to declare processing velocity, agent responsiveness, and general conversation effectiveness. Impartial score companies supply precious insights into the functionality of more than a few firms. Those rankings lend a hand customers determine firms with robust reputations for customer support.

- Monetary steadiness is a essential issue. Firms with robust monetary rankings are higher supplied to maintain claims and handle operational continuity. An organization’s monetary power regularly influences its skill to give you the agreed-upon protection and maintain possible long run demanding situations.

Strengths and Weaknesses Comparability

Inspecting the strengths and weaknesses of various insurance coverage firms is a very powerful for making knowledgeable choices. This comparability desk highlights key sides of more than a few suppliers within the Sioux Falls marketplace.

| Corporate | Strengths | Weaknesses |

|---|---|---|

| State Farm | Intensive community, established recognition, wide selection of goods, robust native presence | Probably greater premiums in comparison to a couple competition |

| Innovative | Aggressive charges, cutting edge approaches, virtual platforms | Restricted protection choices in some spaces in comparison to extra established competition |

| Allstate | Massive nationwide presence, really extensive marketplace proportion, broader protection choices | Customer support rankings can vary relying on native place of work functionality |

| Geico | Aggressive pricing, customer-centric means, regularly gives reductions | Attainable for slower declare processing in comparison to different firms |

| Farmers Insurance coverage | Complete vary of answers, deep roots in native communities, cater to express wishes | Probably much less aggressive pricing in comparison to nationwide competition |

Protection Choices for Sioux Falls Automobile Insurance coverage

Selecting the proper automobile insurance policy in Sioux Falls, SD, is a very powerful for shielding your monetary well-being and peace of thoughts. Figuring out the several types of protection to be had and the way they observe for your explicit wishes is very important. This phase will delve into the more than a few choices, highlighting their significance and advantages throughout the Sioux Falls house.Figuring out your explicit using conduct, car sort, and monetary scenario will let you make a choice probably the most appropriate protection bundle.

Components just like the frequency of your journeys, your using file, and the worth of your car all play a task in figuring out the correct stage of coverage.

Importance of Legal responsibility Protection in Sioux Falls, SD

Legal responsibility protection is prime in Sioux Falls, because it protects you from monetary accountability in case you purpose an coincidence that ends up in hurt to someone else or harm to their assets. It is legally required in South Dakota, and the minimal protection quantities are established via state rules. Having good enough legal responsibility protection is very important to steer clear of non-public monetary destroy within the tournament of a mishap.

Failing to hold enough legal responsibility insurance coverage can result in vital criminal and monetary penalties. For example, in case you are fascinated by a collision and purpose vital harm or damage, your individual belongings may well be in peril with out right kind legal responsibility protection.

Advantages of Complete Protection within the House

Complete protection is going past legal responsibility, safeguarding your car from perils now not associated with collisions. In Sioux Falls, the place climate stipulations can range considerably, complete protection may give coverage in opposition to harm from hail, hearth, vandalism, robbery, or different unexpected occasions. This protection is particularly really useful for more moderen automobiles, as they’re regularly dearer to fix or change. This sort of protection can considerably scale back the monetary burden of sudden harm for your automobile.

Significance of Collision Protection in Sioux Falls, SD

Collision protection steps in when your car is broken in a collision, irrespective of who’s at fault. In Sioux Falls, with its numerous using surroundings, collision protection gives a essential safeguard. It covers the price of maintenance or substitute on your car, making sure you are now not left with really extensive monetary liabilities after an coincidence. With out collision protection, you may face vital out-of-pocket bills, particularly in case your car is a complete loss.

Comparability and Distinction of More than a few Protection Choices

Other protection choices cater to more than a few wishes and budgets. Legal responsibility-only protection gives probably the most elementary coverage, gratifying criminal necessities however now not offering in depth safeguards. A extra complete bundle encompassing legal responsibility, collision, and complete protection supplies broader coverage, addressing more than a few possible dangers. This means protects each you and your car from a much broader vary of eventualities. The price of every protection possibility varies according to elements like your using file, car sort, and site.

Advantages of Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection gives a a very powerful layer of coverage in Sioux Falls. It steps in when every other driving force fascinated by an coincidence is uninsured or underinsured, that means their coverage limits are not enough to hide the damages incurred. This protection guarantees you are compensated on your losses, fighting you from going through monetary hardship because of every other driving force’s negligence or loss of insurance coverage.

It supplies peace of thoughts figuring out you are secure in case you are in an coincidence with a driving force who does not have enough protection.

Protection Choices Desk

| Protection Kind | Description |

|---|---|

| Legal responsibility | Covers damages to others in an coincidence, gratifying criminal necessities. |

| Complete | Covers harm for your car from perils now not associated with collisions, like robbery, vandalism, or climate. |

| Collision | Covers harm for your car in a collision, irrespective of who’s at fault. |

Guidelines for Discovering Reasonably priced Automobile Insurance coverage in Sioux Falls

Securing inexpensive automobile insurance coverage in Sioux Falls, like another location, calls for a strategic means. Figuring out the standards that affect premiums and using sensible methods can considerably have an effect on your per thirty days bills. Through imposing the ideas Artikeld under, you’ll probably scale back your insurance coverage prices and discover a coverage that matches your finances.Discovering the appropriate automobile insurance coverage in Sioux Falls comes to cautious attention of more than a few elements.

Evaluating quotes, keeping up a blank using file, and figuring out some great benefits of bundling insurance policies are key components achieve cost-effective protection. Those methods, mixed with a excellent credit score ranking and the usage of on-line equipment, assist you to protected a aggressive price.

Evaluating Quotes from Other Insurance coverage Suppliers, Sioux falls sd automobile insurance coverage

Evaluating quotes from more than one insurance coverage suppliers is a very powerful for acquiring the most efficient conceivable charges. Other firms use various standards to decide premiums, and a comparability means that you can determine probably the most appropriate coverage on your wishes. This procedure is helping the variety of pricing to be had and probably negotiate higher phrases along with your selected supplier.

Making improvements to Your Using Document

A blank using file is a major factor in acquiring inexpensive automobile insurance coverage. Injuries and site visitors violations can considerably build up your premiums. Fending off site visitors violations and keeping up a secure using taste assist you to handle a excellent using file, resulting in decrease premiums.

Bundling Insurance coverage Insurance policies

Bundling your insurance coverage insurance policies, similar to automobile insurance coverage, householders insurance coverage, and renters insurance coverage, with a unmarried supplier, can regularly lead to reductions. This can be a easy but superb option to scale back your general insurance coverage prices. As an example, when you’ve got each automobile and residential insurance coverage with the similar corporate, you may qualify for a bundled cut price.

Reductions Impacting Automobile Insurance coverage Prices

Many insurance coverage firms be offering more than a few reductions that may considerably scale back your automobile insurance coverage premiums. Those reductions will also be according to elements similar to secure using conduct, anti-theft gadgets, and even your age and site. Figuring out the to be had reductions and qualifying for them assist you to considerably decrease your per thirty days bills.

Keeping up a Excellent Credit score Rating

Keeping up a excellent credit score ranking can not directly have an effect on your automobile insurance coverage premiums. Insurance coverage firms regularly imagine your credit score historical past when figuring out your chance profile. A better credit score ranking would possibly lead to a decrease top class because of the belief of decrease chance.

The usage of On-line Equipment for Discovering Quotes

On-line equipment supply a handy and environment friendly option to examine automobile insurance coverage quotes in Sioux Falls. Those equipment assist you to enter your main points, similar to your using historical past and car data, and obtain quotes from more than one suppliers concurrently. This protects you effort and time in comparison to manually contacting every corporate.

Methods and Their Advantages

| Tip | Receive advantages |

|---|---|

| Examine quotes from more than one suppliers | Decrease premiums via figuring out probably the most aggressive charges. |

| Beef up using file | Decrease premiums via fending off injuries and site visitors violations. |

| Package deal insurance policies | Reductions and decrease general insurance coverage prices. |

Figuring out Automobile Insurance coverage Claims in Sioux Falls

Navigating the method of submitting a automobile insurance coverage declare will also be daunting, particularly after an coincidence. Figuring out the stairs concerned, required documentation, and possible roadblocks could make the enjoy smoother and not more hectic. This phase supplies a complete review of the automobile insurance coverage claims procedure in Sioux Falls, SD.

Submitting a Automobile Insurance coverage Declare

The method for submitting a automobile insurance coverage declare in Sioux Falls, SD, most often comes to a number of key steps. First, right away notify your insurance coverage corporate in regards to the coincidence. This notification initiates the claims procedure and guarantees the corporate can start amassing data and assessing the wear.

Documentation Required for Submitting a Declare

Ok documentation is a very powerful for a clean declare procedure. Very important paperwork come with the police record (if filed), footage of the wear to each automobiles, witness statements (if to be had), and clinical data for any accidents sustained. Insurance coverage firms may additionally require evidence of car possession and any related restore estimates. Thorough documentation is helping streamline the declare procedure and decrease possible delays.

The Position of the Insurance coverage Adjuster

An insurance coverage adjuster performs an important function within the claims procedure. They examine the coincidence, assess the wear, and decide the correct reimbursement. Adjusters assessment the proof, together with the police record, pictures, and witness statements, to reach at a good agreement. They paintings to grasp the level of the wear and the specified maintenance.

Dealing with a Automobile Insurance coverage Declare Dispute

In case you disagree with the preliminary agreement be offering, you’ve gotten choices to get to the bottom of the dispute. Keep up a correspondence your considerations obviously and in writing to the insurance coverage corporate. If a answer cannot be reached via negotiation, chances are you’ll imagine mediation or, as a final lodge, report a proper criticism with the correct regulatory frame.

Commonplace Causes for Declare Denials

Insurance coverage claims will also be denied for more than a few causes. Failure to record the coincidence promptly, offering incomplete or erroneous data, or failure to cooperate with the insurance coverage adjuster’s investigation are commonplace causes for declare denial. Misrepresentation of info or instances surrounding the coincidence too can result in denial. In moderation reviewing the declare shape and offering correct data is very important to steer clear of such problems.

Steps Curious about Submitting a Declare

| Step | Description |

|---|---|

| Document the coincidence | In an instant notify your insurance coverage corporate in regards to the coincidence, offering main points just like the time, location, and different related data. |

| Acquire documentation | Accumulate all essential forms, together with police reviews, clinical data, restore estimates, and witness statements. Take pictures of the wear to each automobiles. |

| Report the declare | Put up the declare shape, in conjunction with all accrued documentation, to the insurance coverage corporate. |

Abstract

In conclusion, securing the appropriate Sioux Falls SD automobile insurance coverage comes to figuring out the native marketplace, evaluating suppliers, and moderately comparing protection choices. This unique interview has highlighted the important thing elements to imagine, from the varied suppliers to the complexities of submitting claims. Through the use of the guidelines introduced right here, you’ll optimistically navigate the sector of auto insurance coverage in Sioux Falls and make a selection a coverage that meets your explicit wishes and finances.

FAQ Nook

What are the most typical kinds of automobile insurance coverage insurance policies to be had in Sioux Falls, SD?

Commonplace insurance policies come with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Legal responsibility covers damages to others, whilst collision and complete quilt harm for your car, irrespective of who led to the coincidence.

How can I beef up my using file to get decrease automobile insurance coverage premiums?

Fending off injuries and site visitors violations is essential. Keeping up a blank using file is a very powerful for purchasing higher charges. Defensive using classes and secure using conduct too can undoubtedly have an effect on your insurance coverage prices.

What elements have an effect on automobile insurance coverage charges in Sioux Falls, SD?

A number of elements, together with your using file, car sort, age and gender, or even your credit score ranking, can affect your premiums. A historical past of injuries or violations will normally result in greater premiums.

How can I in finding inexpensive automobile insurance coverage in Sioux Falls, SD?

Evaluating quotes from other suppliers is very important. Bundling your insurance coverage insurance policies and keeping up a excellent credit score ranking too can lend a hand scale back your premiums.