Low-income automotive insurance coverage in Kentucky items distinctive demanding situations for citizens in search of reasonably priced protection. Navigating the complicated rules and to be had techniques calls for cautious attention of things impacting premiums, reminiscent of using historical past and automobile sort. This information supplies a complete evaluate of the panorama, exploring insurance coverage suppliers, software processes, monetary help, client rights, and selection transportation choices.

Kentucky’s various demographics and ranging financial stipulations affect the fee and accessibility of auto insurance coverage. This information delves into the specifics, offering sensible knowledge and insights to empower low-income drivers to safe appropriate protection.

Assessment of Low-Source of revenue Automobile Insurance coverage in Kentucky

Navigating the complexities of auto insurance coverage can also be daunting, particularly for the ones going through monetary constraints. In Kentucky, securing reasonably priced protection items distinctive demanding situations, stemming from components like emerging premiums and restricted get right of entry to to specialised techniques. This evaluate delves into the precise hurdles low-income folks stumble upon, the state’s regulatory panorama, and commonplace misconceptions surrounding reasonably priced insurance coverage choices.The monetary pressure of keeping up a automobile can also be compounded by way of the excessive charge of insurance coverage.

Restricted revenue frequently restricts get right of entry to to complete protection, leaving folks susceptible to monetary losses within the tournament of an twist of fate or injury. Additionally, Kentucky’s insurance coverage marketplace, whilst no longer explicitly discriminatory, can inadvertently downside the ones with decrease earning because of components like greater threat checks and restricted program availability.

Demanding situations Confronted by way of Low-Source of revenue People

Kentucky’s insurance coverage panorama items distinctive demanding situations for low-income drivers. Those demanding situations come with a common build up in premiums around the board, probably main to better prices for the ones already suffering financially. Additional complicating issues is the truth that insurance coverage corporations continuously assess threat in accordance with components reminiscent of using historical past and automobile sort, which will disproportionately have an effect on folks with restricted monetary sources.

Regulatory Framework and Regulations

Kentucky’s regulatory framework referring to automotive insurance coverage for low-income folks is a fancy interaction of state regulations and business practices. The state’s insurance coverage commissioner oversees the marketplace, making sure compliance with rules designed to give protection to customers. Whilst particular techniques designed for low-income drivers don’t seem to be mandated, the regulatory framework does permit for flexibility in offering choices.

Commonplace Misconceptions

A number of misconceptions encompass low-income automotive insurance coverage in Kentucky. A commonplace false impression is that reasonably priced protection choices are unavailable, or that low-income drivers are robotically deemed high-risk. In fact, specialised techniques and reductions exist, even supposing they would possibly not all the time be readily obvious. Moreover, some imagine that insurance coverage corporations intentionally goal low-income folks with greater premiums; this tradition, whilst probably going on in positive circumstances, isn’t essentially the norm.

Low-Source of revenue Automobile Insurance coverage Methods

Kentucky’s insurance coverage marketplace gives quite a lot of techniques to lend a hand low-income folks in acquiring reasonably priced protection. Spotting the original wishes of drivers with restricted monetary sources, plenty of insurers and state-sponsored techniques supply monetary help, lowered charges, or different improve. Discovering the correct program frequently comes to cautious analysis and comparability.

| Program Kind | Description | Eligibility Standards |

|---|---|---|

| State-sponsored techniques | Those techniques be offering lowered premiums or subsidies to qualifying drivers. | Normally in accordance with revenue and monetary want, with particular pointers established by way of the state. |

| Insurance coverage company-specific techniques | Many insurance coverage corporations be offering reductions or lowered charges to low-income drivers. | Incessantly in accordance with components like employment verification, or evidence of enrollment in positive help techniques. |

| Non-profit organizations | Sure non-profit organizations in Kentucky be offering improve and sources for locating reasonably priced automotive insurance coverage. | Eligibility standards frequently range by way of group. |

Components Affecting Insurance coverage Prices

Navigating the labyrinth of auto insurance coverage premiums can really feel daunting, particularly for low-income drivers in Kentucky. Working out the standards influencing those prices empowers knowledgeable choices and is helping to find appropriate protection choices. This exploration dives deep into the variables that form insurance coverage charges, from using historical past to location, offering readability and perception for Kentucky drivers.The price of automotive insurance coverage isn’t a hard and fast quantity; it is a dynamic mirrored image of quite a lot of threat components.

Insurance coverage corporations meticulously assess those components to decide the fitting top class for each and every driving force. A complete working out of those components is a very powerful for drivers in search of reasonably priced and dependable protection.

Riding Historical past

Riding historical past is a cornerstone of insurance coverage pricing. Injuries, shifting violations, and claims all give a contribution to a driving force’s threat profile. A blank using report, characterised by way of a historical past of accountable using, interprets to decrease premiums. Conversely, drivers with a historical past of injuries or violations face considerably greater premiums because of the higher threat they pose. This theory is universally carried out around the insurance coverage business, and Kentucky is not any exception.

Automobile Kind

The kind of automobile performs a vital position in insurance coverage prices. Top-performance automobiles, sports activities vehicles, or automobiles with excessive robbery charges usually draw in greater premiums. It is because those automobiles are perceived as posing the next threat of injuries, injury, or robbery. Conversely, less expensive and no more robust automobiles frequently command decrease premiums. The price and the style of the automobile affect the pricing.

Location

Location considerably affects insurance coverage prices in Kentucky. Spaces with greater crime charges or twist of fate concentrations have a tendency to have greater premiums. City spaces, frequently characterised by way of greater visitors density and congestion, continuously enjoy extra injuries than rural spaces, resulting in corresponding value diversifications. This can be a a very powerful issue to believe when evaluating charges throughout other portions of the state.

Insurance coverage corporations make the most of knowledge on twist of fate charges, robbery charges, and different components inside of particular areas to regulate premiums.

Demographic Components

Demographic components, reminiscent of age and gender, too can have an effect on insurance coverage prices. More youthful drivers, frequently thought to be a higher-risk team, usually pay greater premiums than older, extra skilled drivers. In a similar fashion, gender-based pricing diversifications are much less commonplace however can nonetheless exist in some areas. On the other hand, those components don’t seem to be as vital as using historical past and automobile sort. Additional, location considerably affects insurance coverage charges inside of a selected demographic team.

| Demographic Issue | Affect on Insurance coverage Price |

|---|---|

| Age (more youthful drivers) | Upper premiums because of perceived greater threat |

| Age (older drivers) | Decrease premiums because of perceived decrease threat |

| Gender | Minor diversifications in some areas, however most often much less vital than different components |

| Location (city vs. rural) | City spaces usually have greater premiums because of greater twist of fate charges |

This desk highlights the connection between quite a lot of demographics and their doable affect on insurance coverage premiums. Observe that those are common developments and person charges might range in accordance with a large number of things.

Insurance coverage Suppliers and Methods

Navigating the complexities of auto insurance coverage can also be daunting, particularly for low-income folks in Kentucky. Thankfully, a number of devoted suppliers and techniques are designed to make reasonably priced protection a fact. This segment delves into the specifics of those choices, highlighting the techniques to be had and the a very powerful components for eligibility.

Insurance coverage Suppliers Providing Specialised Low-Source of revenue Choices

Kentucky’s insurance coverage marketplace includes a vary of suppliers actively engaged in providing adapted answers for low-income drivers. Those suppliers perceive the original monetary constraints confronted by way of many and paintings to supply reasonably priced choices. This willpower lets in get right of entry to to protection for many who would possibly another way be excluded.

Particular Methods Designed to Support Low-Source of revenue People

A large number of techniques are designed to improve folks with restricted monetary sources. Those tasks frequently be offering discounted premiums, lowered deductibles, or versatile fee plans, making sure that the price of insurance coverage aligns with person budgets. Such techniques purpose to bridge the space between affordability and important protection.

Eligibility Standards and Software Procedures

Eligibility standards range amongst techniques however frequently contain demonstrating monetary hardship, reminiscent of low revenue or contemporary unemployment. Some techniques might also require evidence of residency inside of Kentucky. Candidates usually wish to entire an software shape, offering important documentation to ensure their monetary scenario and residency. Those paperwork frequently come with revenue verification, evidence of cope with, and different related knowledge.

Comparability of Low-Source of revenue Methods

| Insurance coverage Supplier | Program Identify | Key Options | Eligibility Standards | Software Procedure |

|---|---|---|---|---|

| Kentucky State Farm | Monetary Help Program | Decreased premiums, versatile fee choices. | Evidence of low revenue, Kentucky residency. | On-line software, in-person session. |

| Kentucky Mutual Insurance coverage Corporate | Inexpensive Care Program | Discounted charges, help with protection variety. | Evidence of low revenue, evidence of Kentucky residency, and different necessities. | On-line software, telephone session. |

| AAA Insurance coverage | Low-Source of revenue Protection | Reductions in accordance with monetary want, help with claims. | Demonstrated monetary want, evidence of Kentucky residency, and different standards. | On-line software, in-person session. |

Observe: Particular program main points and necessities might range. It will be significant to touch the insurance coverage supplier at once for essentially the most present knowledge.

Navigating the Software Procedure

Securing low-income automotive insurance coverage in Kentucky comes to a structured software procedure. Working out the stairs, required paperwork, and doable pitfalls can considerably streamline the method and build up your possibilities of approval. This information supplies a complete evaluate that can assist you navigate the applying with self assurance.

Software Steps

Effectively making use of for low-income automotive insurance coverage comes to a methodical method. Get started by way of collecting all important paperwork and knowledge. This preliminary step lays the groundwork for a easy and environment friendly software. Then, analysis insurance coverage suppliers providing low-income techniques in Kentucky, evaluating protection choices and premiums. After opting for a supplier, entire the applying shape correctly, making sure all required fields are crammed out.

Observe up with submission of the specified documentation and patiently watch for processing. After all, assessment your coverage and make contact with the supplier for any clarifications.

Required Paperwork and Knowledge

The applying procedure necessitates particular paperwork and knowledge. This comprises evidence of revenue, reminiscent of pay stubs, tax returns, or different related monetary information. Evidence of residency, reminiscent of a application invoice or rent settlement, could also be a very powerful. Moreover, you can want your driving force’s license and automobile registration main points. In some circumstances, further documentation like evidence of enrollment in a qualifying program may well be required.

Commonplace Errors to Keep away from

Fending off commonplace pitfalls is very important for a a hit software. Inaccuracies within the software shape may end up in delays or rejection. Incomplete or unsuitable documentation too can obstruct the method. Moreover, failing to fulfill time limits may end up in disqualification. Consider to scrupulously assessment all knowledge sooner than filing your software.

Software Procedure Abstract

| Step | Description | Closing dates | Required Paperwork |

|---|---|---|---|

| 1 | Accumulate important paperwork and knowledge. | Once imaginable | Evidence of revenue, evidence of residency, driving force’s license, automobile registration, evidence of enrollment (if appropriate) |

| 2 | Analysis and make a selection a supplier providing low-income techniques. | Inside a cheap time period to make sure all required knowledge is compiled | None particular to this step, however details about techniques and insurance policies from other suppliers. |

| 3 | Entire the applying shape correctly. | Once imaginable | Finished software shape. |

| 4 | Put up the specified paperwork and knowledge. | Once imaginable | All required paperwork from step 1. |

| 5 | Overview your coverage and make contact with the supplier for clarifications. | Inside a cheap time after receiving the coverage | The coverage report. |

Monetary Help and Subsidies

Navigating the complexities of auto insurance coverage can also be daunting, particularly for the ones with restricted monetary sources. Thankfully, Kentucky gives quite a lot of techniques and subsidies designed to ease the load of insurance coverage prices for low-income drivers. Those tasks purpose to make sure that get right of entry to to reasonably priced insurance coverage stays a fact for everybody, irrespective of their revenue bracket.

Monetary Help Methods in Kentucky

Kentucky’s dedication to reasonably priced automotive insurance coverage extends past elementary protection. A large number of techniques purpose to supply monetary help, lowering the monetary pressure on drivers with modest earning. Those techniques acknowledge the significance of transportation in day-to-day lifestyles and attempt to make insurance coverage extra obtainable.

Sorts of Monetary Help

Different types of monetary help lend a hand offset the price of automotive insurance coverage. Those choices range in scope and eligibility standards, catering to other monetary eventualities. Some techniques would possibly be offering direct reductions, whilst others might supply subsidies that scale back the whole top class. Those mechanisms attempt to create a extra equitable enjoying box within the insurance coverage marketplace.

Kentucky’s Monetary Help Choices

| Supplier | Eligibility Standards | Software Procedure |

|---|---|---|

| Kentucky Division of Insurance coverage | Drivers assembly low-income necessities, decided by way of particular revenue thresholds in accordance with circle of relatives dimension and site. Particular main points in regards to the standards can also be discovered at the division’s web page. | Normally comes to filing documentation to reveal revenue and family dimension. The method frequently calls for filling out an software shape and offering important supporting paperwork. Touch the dept for particular main points on software procedures. |

| Native Non-profit Organizations | Eligibility depends upon the precise program introduced by way of the non-profit. Incessantly, those organizations focal point on particular demographics or communities, with standards adapted to their venture. Detailed details about each and every group’s eligibility necessities can also be discovered on their web page or by way of contacting them at once. | Software processes range. You want to touch the group at once for particular directions on find out how to follow. |

| Insurance coverage Firms | Insurance coverage corporations would possibly be offering reductions or particular techniques adapted for low-income drivers. Those might come with bundled programs or particular reductions on insurance coverage insurance policies. Details about those techniques is to be had at the corporation’s web page. | The method for making use of for those reductions normally comes to contacting the insurance coverage corporation at once and inquiring about their to be had techniques. |

Shopper Coverage and Rights

Navigating the complexities of auto insurance coverage, in particular for low-income folks in Kentucky, calls for working out your rights and protections. Realizing those rights empowers you to make knowledgeable choices and cope with doable problems with insurance coverage suppliers. Kentucky regulation, coupled with federal rules, establishes a framework to safeguard customers from unfair practices.Kentucky’s dedication to client coverage extends to the automobile insurance coverage business.

Rules are in position to make sure equity and transparency within the dealings between insurance coverage corporations and their policyholders. This framework, whilst complete, necessitates an working out of the precise rights and processes to be had to customers.

Kentucky Shopper Coverage Regulations

Kentucky’s client coverage regulations, like the ones discovered on the federal stage, purpose to defend customers from predatory practices by way of insurance coverage corporations. Those regulations cope with problems like misleading promoting, unfair agreement practices, and failure to supply well timed claims processing. Realizing your rights is a very powerful for announcing your place when coping with an insurance coverage supplier.

Reporting Insurance coverage Court cases

Kentucky supplies avenues for reporting court cases about insurance coverage suppliers. Those avenues usually contain submitting a proper grievance with the Kentucky Division of Insurance coverage. A transparent and concise description of the problem is very important to facilitate a instructed and positive solution.

Steps for Addressing Unfair or Misleading Practices

In the event you imagine you’ve got encountered unfair or misleading practices from an insurance coverage corporation, a structured method is necessary. To start with, report all communique, together with correspondence, telephone calls, and any related main points. Accumulate supporting proof, reminiscent of coverage paperwork, declare paperwork, and any proof of misleading advertising and marketing or practices. Formal court cases to the Kentucky Division of Insurance coverage will have to be made in writing, offering an in depth account of the alleged violations.

If the problem stays unresolved, consulting with an legal professional is also important to pursue felony recourse.

Desk of Shopper Rights and Reporting Mechanisms

| Shopper Proper | Description | Reporting Mechanism |

|---|---|---|

| Truthful and Clear Pricing | Insurance coverage charges will have to be in accordance with respectable components and no longer discriminatory practices. | Kentucky Division of Insurance coverage, client advocacy teams |

| Instructed Declare Processing | Insurance coverage corporations are obligated to procedure claims in a well timed way, consistent with established procedures. | Kentucky Division of Insurance coverage, formal grievance channels |

| Coverage from Unfair Agreement Practices | Agreement negotiations will have to be performed relatively and according to coverage phrases and Kentucky regulation. | Kentucky Division of Insurance coverage, felony suggest |

| Get admission to to Knowledge | Customers have the correct to get right of entry to details about their coverage and claims. | Kentucky Division of Insurance coverage, supplier’s inner grievance process |

Selection Transportation Choices

For plenty of low-income Kentuckians, proudly owning a automotive is a need, however affording automotive insurance coverage could be a vital hurdle. This necessitates exploring viable choices to standard automotive possession, offering sensible and reasonably priced mobility answers. Those choices, frequently overpassed, can dramatically scale back monetary burdens and reinforce get right of entry to to very important services and products.

Public Transportation Choices

Public transportation techniques, together with buses and lightweight rail, be offering a cheap solution to navigate towns and cities. Those techniques range significantly of their protection and frequency, impacting their practicality. For instance, city spaces most often boast extra in depth and common services and products, while rural communities will have restricted get right of entry to. Working out the native transit machine’s path maps and schedules is a very powerful for environment friendly commute making plans.

Many public transit businesses be offering cell apps for real-time monitoring, path making plans, and fare knowledge, additional streamlining the enjoy.

Trip-Sharing Services and products

Trip-sharing services and products, like Uber and Lyft, supply every other selection to automotive possession. Those services and products be offering versatile and handy transportation, in particular for short-distance commute or rare journeys. On the other hand, prices can range relying on call for and distance, now and again making them similar to and even exceeding the price of automotive possession in some cases. Moreover, the supply of those services and products may well be restricted in rural spaces.

Bicycle and Strolling

Biking and strolling are eco-friendly and cost-effective modes of transportation for shorter distances. Their accessibility is at once connected to the geographic format and the supply of pedestrian and biking infrastructure. Towns with well-developed motorbike lanes and pedestrian walkways be offering a lot better stipulations for those modes. In spaces with restricted infrastructure, those choices may well be more difficult. Moreover, climate stipulations and protection issues play a task within the practicality of strolling and biking.

Comparative Research of Transportation Choices

The most efficient selection transportation choice is dependent closely on person wishes and cases. Components like distance, frequency of commute, time constraints, and native infrastructure all play a task. For common and long-distance commute, public transportation may well be essentially the most cost-effective choice. Trip-sharing services and products are perfect for occasional journeys, whilst biking and strolling are perfect suited to brief distances in appropriate spaces.

An intensive evaluate of person commute patterns is a very powerful in opting for essentially the most suitable selection.

Price Comparability Desk

| Transportation Possibility | Conventional Prices (consistent with go back and forth/month) | Further Concerns |

|---|---|---|

| Public Transportation | $1-$5 consistent with go back and forth; $20-$100 per 30 days (relying on frequency and path) | Calls for making plans; will not be appropriate for all locations; restricted availability in rural spaces. |

| Trip-Sharing Services and products | $5-$20 consistent with go back and forth; $50-$200 per 30 days (relying on distance and frequency) | Price can vary with call for; availability is also restricted in some spaces. |

| Bicycle/Strolling | Unfastened | Restricted by way of distance and terrain; calls for suitable tools and protection precautions; no longer appropriate for all climate stipulations. |

Illustrative Case Research

Navigating the complexities of reasonably priced automotive insurance coverage in Kentucky can also be daunting, particularly for low-income drivers. This segment items real-world situations, highlighting the demanding situations confronted and the way to be had techniques and subsidies can be offering answers. We discover how using historical past and different components have an effect on premiums, showcasing the various eventualities encountered by way of folks in search of reasonably priced protection.

Case Learn about 1: The Fresh Graduate

A up to date school graduate in Kentucky, Sarah, is hired part-time and has a restricted using historical past. Her restricted revenue makes complete insurance coverage a vital monetary burden. The price of protection is a substantial portion of her per 30 days finances, probably hindering her skill to save lots of or meet different monetary tasks. Kentucky’s low-income automotive insurance coverage techniques can give monetary help, probably lowering the per 30 days top class burden.

The techniques might also believe her loss of in depth using enjoy and be offering particular charges designed for younger drivers.

Case Learn about 2: The Unmarried Father or mother with A couple of Automobiles, Low-income automotive insurance coverage in kentucky

A unmarried guardian, David, in Kentucky, maintains more than one automobiles for paintings and circle of relatives wishes. He has a constant task, however the bills related to more than one automobiles, blended together with his circle of relatives’s wishes, pose a vital problem in securing reasonably priced insurance plans. The insurance coverage charge can briefly escalate in accordance with the choice of automobiles insured, the sorts of automobiles, and their use circumstances.

Kentucky’s insurance coverage techniques might be offering subsidies or reductions for households, and believe his task balance and monetary duty.

Affect of Riding Historical past

Riding historical past considerably influences insurance coverage premiums. Injuries and violations, even minor ones, may end up in really extensive will increase in premiums. A driving force with a blank using report can be expecting a decrease top class in comparison to a driving force with violations or injuries. Components like the kind of violation (e.g., dashing as opposed to reckless using) and the frequency of violations will additional have an effect on the premiums.

Insurance coverage suppliers usually use actuarial fashions to evaluate threat in accordance with using historical past, which is helping them to value insurance coverage accurately. This frequently leads to drivers with extra in depth or critical violations going through greater premiums.

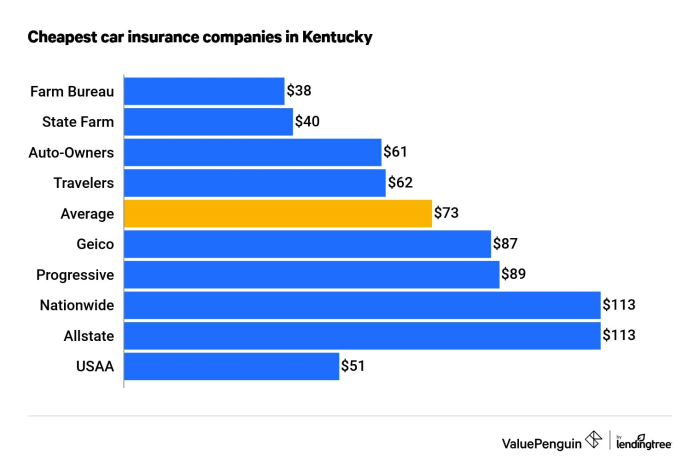

Insurance coverage Supplier Choices

Quite a lot of insurance coverage suppliers be offering low-income automotive insurance coverage choices in Kentucky. Every supplier will have particular eligibility standards and techniques. Some suppliers might be offering reductions or help techniques for drivers with restricted earning, whilst others might spouse with state techniques to supply discounted charges. Researching more than one suppliers is a very powerful to discovering the most suitable choice adapted to the person’s particular wishes and monetary scenario.

This exploration lets in the motive force to discover a supplier that aligns with their finances and scenario. The provision of particular techniques, reductions, and subsidies varies amongst suppliers.

Monetary Help Methods

A number of techniques in Kentucky be offering monetary help for low-income drivers in search of automotive insurance coverage. Those techniques frequently supply subsidies or reductions to certified folks, enabling them to get right of entry to reasonably priced protection. Kentucky’s techniques is also administered at once by way of the state or thru partnerships with insurance coverage suppliers. The eligibility standards and alertness procedures range relying at the particular program.

Illustrative Examples: Low-income Automobile Insurance coverage In Kentucky

Navigating the complicated panorama of low-income automotive insurance coverage in Kentucky can really feel daunting. On the other hand, with a transparent working out of the method, monetary improve, and to be had choices, securing reasonably priced protection turns into extra achievable. This segment supplies concrete examples as an example the sensible software of the tips introduced prior to now.

A Hypothetical Low-Source of revenue Driving force’s Insurance coverage Software

Making use of for low-income automotive insurance coverage comes to a structured procedure. A potential insured, let’s name her Sarah, living in Kentucky and incomes beneath the state’s median revenue, would wish to provide her monetary scenario. She would acquire documentation proving her revenue, together with pay stubs, tax returns, and another related monetary information. Moreover, Sarah wishes to supply evidence of car possession, such because the automobile’s identify and registration.

A complete software, detailing her using historical past and any prior injuries, is very important. Insurance coverage suppliers usually assess the dangers related to Sarah’s using report and automobile sort, then regulate top class charges accordingly. Certain results might come with securing an acceptable insurance plans with reasonably priced per 30 days premiums. Conversely, relying on components reminiscent of using historical past or automobile situation, the insurance coverage supplier would possibly counsel other coverage choices or request additional knowledge.

Monetary Help Methods: An Instance

Kentucky gives quite a lot of monetary help techniques to assist low-income drivers in acquiring reasonably priced automotive insurance coverage. One such program is the Kentucky Transportation Cupboard’s low-income automobile insurance coverage help program. This program gives subsidies or reductions on insurance coverage premiums for certified candidates. The applying procedure normally comes to a verification of revenue and family dimension. The applicant will wish to supply related paperwork, and this system administrator will evaluation eligibility and approve the help.

A success candidates will obtain a discounted insurance coverage top class in accordance with their demonstrated want.

Insurance coverage Price Comparability

| Driving force Profile | Automobile Kind | Riding Historical past | Insurance coverage Price (USD/Month) |

|---|---|---|---|

| Sarah (Low-income, contemporary graduate) | Used Compact Automobile | Blank report | $50 |

| John (Low-income, with a 2-year-old automobile) | SUV | Minor twist of fate 2 years in the past | $75 |

| Emily (Low-income, with a 5-year-old automobile) | SUV | Blank report, with a high-risk using historical past | $100 |

| David (Low-income, with a 10-year-old automobile) | Pickup Truck | Blank report | $85 |

This desk illustrates a hypothetical comparability of insurance coverage prices for various eventualities. Components like automobile age, sort, and the applicant’s using historical past at once affect the overall charge. The monetary help techniques, like the only discussed above, can considerably scale back those prices for eligible drivers, enabling them to care for ok protection.

Conclusive Ideas

In conclusion, securing reasonably priced automotive insurance coverage in Kentucky for low-income folks calls for working out the to be had techniques, monetary help, and client rights. This information has explored the complexities of the problem, providing sensible steps and sources to navigate the method. Whilst demanding situations stay, choices for securing reasonably priced protection and selection transportation exist, empowering folks to make knowledgeable choices.

FAQ Information

What are the average misconceptions about low-income automotive insurance coverage in Kentucky?

Some commonplace misconceptions come with the realization that low-income drivers are robotically denied protection or that specialised techniques are restricted in availability. In fact, quite a lot of techniques exist to lend a hand certified folks.

What paperwork are usually required for making use of for low-income automotive insurance coverage in Kentucky?

Required paperwork might range by way of supplier however most often come with evidence of revenue, id, and probably automobile knowledge.

What are some selection transportation choices to be had to low-income folks in Kentucky who would possibly not have the ability to manage to pay for automotive insurance coverage?

Selection choices come with public transportation, ride-sharing services and products, and carpooling, each and every with various prices and accessibility.

How can I record a grievance if I’ve problems with an insurance coverage supplier referring to low-income automotive insurance coverage?

Touch the Kentucky Division of Insurance coverage or the related client coverage company for steering on submitting a grievance.