If Chris has automobile legal responsibility insurance coverage everfi, it is a query that many of us are asking. Working out automobile insurance coverage, particularly legal responsibility protection, is necessary. This dialogue delves into the specifics of Chris’s scenario, exploring the function of Everfi in schooling and the more than a few elements that affect insurance coverage insurance policies.

We’re going to discover the elemental ideas of auto legal responsibility insurance coverage, inspecting protection main points, attainable situations involving Chris, and Everfi’s function in teaching policyholders about their duties. We’re going to additionally have a look at real-world examples, hypothetical case research, and insurance coverage research to supply a complete image.

Working out Automobile Legal responsibility Insurance coverage

Automobile legal responsibility insurance coverage is a the most important element of auto possession, protective you from monetary burdens within the tournament of an twist of fate the place you’re at fault. It is designed to hide the prices related to damages you inflict on others. Working out its specifics is necessary for accountable using and monetary preparedness.Automobile legal responsibility insurance coverage, at its core, acts as a security internet.

It safeguards you from vital monetary losses if you are answerable for an twist of fate. This protection guarantees that you are not held in my opinion responsible for the damages brought about to someone else or their belongings.

Basic Thought of Automobile Legal responsibility Insurance coverage

Automobile legal responsibility insurance coverage is designed to offer protection to the monetary pursuits of others enthusiastic about an twist of fate brought about by means of the insured motive force. This is a legally required protection in maximum jurisdictions, making sure that the ones harmed by means of a motive force’s movements are compensated. The basic idea is to switch the monetary duty for damages from the driving force to an insurance coverage corporate.

Protection Equipped by means of Automobile Legal responsibility Insurance coverage

Legal responsibility insurance coverage covers damages as a consequence of injuries the place the insured motive force is at fault. This contains two number one classes: physically damage and belongings injury. Physically damage protection will pay for scientific bills, misplaced wages, and ache and struggling of the injured events. Assets injury protection compensates for the restore or substitute prices of broken belongings, together with cars, properties, or different property.

Examples of Scenarios The place Automobile Legal responsibility Insurance coverage Would Be Used

A lot of situations necessitate the usage of automobile legal responsibility insurance coverage. When you rear-end every other car, inflicting vital injury, your legal responsibility insurance coverage would step in to hide the opposite motive force’s restore prices. In a similar way, in case you purpose an twist of fate that leads to accidents to passengers within the different car, your legal responsibility insurance coverage would take care of the scientific bills and attainable misplaced wages.

Any other instance is harmful a pedestrian’s belongings throughout an twist of fate.

Comparability with Different Forms of Auto Insurance coverage

Whilst automobile legal responsibility insurance coverage makes a speciality of protecting damages to others, different auto insurance coverage varieties deal with other sides of auto possession. Collision insurance coverage, as an example, covers injury for your personal car without reference to who’s at fault. Complete insurance coverage protects in opposition to non-collision injury, comparable to robbery or weather-related incidents. Legal responsibility insurance coverage is distinct as it essentially addresses the monetary duty for damages brought about to others.

Other Forms of Automobile Legal responsibility Insurance coverage Insurance policies

Automobile legal responsibility insurance coverage insurance policies usually come with two major kinds of protection:

- Physically Harm Legal responsibility (BIL): This protection will pay for the scientific bills, misplaced wages, and ache and struggling of the ones injured in an twist of fate the place the insured motive force is at fault. BIL is the most important for making sure injured events obtain reimbursement.

- Assets Injury Legal responsibility (PDL): PDL protection addresses the restore or substitute prices of broken belongings, together with cars, structures, or different property. You should for protecting the monetary burden of damages to every other birthday celebration’s belongings.

Significance of Automobile Legal responsibility Insurance coverage

Automobile legal responsibility insurance coverage is very important for felony and monetary causes. It safeguards the insured from attainable court cases and exorbitant monetary responsibilities. Moreover, it is regularly a felony requirement in lots of jurisdictions, and failure to hold enough protection can result in critical consequences. It protects each the driving force and the general public by means of making sure monetary duty within the tournament of an twist of fate.

Desk Illustrating More than a few Forms of Protection and Their Descriptions

| Protection Sort | Description |

|---|---|

| Physically Harm Legal responsibility (BIL) | Covers scientific bills, misplaced wages, and ache and struggling of injured events in injuries the place the insured motive force is at fault. |

| Assets Injury Legal responsibility (PDL) | Covers the restore or substitute prices of broken belongings (cars, structures, and so on.) in injuries the place the insured motive force is at fault. |

Figuring out Insurance coverage Protection for Chris

Working out automobile insurance policy is the most important for people like Chris, particularly when navigating attainable dangers. This segment delves into the specifics of the way insurance coverage protects Chris within the tournament of an twist of fate, taking into consideration more than a few situations and the criteria influencing protection. An intensive seize of those ideas is very important for accountable monetary making plans.

Twist of fate Situations and Attainable Liabilities

Injuries are unpredictable occasions that can result in vital monetary repercussions. For Chris, the possible liabilities lengthen past simply restore prices. For instance, a collision may contain belongings injury, accidents to different events, and even felony penalties. Those elements considerably affect the character and extent of insurance policy required.

Function of Insurance coverage in Mitigating Liabilities

Insurance coverage performs a important function in mitigating the monetary burden related to injuries. Insurance coverage insurance policies usually duvet damages to the insured car, in addition to accidents to the insured birthday celebration and others concerned. The level of protection is decided by means of the coverage specifics and the instances of the twist of fate. For example, complete protection would possibly lengthen to incidents indirectly involving a collision.

Hypothetical Case Learn about: Chris at Fault

Believe Chris is located at fault in a automobile twist of fate the place vital belongings injury and accidents happen. On this state of affairs, Chris’s legal responsibility insurance coverage would most likely duvet the damages to the opposite car, and probably the scientific bills of the injured birthday celebration. Alternatively, the precise quantity of protection depends upon the coverage limits and the level of the wear and tear.

It’s a must to notice that even with insurance coverage, Chris would possibly nonetheless have non-public monetary responsibilities that reach past the coverage limits.

Diversifications in Insurance coverage Protection

Insurance plans varies considerably in accordance with a number of elements associated with Chris’s scenario. Those elements come with the kind of coverage (e.g., liability-only, complete), the coverage limits, and the particular instances of the twist of fate. Moreover, elements like the driving force’s historical past and the site of the twist of fate can affect premiums. The protection presented may additionally vary in accordance with the particular state’s regulations.

Insurance coverage Corporate Possibility Overview

Insurance coverage firms make use of subtle possibility review fashions to resolve premiums. Those fashions analyze more than a few elements comparable to the driving force’s historical past (e.g., injuries, site visitors violations), the car’s make and fashion, the driving force’s location, and different demographic information. A historical past of injuries or violations usually ends up in upper premiums. A protected using report, alternatively, would possibly lead to decrease premiums.

Comparability of Attainable Insurance coverage Wishes

| Insurance coverage Function | Chris’s Attainable Wishes (In response to State of affairs) | Same old Coverage Providing |

|---|---|---|

| Legal responsibility Protection | Most probably wishes enough protection to fulfill attainable damages and accidents to different events. | Most often features a minimal legal responsibility protection requirement mandated by means of regulation. |

| Collision Protection | Relies on the twist of fate state of affairs and attainable injury to Chris’s car. | Supplies protection for injury to Chris’s car, without reference to who’s at fault. |

| Complete Protection | Could be important if the twist of fate comes to non-collision elements, comparable to vandalism or climate injury. | Covers injury to Chris’s car from occasions rather then collisions, like fireplace or robbery. |

| Uninsured/Underinsured Motorist Protection | Very important to offer protection to Chris from injuries brought about by means of drivers with out enough insurance coverage. | Covers damages if the at-fault motive force has inadequate insurance coverage. |

Everfi’s Function in Insurance coverage Training

Everfi performs a the most important function in offering available and attractive insurance coverage schooling, specifically for figuring out automobile legal responsibility insurance coverage. Their interactive techniques transcend merely defining phrases; they target to equip newcomers with the information and abilities to navigate real-world insurance coverage situations successfully. This empowers people to make knowledgeable choices about their insurance coverage wishes and duties.Everfi’s techniques be offering a structured solution to finding out about automobile legal responsibility insurance coverage, emphasizing the significance of proactive possibility control and accountable policyholder conduct.

The interactive nature of the teachings permits newcomers to use their wisdom in simulated situations, fostering a deeper figuring out of the complexities of insurance coverage.

Instructional Fabrics on Automobile Legal responsibility Insurance coverage

Everfi’s fabrics duvet a variety of subjects associated with automobile legal responsibility insurance coverage, from elementary definitions to advanced claims processes. This system’s interactive modules supply transparent explanations of coverage phrases and stipulations, emphasizing the felony and monetary implications of injuries and insurance coverage claims.

Tasks of Insurance coverage Policyholders

Everfi techniques obviously delineate the duties of policyholders. Those duties come with figuring out coverage protection limits, reporting injuries promptly, and adhering to the phrases and stipulations of the insurance coverage settlement. Policyholders are taught that their movements without delay affect their claims procedure and their monetary responsibilities.

Actual-Global Software of Insurance coverage Ideas

Everfi successfully connects summary insurance coverage ideas to real-world situations. For instance, this system may provide a simulated twist of fate involving a motive force who did not handle enough insurance policy. Freshmen analyze the consequences of this example, figuring out how insufficient protection can result in vital monetary penalties. Additionally they read about the method of submitting a declare and the significance of keeping up correct information.

Significance of Acquiring and Keeping up Automobile Legal responsibility Insurance coverage

Everfi highlights the important significance of auto legal responsibility insurance coverage. This system demonstrates how this kind of insurance coverage protects people and their property in case of injuries. By means of illustrating the possible monetary and felony repercussions of using with out ok insurance coverage, Everfi motivates newcomers to prioritize insurance coverage.

Possibility Overview and Insurance coverage Prices

Everfi’s techniques educate customers about possibility review and its connection to insurance coverage prices. This system most likely explains how elements comparable to using historical past, location, and car sort can affect insurance coverage premiums. For instance, a motive force with a historical past of injuries may face upper premiums in comparison to a motive force with a blank report. This system explains the correlation between possibility and value, enabling knowledgeable decision-making relating to using behavior and car variety.

Components Influencing Insurance coverage Charges

Everfi’s techniques deal with more than a few elements that affect insurance coverage charges. This contains, however isn’t restricted to, age, using report, car sort, location, and claims historical past. Those elements are defined throughout the context of possibility review, enabling customers to know how their possible choices affect their insurance coverage premiums. For example, more youthful drivers regularly have upper premiums because of their statistically upper twist of fate charges.

Abstract of Key Classes and Subjects

| Lesson/Subject | Key Takeaways |

|---|---|

| Working out Coverage Protection | Understanding the boundaries and stipulations of a coverage is necessary. |

| Reporting Injuries | Instructed and correct reporting is very important for a a hit declare. |

| Possibility Overview | Using historical past, location, and car sort affect insurance coverage prices. |

| Insurance coverage Prices | Working out the correlation between possibility and top rate is the most important. |

| Claims Procedure | Working out the stairs enthusiastic about submitting and resolving a declare. |

| Keeping up Protection | The significance of making sure enough insurance policy always. |

Insurance coverage Coverage Research (Chris’s State of affairs)

Working out Chris’s explicit insurance coverage is the most important to comparing his coverage within the tournament of an twist of fate. This research delves into the main points of a hypothetical coverage, highlighting protection limits, exclusions, and stipulations. It additionally considers the possible implications for Chris in a simulated collision state of affairs and compares more than a few coverage choices to be had to him.

Hypothetical Insurance coverage Coverage Record

This segment gifts a pattern insurance coverage for Chris, that specialize in legal responsibility protection. The specifics are fictional however constitute not unusual components present in genuine insurance policies.

Policyholder: Chris Johnson

Coverage Efficient Date: October 26, 2023

Coverage Quantity: 1234567890

Protection Limits: Legal responsibility protection of $100,000 according to individual and $300,000 according to twist of fate. This implies if Chris reasons an twist of fate leading to $150,000 in damages to at least one individual, the coverage would duvet the entire quantity. Alternatively, if the damages exceed the coverage limits, Chris could be answerable for the adaptation.

Exclusions: The coverage explicitly excludes protection for injury brought about by means of intentional acts, use of the car for unlawful actions, or injury brought about by means of pre-existing prerequisites of the car. Additional, it does now not duvet damages exceeding the coverage restrict.

Prerequisites: The coverage Artikels the duties of each the insurer and the insured. It contains provisions for reporting injuries promptly, offering important documentation, and adhering to felony necessities. The coverage states that Chris will have to cooperate totally with the insurance coverage corporate throughout any declare investigation.

Case Learn about: A Simulated Collision

Believe Chris is enthusiastic about a collision the place every other motive force, deemed at-fault, suffers $120,000 in accidents. A 2nd birthday celebration, a pedestrian, additionally suffers $50,000 in accidents. The coverage’s legal responsibility protection would deal with those damages as much as the boundaries specified. Alternatively, if the entire damages exceed the coverage limits, Chris could be responsible for the surplus quantity.

Coverage Reaction to the Collision

Given the above state of affairs, the insurance coverage corporate would examine the twist of fate, assess the damages, and resolve the suitable quantity to pay out. The coverage’s legal responsibility protection could be applied to compensate the injured events. If the entire damages exceeded the protection limits, the insurance coverage corporate would solely duvet the utmost quantity allowed by means of the coverage, and the rest could be Chris’s duty.

Comparability of Insurance coverage Coverage Choices, If chris has automobile legal responsibility insurance coverage everfi

Other insurance coverage insurance policies be offering various ranges of protection. Some insurance policies may come with uninsured/underinsured motorist protection, which might give protection to Chris if the at-fault motive force lacked ok insurance coverage. Different choices may supply complete protection, which covers injury to Chris’s car in an twist of fate. The selection depends upon Chris’s particular person wishes and possibility tolerance.

Attainable Loopholes and Gaps within the Coverage

One attainable loophole is the loss of an in depth definition for “pre-existing prerequisites” within the car. This is able to result in disputes relating to protection if the wear and tear stems from an underlying factor. Any other attainable hole is the loss of protection for punitive damages, that are awarded in instances of gross negligence or malicious intent. This would go away Chris susceptible if a courtroom deems the twist of fate resulted from serious misconduct by means of the at-fault motive force.

Desk of Coverage Clauses and Implications

| Clause | Implications for Chris |

|---|---|

| Protection Limits | Determines the utmost quantity the insurer pays in a declare. |

| Exclusions | Highlights scenarios the place protection isn’t equipped. |

| Prerequisites | Artikels duties and expectancies for the policyholder. |

Actual-Global Examples and Situations: If Chris Has Automobile Legal responsibility Insurance coverage Everfi

Working out the real-world implications of auto legal responsibility insurance coverage comes to inspecting the way it protects people and companies in more than a few twist of fate situations. This segment explores numerous twist of fate varieties, the claims procedure, and not unusual causes for insurance coverage declare denials. This gives a realistic perception into the day by day workings of insurance coverage insurance policies and their affect on folks’s lives.

Automobile Twist of fate Situations and Their Affect

Automobile injuries can vary from minor fender benders to catastrophic collisions, considerably impacting people and their monetary well-being. Insurance coverage claims are the most important for recuperating damages and making sure responsibility in such occasions.

Forms of Automobile Injuries and Insurance coverage Roles

More than a few twist of fate varieties spotlight the important function of auto legal responsibility insurance coverage. A rear-end collision, for example, regularly comes to vital belongings injury and attainable accidents. An twist of fate involving a distracted motive force or a motive force below the affect will have serious penalties and complicate the claims procedure.

Insurance coverage Declare Submitting Procedures

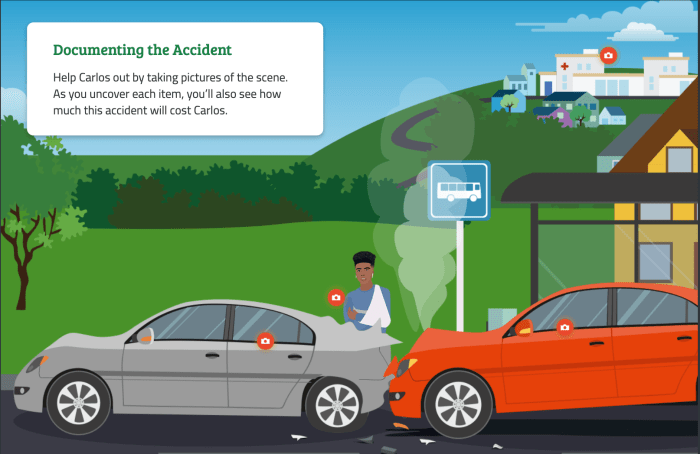

Submitting an insurance coverage declare comes to a number of steps, usually starting with reporting the twist of fate to the police and acquiring important documentation. This contains exchanging data with the opposite motive force, documenting the scene, and accumulating scientific information if accidents passed off. Insurance coverage firms regularly require detailed reviews and supporting proof to guage the declare.

Insurance coverage Corporate Declare Overview

Insurance coverage firms meticulously assess claims to verify truthful and correct payouts. Their review procedure contains reviewing police reviews, scientific information, witness statements, and injury estimates. This complete analysis objectives to resolve legal responsibility and the suitable reimbursement.

Detailed State of affairs: A Automobile Twist of fate and Declare Procedure

Believe a two-car twist of fate the place a motive force, Sarah, used to be rear-ended by means of every other motive force, Mark. Sarah sustained minor accidents and her automobile required vital maintenance. The police file indicated Mark’s negligence. Sarah reported the twist of fate to her insurance coverage corporate, offering police reviews, scientific expenses, and service estimates. The insurance coverage corporate investigated, confirming Mark’s legal responsibility.

Sarah gained a payout protecting her scientific bills and car maintenance, minus her deductible. Mark’s insurance coverage corporate paid for Sarah’s damages in accordance with their coverage phrases.

Examples of Insurance coverage Declare Denials and Causes

Insurance coverage firms would possibly deny claims because of more than a few causes, together with a loss of enough proof, failure to cooperate with the investigation, or if the twist of fate is deemed the policyholder’s fault. For instance, a declare could be denied if the policyholder used to be using below the affect, or if the twist of fate passed off outdoor the coverage’s protection limits, or if pre-existing prerequisites weren’t disclosed.

Desk: Standard Automobile Twist of fate Situations and Insurance coverage Implications

| Twist of fate State of affairs | Insurance coverage Implications |

|---|---|

| Rear-end collision with minor injury | Most often lined by means of at-fault motive force’s insurance coverage. |

| Multi-car twist of fate with critical accidents | Claims involving more than one events and serious accidents require thorough investigation and attainable involvement of more than one insurance coverage insurance policies. |

| Twist of fate involving uninsured/underinsured motive force | Calls for a complete review of the policyholder’s protection choices, together with uninsured/underinsured motorist protection. |

| Twist of fate because of pre-existing situation | Claims could also be denied or diminished if pre-existing prerequisites aren’t correctly disclosed or in the event that they give a contribution to the twist of fate. |

Epilogue

In conclusion, figuring out if Chris has automobile legal responsibility insurance coverage thru Everfi comes to inspecting more than a few sides of insurance coverage insurance policies, attainable liabilities, and Everfi’s instructional fabrics. Working out the main points and exploring attainable situations is secret to meaking knowledgeable choices. Expectantly, this dialogue supplies readability and helpful insights into the complexities of auto insurance coverage.

Query & Solution Hub

What if Chris’s insurance coverage does not duvet all attainable damages in a automobile twist of fate?

It is the most important to check the coverage’s protection limits and exclusions. If there are gaps in protection, further coverage could be important.

How does Everfi lend a hand in figuring out possibility review for insurance coverage?

Everfi techniques regularly spotlight elements that insurance coverage firms use to evaluate possibility, comparable to using historical past and placement, serving to people know how those elements affect premiums.

What are some not unusual causes for insurance coverage declare denials?

Commonplace causes come with offering misguided data, failing to fulfill coverage necessities, or incidents now not lined by means of the coverage, comparable to the ones involving intentional acts.

What are the standard steps enthusiastic about submitting an insurance coverage declare?

Reporting the twist of fate, accumulating documentation (police file, scientific information), and cooperating with the insurance coverage corporate are crucial steps.