Reasonable automotive insurance coverage in Ocala is a beacon of economic freedom, guiding you towards a long run of protected using. This adventure unveils the secrets and techniques to securing the most productive charges, revealing the hidden elements that affect premiums. Unlocking inexpensive automotive insurance coverage in Ocala is inside of your succeed in; we’re going to navigate the complexities, illuminating the trail to monetary peace of thoughts.

Ocala’s automotive insurance coverage marketplace gifts a various panorama, influenced by way of quite a lot of elements. Working out those parts is vital to discovering the suitable protection on the proper worth. This exploration will equip you with the information to hopefully evaluate quotes and make a selection the coverage that completely fits your wishes and funds.

Advent to Reasonable Automobile Insurance coverage in Ocala

Unlocking the secrets and techniques to inexpensive automotive insurance coverage in Ocala, Florida is more uncomplicated than you suppose! The Ocala space, like another area, has a dynamic automotive insurance coverage marketplace. Working out the criteria using costs and not unusual misconceptions will empower you in finding the most productive offers. This information supplies a transparent review of the Ocala insurance coverage panorama, serving to you navigate the method and protected the protection you wish to have at a value you’ll be able to manage to pay for.

Elements Influencing Automobile Insurance coverage Prices in Ocala

A number of elements considerably affect the price of automotive insurance coverage in Ocala. Riding file, car sort, and site all play a the most important function. A blank using file, without a injuries or visitors violations, is ceaselessly related to decrease premiums. In a similar way, more recent, more secure automobiles in most cases draw in decrease charges. The precise location inside of Ocala additionally impacts charges, as some spaces may have a better frequency of injuries or claims.

Moreover, your age and gender can affect your top rate. Those parts mix to create a personalised insurance coverage price.

Not unusual Misconceptions About Reasonable Automobile Insurance coverage

A number of not unusual myths encompass affordable automotive insurance coverage. One false impression is that you wish to have to sacrifice protection to save cash. In truth, complete and collision protection is important for shielding your car and monetary well-being. Some other false impression is that the most cost effective choice is at all times the most productive. It is the most important to prioritize respected insurance coverage firms and complete protection, now not simply the bottom worth.

A radical comparability of various insurance policies is very important to make sure you get the most productive price in your cash. Opting for an organization with a forged monetary ranking could also be the most important for the long-term reliability of your protection.

Significance of Evaluating Quotes for Automobile Insurance coverage in Ocala

Evaluating quotes is paramount when in search of affordable automotive insurance coverage in Ocala. Other insurance coverage suppliers be offering various charges in response to your profile and protection wishes. Via evaluating quotes from a couple of firms, you’ll be able to establish essentially the most inexpensive choice with out compromising on very important protection. This procedure permits you to store successfully and lower your expenses. Do not restrict your self to only a few quotes; the extra quotes you evaluate, the better your likelihood of discovering a really outstanding deal.

Forms of Automobile Insurance coverage Protection To be had in Ocala

| Protection Kind | Description | Significance |

|---|---|---|

| Legal responsibility Protection | Protects you financially in the event you purpose an coincidence and are held legally liable for damages to someone else or their belongings. | A elementary protection that protects your belongings. |

| Collision Protection | Can pay for damages for your car, without reference to who brought about the coincidence. | Very important for repairing or changing your car after an coincidence, despite the fact that you’re at fault. |

| Complete Protection | Covers damages for your car brought about by way of occasions instead of collisions, akin to vandalism, robbery, fireplace, or herbal failures. | An important for shielding your car from unexpected occasions that can result in really extensive restore prices and even overall loss. |

| Uninsured/Underinsured Motorist Protection | Supplies coverage if you are taken with an coincidence with a driving force who does not have insurance coverage or has inadequate protection. | Protects you and your car if you are taken with an coincidence with an uninsured or underinsured driving force. |

| Private Damage Coverage (PIP) | Can pay for clinical bills and misplaced wages for you and your passengers within the match of an coincidence, without reference to fault. | A the most important protection in your well-being, protecting clinical prices and misplaced source of revenue, and protects your circle of relatives. |

Evaluating quite a lot of protection choices is very important for figuring out the optimum package deal that meets your particular wishes and monetary scenario.

Figuring out Elements Affecting Insurance coverage Premiums in Ocala

Unveiling the secrets and techniques to securing inexpensive automotive insurance coverage in Ocala comes to figuring out the important thing elements that affect premiums. Those elements are not arbitrary; they are calculated threat exams in response to statistical knowledge and previous claims. Realizing those elements empowers you to make instructed selections about your protection and doubtlessly lower your expenses.

Riding File Have an effect on on Insurance coverage Charges

Riding data are a vital determinant of insurance coverage premiums in Ocala. A blank using file, devoid of injuries or visitors violations, in most cases interprets to decrease premiums. Conversely, drivers with a historical past of injuries or violations face upper premiums. Insurance coverage firms use this knowledge to evaluate the possibility of long run claims. As an example, a driving force with a couple of rushing tickets or at-fault injuries will most likely pay extra for insurance coverage in comparison to a driving force without a violations.

This displays the danger related to their using habits.

Car Kind and Worth Have an effect on on Insurance coverage Prices

The kind and worth of your car without delay affect your insurance coverage premiums. Top-performance sports activities vehicles, luxurious automobiles, and automobiles with distinctive or dear options generally tend to have upper premiums. It is because those automobiles are ceaselessly costlier to fix or substitute in case of an coincidence. In a similar way, the worth of the car performs a vital function.

A high-value car will draw in a better top rate than a lower-value car. This displays the prospective monetary loss to the insurance coverage corporate within the match of wear or robbery.

Location and Demographics Affect on Automobile Insurance coverage Costs

Location and demographics in Ocala too can impact insurance coverage prices. Spaces with upper crime charges or upper coincidence frequencies ceaselessly have upper insurance coverage premiums. It is because the insurance coverage corporate must account for a better threat of claims in the ones spaces. Demographic elements, akin to age and marital standing, might also give a contribution to top rate variations. Insurance coverage firms ceaselessly use statistical knowledge to correlate demographic traits with declare frequencies, which in the long run influences the top rate.

Insurance coverage Prices for Other Age Teams

Insurance coverage premiums range considerably between other age teams. More youthful drivers are ceaselessly assigned upper premiums because of their statistically upper declare frequency. That is essentially attributed to inexperience and risk-taking habits. As drivers acquire revel in and age, their premiums in most cases lower. This development displays the diminished threat related to mature drivers.

Have an effect on of Claims Historical past on Insurance coverage Premiums

A driving force’s claims historical past is a the most important consider figuring out insurance coverage premiums. Drivers with a historical past of constructing claims, whether or not for injuries, robbery, or different damages, will normally face upper premiums. Insurance coverage firms use this knowledge to evaluate the possibility of long run claims, reflecting the larger threat related to such drivers.

Reductions To be had for Automobile Insurance coverage

A large number of reductions can lend a hand cut back automotive insurance coverage premiums in Ocala. Those reductions ceaselessly rely on elements like the driving force’s profile, the car sort, or the insurance coverage corporate’s particular program.

| Bargain Kind | Description |

|---|---|

| Secure Riding Reductions | Drivers with a blank using file would possibly qualify for reductions. |

| Defensive Riding Lessons | Finishing defensive using classes can earn reductions. |

| Multi-Coverage Reductions | Proudly owning a couple of insurance policies with the similar insurance coverage corporate would possibly result in reductions. |

| Anti-theft Gadgets | Putting in anti-theft gadgets for your car would possibly qualify for reductions. |

| Just right Pupil Reductions | Scholars with excellent educational data may qualify for reductions. |

Impact of Credit score Historical past on Automobile Insurance coverage Charges

Insurance coverage firms would possibly imagine a driving force’s credit score historical past when atmosphere premiums. A adverse credit historical past would possibly result in upper premiums. This displays a correlation between monetary accountability and coincidence or declare frequency. It is a the most important side for insurance coverage firms in comparing threat. A excellent credit score historical past ceaselessly interprets to decrease premiums.

Methods for Discovering Inexpensive Automobile Insurance coverage in Ocala

Unlocking the secrets and techniques to inexpensive automotive insurance coverage in Ocala is more uncomplicated than you suppose! Via using sensible methods and using the suitable equipment, you’ll be able to considerably cut back your insurance coverage premiums with out sacrificing very important protection. This information will equip you with the information and how to in finding the most productive offers adapted for your particular wishes.Discovering the most productive automotive insurance coverage deal in Ocala comes to a proactive manner, shifting past merely accepting the primary quote.

Working out the criteria influencing premiums and using efficient comparability strategies are key to securing essentially the most aggressive charges.

Evaluating Automobile Insurance coverage Quotes in Ocala

Evaluating quotes is the cornerstone of discovering inexpensive automotive insurance coverage. Thorough comparisons permit you to establish the most productive price and tailor protection for your distinctive cases. This comes to comparing now not best the top rate quantity but additionally the scope of protection presented.

Dependable On-line Automobile Insurance coverage Comparability Web sites in Ocala

A number of respected on-line platforms focus on evaluating automotive insurance coverage quotes, offering a handy and environment friendly approach to in finding aggressive charges. Those platforms accumulate knowledge from a couple of insurers, permitting you to peer a complete review of to be had choices in Ocala.

- Insurify: A user-friendly platform that aggregates quotes from quite a lot of insurers. Insurify permits you to evaluate insurance policies in response to particular elements, serving to you in finding the most productive have compatibility.

- Policygenius: This platform supplies complete comparisons, enabling you to customise your seek in response to desired protection and deductibles. It is identified for its ease of use and transparent presentation of choices.

- NerdWallet: A well known monetary useful resource, NerdWallet’s automotive insurance coverage comparability software facilitates simple navigation and permits for fine-tuning searches to align with particular wishes.

- QuoteWizard: Recognized for its user-friendly interface and vast community of insurance coverage suppliers, QuoteWizard provides an in depth comparability of insurance policies, permitting you to evaluate choices from other firms.

Negotiating Decrease Premiums with Insurance coverage Suppliers in Ocala

Insurance coverage firms ceaselessly be offering versatile choices and negotiation alternatives. Researching those choices earlier than enticing in discussions can empower you to protected extra favorable phrases. Being well-prepared can result in really extensive financial savings.

Acquiring A couple of Quotes from Other Insurance coverage Firms in Ocala

Securing quotes from quite a lot of insurance coverage suppliers is the most important for acquiring a complete comparability. This comes to inputting your particular knowledge into a couple of platforms to generate numerous quotes. A various set of quotes supplies a forged basis for settling on the most suitable option.

The use of On-line Equipment to Examine Automobile Insurance coverage Charges in Ocala

Using on-line comparability equipment simplifies the method of discovering aggressive automotive insurance coverage charges. Those equipment ceaselessly permit for detailed comparisons in response to quite a lot of elements like using historical past, car sort, and site.

Evaluating Other Insurance coverage Corporate Choices in Ocala, Reasonable automotive insurance coverage in ocala

A well-structured comparability desk permits for a transparent and concise review of various insurance coverage corporate choices. This visible illustration makes it more uncomplicated to spot the most suitable choice in your wishes.

| Insurance coverage Corporate | Top rate (Estimated) | Protection Choices | Buyer Provider Score |

|---|---|---|---|

| Corporate A | $1,200 | Complete, Collision, Legal responsibility | 4.5 Stars |

| Corporate B | $1,050 | Complete, Collision, Legal responsibility, Uninsured Motorist | 4.2 Stars |

| Corporate C | $1,150 | Complete, Collision, Legal responsibility, Private Damage Coverage | 4.7 Stars |

Benefits and Disadvantages of Other Automobile Insurance coverage Insurance policies in Ocala

Working out the nuances of various automotive insurance coverage insurance policies is very important for making instructed selections. Insurance policies range considerably of their protection and phrases, affecting your general price and coverage.

- Legal responsibility Protection: Provides fundamental coverage in opposition to claims for damages brought about to others, however supplies minimum protection in your car.

- Collision Protection: Covers damages for your car without reference to who’s at fault. It is the most important for shielding your funding.

- Complete Protection: Covers damages for your car from occasions instead of collisions, akin to vandalism or climate injury. This can be a the most important safeguard in opposition to unexpected incidents.

- Uninsured/Underinsured Motorist Protection: Supplies coverage if you are taken with an coincidence with a driving force who does not have insurance coverage or has inadequate protection.

Working out Insurance coverage Protection Choices in Ocala

Unlocking the secrets and techniques to inexpensive automotive insurance coverage in Ocala comes to extra than simply worth comparisons. It is the most important to grasp the quite a lot of protection choices to be had to make sure you’re adequately secure at the street. This complete information delves into the various kinds of automotive insurance policy, illuminating their significance and advantages.

Legal responsibility Protection in Ocala

Legal responsibility protection is the cornerstone of vehicle insurance coverage, protective you financially if you are at fault in an coincidence. It covers damages you purpose to people’s belongings or accidents to others. This protection is in most cases required by way of regulation in Ocala and plenty of different spaces. A minimal legal responsibility protection quantity is generally mandated, however it is strongly really useful to imagine upper limits to raised offer protection to your belongings.

For instance, a low legal responsibility restrict may now not duvet in depth clinical expenses or belongings injury in a significant coincidence.

Complete Protection in Ocala

Complete protection safeguards your car in opposition to perils past injuries, like vandalism, robbery, fireplace, hail, or climate injury. This protection is important as it protects your funding, protecting maintenance or substitute prices for surprising occasions. With out complete protection, you would be liable for vital out-of-pocket bills in case your automotive have been broken by way of one thing instead of a collision. As an example, a surprising hail typhoon may just critically injury your automotive, and with out complete protection, you’ll must undergo the price of maintenance or substitute.

Collision Protection in Ocala

Collision protection kicks in when your car collides with some other object, without reference to who is at fault. It can pay for the restore or substitute of your car. That is the most important, because it guarantees you are financially secure despite the fact that you are taken with a collision the place you are now not at fault. For instance, if you are hit by way of a negligent driving force, collision protection would duvet your car’s restore or substitute, making sure you are not left with vital monetary burdens.

Uninsured/Underinsured Motorist Protection in Ocala

Uninsured/underinsured motorist protection steps in if you are taken with an coincidence with a driving force missing enough insurance coverage or no insurance coverage in any respect. It compensates you for clinical bills and belongings injury. This protection is important in Ocala, the place injuries can contain drivers with inadequate or no insurance coverage. This protection is especially necessary as it protects you from the monetary fallout of an coincidence with a driving force who is not adequately insured.

Very important Coverages for Automobile Insurance coverage in Ocala

| Protection Kind | Description |

|---|---|

| Legal responsibility Physically Damage | Covers accidents to others in an coincidence you purpose. |

| Legal responsibility Assets Harm | Covers injury to people’s belongings in an coincidence you purpose. |

| Complete | Covers injury for your car from non-collision occasions. |

| Collision | Covers injury for your car in a collision, without reference to fault. |

| Uninsured/Underinsured Motorist | Covers you if you are taken with an coincidence with an uninsured or underinsured driving force. |

Further Choices in Ocala

Past the core coverages, further choices like roadside help and apartment automotive protection can considerably give a boost to your coverage. Roadside help supplies lend a hand with flat tires, leap begins, and lockouts. Apartment automotive protection provides brief transportation in case your car is broken or taken with an coincidence, decreasing inconvenience and rigidity.

Pointers for Keeping up a Low Automobile Insurance coverage Top rate in Ocala

Unlocking the secrets and techniques to inexpensive automotive insurance coverage in Ocala begins with proactive steps to care for a good using file and a financially sound manner. Via specializing in accountable using, credit score control, and car repairs, you’ll be able to considerably affect your insurance coverage premiums. Those methods is not going to best prevent cash but additionally give a contribution to a more secure using surroundings for everybody at the roads.

Keeping up a Pristine Riding File

A spotless using file is paramount for securing favorable insurance coverage charges. Constant adherence to visitors rules and protected using practices is the most important. Keeping off injuries and visitors violations without delay affects your insurance coverage premiums. Insurance coverage firms use using historical past to evaluate threat and assign top rate ranges. A blank file interprets to decrease premiums, demonstrating your accountable habits at the street.

Secure Riding Conduct in Ocala

Enforcing protected using conduct is not just very important in your protection but additionally for holding your insurance coverage premiums low. At all times observe pace limits, care for a protected following distance, and steer clear of distractions akin to mobile phone use. Riding inebriated or medicine is exactly prohibited and can result in vital will increase in insurance coverage premiums and attainable prison penalties.

Via proactively averting dangerous using behaviors, you reduce the possibility of injuries, decreasing your insurance coverage prices.

Managing Your Credit score Historical past

Your credit score rating performs a vital function in figuring out your automotive insurance coverage charges. Keeping up a wholesome credit score rating demonstrates monetary accountability to insurance coverage suppliers. Top credit score ratings ceaselessly translate to decrease insurance coverage premiums. Lenders use credit score ratings to evaluate the danger of lending, and insurers use a identical manner when comparing threat. Paying expenses on time and managing debt responsibly contributes to a good credit score rating, impacting your insurance coverage charges undoubtedly.

Car Repairs for Decrease Premiums

Common car upkeep is not only about holding your automotive working easily; it will possibly additionally lend a hand decrease your insurance coverage premiums. Correctly maintained automobiles are much less at risk of mechanical screw ups and injuries, which will cut back the danger for insurance coverage suppliers. Making sure your car is correctly inspected and maintained can result in decrease premiums. Making an investment in preventative upkeep can prevent cash ultimately.

Evaluating Insurance coverage Insurance policies with Other Deductibles

Working out deductibles is the most important when evaluating insurance coverage insurance policies. The next deductible way a decrease top rate, however you can wish to pay extra out-of-pocket within the match of a declare. Decrease deductibles lead to upper premiums however be offering better monetary coverage. In moderation review your monetary scenario and threat tolerance when opting for a deductible quantity. Believe the possibility of wanting to make a declare and your talent to pay a better deductible to decrease your top rate.

Elements Influencing Automobile Insurance coverage Prices in Ocala

| Issue | Description |

|---|---|

| Riding File | Injuries, violations, and claims impact premiums. |

| Credit score Ranking | Monetary accountability is mirrored in insurance coverage charges. |

| Car Kind | Top-performance or luxurious vehicles ceaselessly have upper premiums. |

| Location | Visitors density and coincidence charges affect premiums in particular spaces. |

| Age and Gender | Statistics display that sure age and gender teams have upper or decrease coincidence charges. |

| Protection Choices | Upper ranges of protection translate to better premiums. |

Not unusual Errors to Keep away from in Automobile Insurance coverage Variety

Ignoring your credit score rating, failing to check quotes from a couple of suppliers, and neglecting to grasp protection choices are not unusual pitfalls. Reviewing insurance coverage main points in moderation and in search of recommendation from monetary mavens mean you can steer clear of those errors. Faulty or incomplete knowledge can result in wrong insurance policy and doubtlessly upper prices.

Assets for Additional Knowledge on Automobile Insurance coverage in Ocala

Navigating the sector of vehicle insurance coverage can really feel overwhelming, particularly if you end up in search of the most productive offers in a selected space like Ocala. This phase supplies very important sources that will help you make instructed selections and in finding the suitable protection in your wishes. Armed with this information, you’ll be able to hopefully evaluate insurance policies and make a selection the most suitable option in your using scenario.Working out the to be had sources empowers you to proactively set up your insurance coverage wishes, main to larger peace of thoughts and doubtlessly vital financial savings.

Via exploring those avenues, you can acquire a complete viewpoint on automotive insurance coverage in Ocala and hopefully choose essentially the most appropriate protection.

Native Insurance coverage Brokers in Ocala

Discovering a neighborhood insurance coverage agent will also be extremely really useful. They possess in-depth wisdom of the Ocala marketplace, providing personalised recommendation and doubtlessly figuring out unique offers adapted for your cases. Native brokers perceive the particular visitors patterns, coincidence charges, and different elements distinctive to the realm, which will affect your insurance coverage premiums.

- Native insurance coverage companies ceaselessly have a deep figuring out of the native marketplace, which will also be tremendous when in search of aggressive charges. They may be able to supply personalised recommendation and cater to precise wishes, making sure you get the most productive imaginable protection.

- Many native companies be offering the facility to fulfill in individual, making an allowance for detailed dialogue and questions on your specific scenario. They may be able to allow you to perceive advanced insurance policies and supply insights on choices now not readily obvious on-line.

State Insurance coverage Departments in Ocala

State insurance coverage departments supply the most important sources for customers. They care for data of approved insurance coverage firms, be sure that compliance with laws, and take care of shopper court cases. Working out those sources empowers you to successfully cope with issues and suggest in your pursuits.

- The Florida Division of Monetary Products and services (DFS) is the principle regulatory frame for insurance coverage in Florida. You’ll be able to in finding precious details about approved insurers, insurance-related rules, and shopper coverage measures on their web site.

- Contacting the DFS without delay can come up with insights into particular insurance coverage insurance policies and their compliance with state laws. Additionally they be offering steering on resolving insurance-related disputes.

Shopper Coverage and Insurance coverage Lawsuits in Ocala

Navigating insurance coverage disputes will also be difficult. Realizing report a criticism and search recourse is the most important for customers. Working out those processes guarantees your rights are secure and your issues are addressed as it should be.

- The Florida Division of Monetary Products and services (DFS) handles shopper court cases and investigations associated with insurance coverage insurance policies. Submitting a criticism with the DFS supplies a proper street for addressing dissatisfaction with an insurance coverage corporate.

- The DFS maintains detailed pointers for submitting insurance coverage court cases. Working out those pointers guarantees the criticism is submitted accurately, maximizing its effectiveness.

Researching Insurance coverage Insurance policies Explicit to Ocala

Researching insurance policies adapted to Ocala’s particular stipulations is very important for locating the most productive imaginable price. Working out native elements can considerably affect your insurance coverage prices.

- On-line comparability equipment generally is a nice place to begin for exploring quite a lot of insurance coverage insurance policies. Those equipment ceaselessly supply personalised quotes in response to your using historical past, car sort, and site.

- Reviewing coverage main points completely is very important. Working out the protection, exclusions, and particular clauses related to Ocala can prevent cash and save you long run disputes.

Regularly Requested Questions (FAQ) About Automobile Insurance coverage in Ocala

Working out not unusual questions on automotive insurance coverage in Ocala can save you confusion and supply precious insights.

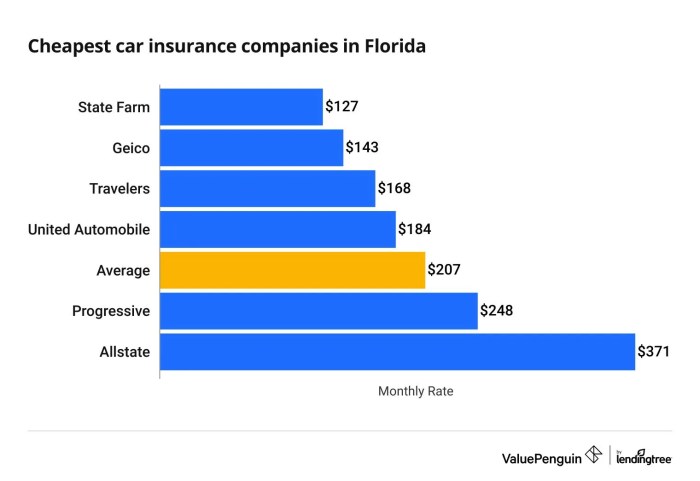

- Query: What are the everyday automotive insurance coverage charges in Ocala?

Resolution: Automobile insurance coverage charges in Ocala, like in any space, range in response to elements like your using historical past, car sort, and selected protection. Evaluating quotes from a couple of suppliers is very important to decide essentially the most inexpensive choice. - Query: How can I decrease my automotive insurance coverage charges in Ocala?

Resolution: Keeping up a blank using file, expanding your deductible, and taking into consideration complete protection with a excessive deductible can ceaselessly result in decrease premiums. Insurance coverage suppliers in Ocala, as somewhere else, ceaselessly praise accountable using habits.

Key Touch Knowledge for Insurance coverage Comparable Products and services in Ocala

Having access to related touch knowledge streamlines the method of in search of help. This desk supplies very important main points in your comfort.

| Provider | Touch Knowledge |

|---|---|

| Florida Division of Monetary Products and services (DFS) | (Details about the Florida DFS’s web site and get in touch with quantity) |

| Ocala Chamber of Trade | (Details about the Ocala Chamber of Trade’s web site and get in touch with quantity) |

| Nationwide Insurance coverage Shopper Helpline | (Details about the Nationwide Insurance coverage Shopper Helpline’s web site and get in touch with quantity) |

Opting for the Proper Automobile Insurance coverage Supplier in Ocala

Selecting the best insurance coverage supplier comes to cautious attention of quite a lot of elements. Working out those parts is the most important to creating an educated determination.

- Reviewing monetary balance experiences for insurance coverage firms is the most important. Firms with robust monetary rankings ceaselessly supply better balance and safety in your coverage.

- Buyer evaluations and testimonials can be offering insights into an organization’s recognition and repair high quality. Sure evaluations and comments ceaselessly level to a supplier dedicated to buyer pride.

Conclusive Ideas

In conclusion, securing affordable automotive insurance coverage in Ocala is achievable with a well-informed manner. Via figuring out the influencing elements, evaluating quotes strategically, and selecting the proper protection, you’ll be able to navigate the complexities and in finding the easiest stability between affordability and coverage. Embody this information as a device for monetary empowerment, permitting you to power hopefully and with peace of thoughts.

Common Inquiries: Reasonable Automobile Insurance coverage In Ocala

What’s the reasonable price of vehicle insurance coverage in Ocala?

Moderate prices range very much relying on elements like using file, car sort, and protection alternatives. It is best to get personalised quotes to decide your particular price.

Can I am getting a cut price on my automotive insurance coverage in Ocala?

Sure, a lot of reductions are to be had, akin to reductions for protected drivers, excellent scholars, and for bundling insurance coverage merchandise. Be sure you inquire about all to be had reductions.

What are the most typical misconceptions about affordable automotive insurance coverage?

A not unusual false impression is that sacrificing protection will robotically yield decrease premiums. On the other hand, insufficient protection can depart you at risk of monetary hardship. Complete and thorough protection is very important, and inexpensive choices are to be had to suit any funds.

How can I evaluate automotive insurance coverage quotes successfully?

Make the most of on-line comparability internet sites in particular adapted for Ocala. Examine a couple of quotes from other insurers to spot the most productive deal in your wishes. This thorough comparability will empower you to take advantage of instructed determination.