Hertz Eire automobile condominium insurance coverage supplies a the most important layer of coverage for vacationers. This complete information delves into the specifics of Hertz’s insurance coverage choices, evaluating them to competitor choices within the Irish marketplace. It main points the more than a few protection varieties, extra quantities, and related prices, enabling knowledgeable selections referring to condominium insurance coverage variety. The file additionally addresses crucial Irish riding laws, the claims procedure, and extra protection choices, making sure a whole working out of the insurance coverage panorama.

Working out the other insurance coverage tiers and their related coverages is the most important. A comparative research of Hertz’s insurance policies towards the ones of different primary condominium corporations is gifted, providing precious perception into the marketplace panorama. Elements like extra quantities and pricing methods are tested, helping within the collection of probably the most appropriate insurance coverage choice. This research additionally addresses the consequences of insufficient insurance coverage and possible consequences below Irish legislation.

Review of Automobile Condominium Insurance coverage in Eire

Hiring a automobile in Eire generally is a breeze, however working out the insurance coverage choices is vital to a clean shuttle. Other corporations be offering more than a few ranges of coverage, making sure you are lined for various scenarios. Understanding what is incorporated in each and every package deal is helping you select the best degree of insurance coverage on your wishes and finances.

Commonplace Automobile Condominium Insurance coverage Choices

Automobile condominium insurance coverage in Eire most often contains choices starting from elementary protection to complete coverage. Those choices range considerably within the kinds of incidents they quilt and the extent of economic accountability they switch. This implies you wish to have to scrupulously believe what sort of coverage you wish to have.

Kinds of Coverages

Commonplace coverages come with collision harm waiver (CDW), robbery coverage, and legal responsibility insurance coverage. CDW protects you from harm to the condominium automobile, without reference to who’s at fault. Robbery coverage covers the lack of the automobile. Legal responsibility insurance coverage covers any harm you motive to other folks’s belongings or damage to others. Working out the specifics of those coverages is the most important to choosing the right plan.

Insurance coverage Tiers and Coverage Ranges

Insurance coverage tiers frequently differentiate via the extent of extra (the volume you are chargeable for paying within the match of an coincidence or harm) and the breadth of coverage. A elementary coverage would possibly have the next extra and less coverages than a top class package deal. Upper tiers most often be offering larger coverage and a decrease extra, even though this comes at the next charge.

Imagine the prospective dangers you face when renting a automobile and select the proper degree of coverage.

Insurance coverage Choice Comparability Desk

| Insurance coverage Kind | Protection | Extra | Price |

|---|---|---|---|

| Elementary | Collision harm, robbery, third-party legal responsibility. This can be a naked minimal protection, and the surplus is frequently important. | €1,000 – €2,000 (or extra). This will range a great deal relying at the condominium corporate and the automobile sort. | Usually probably the most inexpensive choice. |

| Top class/Complete | Collision harm, robbery, third-party legal responsibility, and frequently further coverages like windscreen harm, unintentional harm, and private coincidence quilt. | €0 – €500 (or much less). The surplus is frequently considerably not up to elementary choices. | Upper than elementary, however frequently price the price for additonal coverage. |

Hertz Automobile Condominium Insurance coverage Specifics

Hertz provides more than a few insurance coverage applications to fit other wishes and budgets for automobile leases in Eire. Working out those choices is the most important for making sure your shuttle is going easily and you are safe towards sudden bills. This phase dives deep into the main points of Hertz’s insurance coverage choices, highlighting key options and comparisons to competition.

Insurance coverage Package deal Choices

Hertz supplies a spread of insurance coverage choices, permitting you to select the extent of protection that most closely fits your wishes and expected chance. Each and every package deal has other ranges of coverage and extra quantities. In moderation taking into consideration those choices is very important to steer clear of pointless monetary burdens.

| Package deal Identify | Protection | Extra | Value |

|---|---|---|---|

| Elementary Insurance coverage | Covers harm to the automobile, robbery, and third-party legal responsibility. | €1,500 | €15-€25 according to day (depending on condominium duration and automobile sort). |

| Enhanced Insurance coverage | Supplies complete protection together with harm, robbery, third-party legal responsibility, and private coincidence insurance coverage. | €0 | €20-€30 according to day (depending on condominium duration and automobile sort). |

| Top class Insurance coverage | Covers all sides of the Elementary and Enhanced package deal, plus further advantages comparable to windscreen harm and hearth harm. | €0 | €25-€35 according to day (depending on condominium duration and automobile sort). |

Extra Quantities Defined

The surplus quantity is the portion of the wear or loss that you are chargeable for paying. Working out that is the most important when opting for your insurance coverage package deal. Decrease excesses most often imply you pay much less if one thing is going fallacious, however this frequently comes with the next day by day insurance coverage charge.

Buying Insurance coverage Immediately from Hertz

You’ll be able to acquire insurance coverage without delay from Hertz on the time of reserving your condominium. That is frequently probably the most handy and simple means, making sure you are lined from the beginning. Hertz additionally supplies on-line reserving amenities and get in touch with make stronger to help you.

Comparability to Competition

Evaluating Hertz’s insurance coverage applications with the ones of competition like Undertaking or Avis is very important. Take a look at the particular protection, extra quantities, and costs. Hertz frequently supplies aggressive pricing, however you will have to take a look at explicit offers and promotions for the most productive general worth.

Buying Insurance coverage

The method for buying insurance coverage without delay from Hertz is in most cases simple. All over the web reserving procedure, you’ll be able to be introduced with more than a few insurance coverage choices. Make a choice the one who easiest suits your wishes and entire the reserving. You’ll be able to additionally touch Hertz without delay for additional help.

Evaluating Hertz to Different Condominium Corporations

Choosing the proper automobile condominium insurance coverage in Eire can really feel like navigating a maze. Other corporations have other insurance policies, extra charges, and pricing buildings. Working out how Hertz stacks up towards different primary avid gamers can prevent cash and complications.Evaluating Hertz’s insurance coverage applications to these of competitors like Undertaking, Avis, and Finances unearths a combined bag. Elements like extra fees, add-on choices, and general pricing range considerably.

Working out those nuances is vital to getting the most productive deal.

Insurance coverage Coverage Variations

Other condominium corporations tailor their insurance coverage choices to fit more than a few buyer wishes and chance profiles. Some corporations emphasize complete protection, whilst others focal point on extra elementary coverage. Working out those variations is the most important for making an educated resolution. Hertz, like different primary condominium corporations, provides a spread of choices, together with non-compulsory extras, each and every with its personal set of barriers and prices.

Extra Fees

Extra fees are a major factor in insurance coverage prices. They constitute the volume you are chargeable for paying in case your condominium automobile is broken or stolen. Hertz’s extra insurance policies can range relying on the kind of insurance coverage package deal you choose. Different corporations would possibly have equivalent buildings, however the explicit quantities and related prerequisites frequently fluctuate. It is important to match the surplus quantities throughout more than a few condominium companies.

Pricing Methods

Condominium corporations make use of numerous pricing methods for insurance coverage. Some corporations be offering a base insurance coverage package deal that incorporates legal responsibility protection. Others be offering a extra complete protection at the next value. Hertz’s pricing type for insurance coverage is one instance. Understanding the pricing construction of the other condominium companies permits you to select probably the most cost-effective choice.

Elements like your riding historical past, the kind of automobile, and the length of the condominium can affect the price.

Comparability Desk

| Condominium Corporate | Insurance coverage Choice | Extra | Value |

|---|---|---|---|

| Hertz | Elementary Insurance coverage | €1,500 | €25 according to day |

| Hertz | Enhanced Insurance coverage | €0 | €40 according to day |

| Undertaking | Elementary Insurance coverage | €1,000 | €20 according to day |

| Avis | Elementary Insurance coverage | €1,200 | €22 according to day |

| Finances | Elementary Insurance coverage | €1,800 | €28 according to day |

Observe: Costs are estimated and might range in keeping with explicit condominium prerequisites and dates.

Working out Eire’s Riding Rules: Hertz Eire Automobile Condominium Insurance coverage

Eire’s riding laws are beautiful simple, however understanding them is the most important for a clean and enjoyable shuttle. Those regulations practice to all drivers, without reference to their nationality. Working out those regulations guarantees you are compliant and steer clear of possible problems with the legislation.Eire takes highway protection severely, and having good enough insurance coverage is a key element of that. This phase dives into the specifics of Irish riding laws, specializing in the insurance coverage sides, and the consequences of now not assembly those necessities.

Irish Riding Rules Referring to Insurance coverage

Irish legislation mandates that every one automobiles at the highway have legitimate insurance coverage. This isn’t only a advice; it is a felony requirement. This insurance coverage covers possible harm to other folks’s belongings or damage to other folks in case of an coincidence. Failure to conform to this legislation has severe penalties.

Implications of Inadequate Insurance coverage

Failing to hold enough insurance coverage can result in hefty fines, doubtlessly even legal fees. Riding with out insurance coverage can lead to a considerable penalty. It’s good to face speedy motion from the government or even the prospective seizure of your automobile.

Consequences for Riding With out Right kind Insurance coverage

The consequences for riding with out correct insurance coverage in Eire are important. Fines are really extensive and will range relying at the explicit instances, however are most often within the masses and even hundreds of Euros. In some circumstances, a courtroom order to pay reimbursement may be issued to the injured get together. Moreover, riding with out insurance coverage may affect your talent to procure insurance coverage at some point, making it more difficult and costlier to procure at some point.

Necessities for World Drivers

World drivers wish to adhere to the similar insurance coverage laws as Irish drivers. If you are renting a automobile, make sure that the condominium corporate’s insurance coverage covers you. Even though you’ve insurance coverage from your house nation, you’ll be able to most probably wish to end up this meets the Irish usual and take note of any barriers in protection. If you’re unsure, all the time touch the related government for rationalization.

Abstract of Felony Responsibilities for Automobile Condominium Insurance coverage in Eire

In abstract, all drivers in Eire, together with world guests, will have to be sure their automobile is roofed via legitimate insurance coverage. Renting a automobile obligates the condominium corporate to offer insurance policy. This insurance coverage wishes to fulfill the criteria of Irish legislation. Failure to fulfill those responsibilities can lead to important felony and fiscal penalties.

Pointers for Opting for the Proper Insurance coverage

Choosing the right automobile condominium insurance coverage in Eire is the most important for a clean and enjoyable shuttle. It protects you from sudden prices and guarantees you are lined in case of injuries, harm, or robbery. Working out the more than a few choices to be had and the way they practice in your explicit wishes is vital.

Elements to Imagine When Settling on Insurance coverage

Cautious attention of a number of elements is very important when opting for automobile condominium insurance coverage. Those elements vary from the particular phrases of the coverage to the total prices concerned. Working out those main points will permit you to make an educated resolution.

- Protection Extent: Review the scope of the insurance coverage package deal. Does it quilt harm to the condominium automobile, private damage, or third-party legal responsibility? Insurance policies fluctuate considerably, and a complete working out of what is incorporated is paramount.

- Extra (Deductible): The surplus is the volume you’ll be able to pay out-of-pocket if you are making a declare. A decrease extra most often manner the next top class. Take into accounts your finances and what kind of you are at ease paying within the match of an coincidence or harm.

- Condominium Length: The period of your condominium duration will affect the price of the insurance coverage. An extended condominium duration frequently ends up in the next top class. Issue this into your general finances.

- Driving force Profile: Imagine the motive force’s revel in and riding report. A amateur driving force would possibly require the next degree of protection and the next top class. Pay attention to your driving force profile and modify your insurance coverage selection accordingly.

- Pre-existing Prerequisites: If in case you have any pre-existing prerequisites or a historical past of injuries, it is necessary to pay attention to the consequences on insurance policy. Evaluate the particular phrases and stipulations.

Evaluating Costs and Protection Throughout Choices

Evaluating automobile condominium insurance coverage throughout other suppliers is a crucial step to find the most productive deal. There are a number of the right way to successfully examine insurance policies and costs.

- Use Comparability Web pages: On-line comparability internet sites may give an summary of more than a few insurance coverage applications from other condominium corporations. This lets you briefly examine costs and protection without having to touch each and every supplier in my view.

- Touch Condominium Corporations Immediately: Do not hesitate to touch the condominium corporations without delay for quotes. This permits for a customized dialogue of your wishes and can result in better-tailored insurance coverage applications.

- Test 3rd-Celebration Suppliers: Imagine third-party insurance coverage suppliers who be offering supplementary or choice choices. They could be offering aggressive charges or explicit coverages.

Studying the Advantageous Print of Insurance coverage Insurance policies

Totally reviewing the tremendous print is necessary to totally working out the phrases and stipulations of your preferred insurance plans. This meticulous evaluation will save you sudden problems down the street.

- Perceive Exclusions: Insurance policies frequently include exclusions, comparable to pre-existing harm or explicit kinds of utilization. In moderation evaluation those exclusions to be sure you perceive what is not lined.

- Examine Declare Procedures: Understanding the stairs for creating a declare will end up precious in case of an incident. Be sure to are pleased with the procedures and the time frame.

- Search for Boundaries: Insurance coverage insurance policies could have barriers at the quantity of protection or the length of the security. Be certain the constraints align together with your wishes.

Maximizing Coverage With out Overspending

Discovering a stability between complete protection and cost-effectiveness is the most important. There are methods to maximise coverage with out breaking the financial institution.

- Imagine Extra Choices: Review the potential of expanding the surplus (deductible) to decrease the top class. If you’re assured for your talent to regulate the monetary accountability, it will prevent cash.

- Review Protection Ranges: In moderation believe the extent of protection you require. Whilst complete insurance coverage is effective, it will not be vital if you’re best touring for a brief length.

- Evaluate Upload-ons: Search for add-ons that may complement the fundamental coverage, comparable to roadside help or further driving force protection, and moderately weigh whether or not they’re vital.

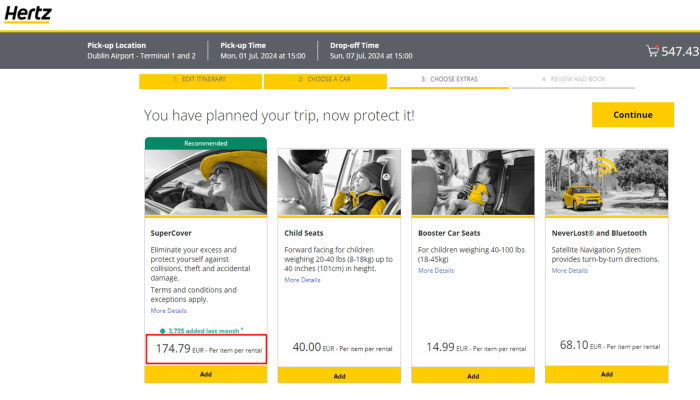

Further Protection Choices

Choosing the right insurance coverage on your condominium automobile is going past the fundamentals. From time to time, usual insurance policies do not quilt the entirety chances are you’ll want. That is the place non-compulsory add-ons come in useful, providing peace of thoughts for more than a few eventualities.Those further coverages can offer protection to you from sudden bills and make sure a smoother condominium revel in. Working out those choices is secret to meaking an educated resolution.

Non-compulsory Upload-on Coverages

Further coverages are the most important to counterpoint your base insurance coverage. They frequently cope with explicit situations or supply broader coverage. Those extras can also be custom designed in your wishes and finances.

- Non-public Coincidence Insurance coverage: This protection protects you and your passengers in case of damage right through your condominium. It is the most important addition, particularly for longer journeys or when touring with others. It most often covers clinical bills and possible misplaced wages because of damage. As an example, a surprising coincidence on a winding Irish highway may lead to important clinical expenses, and this insurance coverage would lend a hand offset the ones prices.

- Kid Seat Insurance coverage: If you are renting a automobile with youngsters, kid seat insurance coverage is very important. You need to verify with the condominium corporate if a kid seat is needed on your adventure. This protection frequently protects the condominium corporate from any harm or legal responsibility associated with the kid seat. That is crucial to verify your shuttle is compliant with native laws, and that the kid is correctly secured.

- GPS Instrument or Navigation Protection: A GPS or navigation machine could make your Irish highway shuttle more straightforward. Some condominium corporations would possibly price further for those who harm the apparatus. Non-compulsory protection would quilt any prices associated with the GPS if it is broken right through the condominium duration. That is specifically useful for unfamiliar routes or for vacationers unfamiliar with the Irish highway community.

Further Prices

It is the most important to know the additional charge of those choices. The costs can range in keeping with the condominium duration, the kind of automobile, and the particular protection. Condominium corporations most often listing the precise value breakdown of those further coverages on their internet sites.

| Protection | Conventional Price Instance (according to day) |

|---|---|

| Non-public Coincidence Insurance coverage | €5-€10 |

| Kid Seat Insurance coverage | €2-€5 |

| GPS Instrument Protection | €3-€7 |

Further prices can also be really extensive. Evaluating quotes from other condominium corporations is a great way to get the most productive deal.

Insurance coverage Claims Procedure

Submitting a declare with Hertz Eire automobile condominium insurance coverage is easy, however having the best data and documentation in a position will accelerate the method. Working out the stairs concerned previously can ease any rigidity or confusion right through the declare process. Observe those steps to verify a clean and environment friendly declare solution.The Hertz Eire automobile condominium insurance coverage declare procedure is designed to be environment friendly and clear.

It is important to collect all required documentation to expedite the method and steer clear of delays. This complete information Artikels the vital steps and data that will help you document a declare successfully.

Declare Process Review

This phase supplies a step by step information that will help you navigate the Hertz Eire automobile condominium insurance coverage declare procedure.

- Preliminary Touch and Document: In an instant after an incident, touch Hertz Eire customer support or your designated touch particular person. Supply them with an in depth account of the development, together with the time, location, and nature of the wear or incident. Documenting the development with pictures or movies is strongly beneficial to make stronger your declare. This preliminary file is important in starting up the declare procedure and making sure a well timed reaction.

- Collecting Documentation: Accumulate all vital documentation. This most often contains your condominium settlement, evidence of acquire, police file (if appropriate), and any related restore quotes. Detailed pictures and movies of the wear to the automobile are crucial proof. It is beneficial to get a written remark from any witnesses if conceivable.

- Declare Submission: Hertz will information you at the vital steps for filing your declare on-line or by way of a chosen shape. Be sure to supply all of the required data appropriately and entirely. Complying with the supplied directions will expedite the method.

- Analysis and Review: Hertz will overview the declare in keeping with the supplied documentation. This may occasionally contain an inspection of the broken automobile. They are going to touch you for additional data or rationalization. Be ready to reply to any questions and supply further paperwork if vital.

- Declare Solution: Upon declare approval, Hertz will tell you of the following steps. This may occasionally come with maintenance or a agreement, relying at the nature of the declare and the coverage protection. You’ll be able to be stored up to date all through the method.

Required Documentation

Offering the proper documentation is necessary for a clean declare procedure. Make certain that you’ve the vital fabrics in a position to steer clear of delays.

- Condominium Settlement: This file main points the condominium phrases, together with the automobile’s situation initially of the condominium duration.

- Evidence of Acquire: Proof of your fee for the condominium, appearing the condominium dates and quantity paid.

- Police Document (if appropriate): A police file is frequently required for incidents involving injuries or harm requiring police intervention. It is the most important for felony functions.

- Restore Quotes: Estimates for maintenance to the automobile from a relied on mechanic. Those quotes will probably be used to evaluate the price of the wear.

- Pictures and Movies: Complete visible documentation of the wear to the automobile, taken straight away after the incident.

- Witness Statements (if appropriate): Written statements from any witnesses to the incident can also be extraordinarily useful.

Pointers for a Clean Declare Procedure, Hertz eire automobile condominium insurance coverage

Following the following pointers mean you can navigate the declare procedure successfully.

- Be in contact Successfully: Take care of open conversation with Hertz all through the declare procedure. Promptly reply to any requests for info or rationalization.

- Be Correct and Detailed: Supply exact information about the incident and harm to the automobile. Correct data will expedite the declare procedure.

- Stay Copies: Retain copies of all paperwork submitted on your data. That is the most important for long run reference.

- Be Affected person: The declare procedure might take time, relying at the complexity of the declare. Keep affected person and cooperative all through the method.

Final Conclusion

In conclusion, Hertz Eire automobile condominium insurance coverage is a crucial side of the Irish condominium automobile revel in. Cautious attention of protection ranges, extra charges, and comparative pricing amongst condominium companies is paramount. Working out Eire’s riding laws and the claims procedure are similarly vital. Through totally comparing those elements, vacationers can choose the optimum insurance coverage package deal, balancing coverage with cost-effectiveness.

Further protection choices, comparable to private coincidence insurance coverage, will have to even be thought to be to verify complete coverage. This information supplies a complete review to empower knowledgeable decision-making for condominium automobile insurance coverage in Eire.

Q&A

What’s the standard extra quantity for a elementary Hertz insurance coverage package deal?

The surplus quantity for a elementary Hertz insurance coverage package deal varies relying at the explicit automobile and condominium duration. Seek advice from the Hertz Eire website online for probably the most up-to-date data.

What documentation is needed for a Hertz insurance coverage declare?

Documentation necessities for a Hertz insurance coverage declare most often come with the condominium settlement, police file (if appropriate), and evidence of wear to the automobile.

What are the consequences for riding with out good enough insurance coverage in Eire?

Riding with out good enough insurance coverage in Eire carries possible consequences, together with fines and possible felony motion. Seek the advice of the related Irish govt internet sites for exact main points.

Are there any explicit necessities for world drivers referring to insurance coverage in Eire?

World drivers renting a automobile in Eire are matter to the similar insurance coverage necessities as Irish citizens. Verification of good enough protection is very important.