Canadian automobile insurance coverage in USA: Navigating the border between your trusty experience and possible roadside dramas. It is a complete other ballgame when you find yourself cruising American highways with a Canadian registration number plate. From weekend getaways to prolonged remains, this information will mean you can navigate the complexities and doubtlessly steer clear of getting caught in a bureaucratic automobile parking space. Get in a position to free up the secrets and techniques to clean riding adventures south of the border.

This complete review examines the an important components Canadian drivers wish to believe when in the hunt for insurance coverage in america. We will dive into coverage comparisons, outlining protection ranges and possible exclusions. We will additionally element the claims procedure, providing sensible guidelines for a continuing enjoy. So buckle up, Canucks, and let’s discover the arena of American automobile insurance coverage, one fender bender at a time!

Evaluation of Canadian Automobile Insurance coverage in america

Navigating automobile insurance coverage when crossing the border from Canada to america can provide complexities for Canadian drivers. Figuring out the nuances of protection, the other eventualities the place insurance coverage is needed, and the choices to be had is an important to steer clear of pricey errors or felony headaches. This information will light up the panorama of Canadian automobile insurance coverage in america, providing sensible insights for Canadians.

Insurance coverage Necessities for Canadian Drivers in america

Canadian drivers visiting america, whether or not for holiday, trade, or transient residency, will have to consider of insurance coverage necessities. The specifics rely closely at the period of the talk over with. Whilst a legitimate Canadian license might suffice in some scenarios, a US-based insurance plans incessantly proves simpler and dependable.

Other Eventualities Requiring Insurance coverage

A number of eventualities necessitate insurance coverage for Canadian drivers in america. Holiday journeys, generally momentary, may now not all the time call for US-based insurance coverage, relying at the state’s particular laws. Conversely, a trade commute requiring prolonged remains or riding throughout more than one states mandates thorough investigation into insurance coverage choices. In a similar fashion, transient residency in america incessantly calls for a US-based coverage because of possible long-term riding wishes.

Insurance coverage Choices for Canadian Drivers in america

Canadian drivers have a number of choices for acquiring insurance plans whilst in america. They are able to lengthen their present Canadian protection, if it covers US trip, or acquire a brief coverage from US insurance coverage suppliers. Brief insurance policies are generally adapted to precise journeys, outlining the period and house of protection. However, Canadian drivers can discover choices for a extra complete coverage aligned with their duration of keep or trade wishes in america.

Demanding situations Confronted by means of Canadians In quest of US Insurance coverage

Canadians in the hunt for US insurance coverage might stumble upon sure demanding situations. Those can come with variations in protection, boundaries on present Canadian insurance policies, or complexities in shifting protection. The perceived upper prices of US insurance coverage in comparison to Canadian plans too can provide a barrier. Moreover, working out the various necessities throughout US states is significant, as insurance coverage insurance policies incessantly cater to precise state rules and laws.

Sensible Issues

It is very important to touch Canadian insurance coverage suppliers to grasp if their protection extends to america and what boundaries may practice. Moreover, researching US insurance coverage suppliers and evaluating quotes is very beneficial to decide the most suitable choice on your particular instances. Figuring out the consequences of riding with out good enough protection, together with possible fines and felony problems, is paramount.

Comparability of Insurance policies

Canadian drivers visiting america incessantly face questions on insurance plans. Figuring out the diversities between Canadian and US insurance policies is an important for averting surprising bills or gaps in coverage. This segment supplies a comparative research of legal responsibility, collision, and complete protection, highlighting possible exclusions and boundaries.An intensive comparability of protection ranges introduced by means of Canadian and US insurers is important for Canadian drivers in america.

This comparability guarantees that drivers are conscious about the prospective variations and boundaries in protection, thereby facilitating knowledgeable choices referring to their insurance coverage wishes.

Legal responsibility Protection Comparability

Canadian insurance policies incessantly supply legal responsibility protection very similar to US insurance policies, protecting damages to others in an twist of fate. Then again, the bounds and sorts of coated damages may range. Canadian insurance policies will have differing limits on physically harm and assets harm in comparison to US insurance policies, affecting the extent of monetary coverage to be had. The variations might rely at the particular province or territory in Canada.

Collision Protection Comparability

Collision protection in Canadian insurance policies, whilst normally related to US insurance policies, can range on the subject of the level of wear coated. The protection quantity for upkeep or substitute of the insured automobile in an twist of fate with some other automobile may range. Deductibles too can range.

Complete Protection Comparability

Complete protection, designed to offer protection to towards occasions rather than collisions, akin to robbery, vandalism, or weather-related harm, additionally displays some variability between Canadian and US insurance policies. The particular instances coated, the level of upkeep or replacements, and the deductibles are essential components to believe.

Attainable Exclusions and Barriers

Sure exclusions and boundaries might practice to each Canadian and US insurance policies. Those may come with pre-existing harm, particular sorts of cars, or actions undertaken by means of the insured. Figuring out those boundaries is necessary for correct chance evaluate.

Protection Limits Comparability

| Protection Kind | Canadian Coverage (Instance) | US Coverage (Instance) | Key Variations |

|---|---|---|---|

| Legal responsibility | $a million Physically Damage, $a million Belongings Injury | $250,000 Physically Damage, $50,000 Belongings Injury | Canadian coverage supplies considerably upper limits. |

| Collision | $100,000 (restore/substitute), $500 deductible | $50,000 (restore/substitute), $500 deductible | Canadian coverage gives upper protection limits. |

| Complete | $50,000 (restore/substitute), $500 deductible, covers robbery, vandalism, fireplace | $25,000 (restore/substitute), $1000 deductible, covers robbery, vandalism, fireplace | Canadian coverage supplies upper protection limits and doubtlessly broader protection. |

Notice: Those are examples and particular protection limits will range considerably according to the insurer, the coverage selected, and the particular province/state. You could overview the coverage paperwork for detailed data. Comparability buying groceries with other insurers in each international locations is beneficial.

Acquiring Insurance coverage

Securing the best automobile insurance plans as a Canadian motive force in america calls for cautious attention of the particular laws and to be had choices. Figuring out the appliance procedure, important paperwork, and possible suppliers is an important for a clean transition. This segment main points the stairs fascinated with acquiring protection.

Software Procedure Evaluation

The method of acquiring insurance coverage for Canadian drivers in america generally comes to on-line programs or direct touch with insurance coverage suppliers. Each and every supplier’s software process might range somewhat. A an important step is to match quotes from other suppliers, bearing in mind protection wishes and premiums.

Required Paperwork and Knowledge

To use for protection, Canadian drivers in america wish to furnish particular paperwork and knowledge. This guarantees correct evaluate of chance and compliance with insurance coverage laws. Crucial paperwork incessantly come with:

- Driving force’s license and evidence of residency in Canada.

- Car registration and evidence of possession, together with VIN (Car Id Quantity).

- Evidence of deal with in america, akin to software expenses or hire settlement.

- Using file from Canada, together with any visitors violations or injuries.

- Monetary data, akin to credit score historical past or financial institution statements (might range by means of supplier).

- Information about any prior insurance plans, together with the identify of the former insurer and coverage main points.

Verifying Coverage Phrases and Prerequisites

In moderation reviewing coverage phrases and stipulations is paramount. This detailed exam is necessary to working out the specifics of protection, exclusions, and any boundaries. Figuring out the effective print is an important to steer clear of any surprises or disputes later.

- Explicitly observe protection limits, deductibles, and exclusions associated with injuries, harm, and legal responsibility.

- Perceive the claims procedure, together with the stairs to apply in case of an twist of fate or harm.

- Check the coverage’s geographical protection, making sure it extends to the spaces the place the automobile can be utilized in america.

- Pay attention to any restrictions on protection for particular sorts of cars or actions.

- Check the coverage’s validity duration and renewability.

Insurance coverage Suppliers

A number of insurance coverage suppliers focus on serving Canadian drivers in america. Thorough analysis and comparisons are crucial to make a choice essentially the most appropriate supplier.

- Insurers akin to Geico, Modern, State Farm, and Allstate might be offering insurance policies particularly adapted for Canadian drivers.

- Unbiased brokers and agents focusing on world insurance coverage can give complete recommendation and reinforce.

- Immediately contacting insurance coverage corporations focusing on Canadian drivers in america is a treasured method.

Prices and Premiums

The price of automobile insurance coverage for Canadian drivers in america can range considerably, influenced by means of a large number of things. Figuring out those components is an important for Canadians in the hunt for suitable protection and averting possible monetary surprises. Premiums don’t seem to be a hard and fast quantity; relatively, they’re dynamic and conscious of the person instances of the insured.A key attention is that insurance coverage suppliers in america incessantly make use of other actuarial fashions in comparison to the ones in Canada.

Those fashions take into accout native riding patterns, twist of fate charges, and different chance components distinctive to the American marketplace. This implies a Canadian motive force with a blank riding file may enjoy a special top rate calculation than a in a similar fashion located American motive force.

Components Influencing Insurance coverage Prices

The cost of automobile insurance coverage in america will depend on a large number of components. Those components are thought to be in numerous proportions by means of other insurance coverage corporations. This complexity necessitates cautious research to grasp the prospective prices.

Using Document

Using historical past considerably affects insurance coverage premiums. A blank riding file, demonstrating accountable riding behavior and a low twist of fate historical past, normally ends up in decrease premiums. Conversely, drivers with injuries, violations, or claims on their file will most probably face upper premiums. It’s because insurers assess chance according to previous conduct. For instance, a motive force with a dashing price ticket will most probably have a better top rate in comparison to a motive force with a blank file.

Car Kind

The kind of automobile additionally influences premiums. Sports activities automobiles, high-performance cars, and comfort fashions have a tendency to have upper premiums because of their perceived upper chance of injuries or harm. Conversely, smaller, more cost effective cars incessantly draw in decrease premiums. Components just like the automobile’s make, fashion, 12 months, and lines are thought to be. Insurance coverage corporations assess the danger of wear or robbery related to other automobile varieties.

Protection Stage, Canadian automobile insurance coverage in united states of america

The extent of protection selected immediately impacts the top rate. Upper protection ranges, together with complete and collision protection, normally lead to upper premiums. Legal responsibility-only protection, which protects the policyholder towards harm to folks or assets, incessantly has the bottom premiums. Other insurance coverage choices affect the danger profile and next premiums. For example, the extent of uninsured/underinsured motorist protection may even affect the top rate.

Comparability of Moderate Premiums

Sadly, actual reasonable premiums for identical protection ranges are tricky to quantify. The loss of standardization in protection choices throughout insurance coverage suppliers in america makes a right away comparability difficult. Insurance coverage quotes are extremely variable and rely on person instances. Whilst common developments can also be seen, precise figures don’t seem to be readily to be had.

Desk of Components Figuring out Value of Protection

| Issue | Description | Affect on Top class |

|---|---|---|

| Using Document | Injuries, violations, claims, and riding historical past. | Upper chance ends up in upper premiums; blank data result in decrease premiums. |

| Car Kind | Make, fashion, 12 months, and lines of the automobile. | Prime-performance or luxurious cars normally have upper premiums. |

| Protection Stage | The level of coverage introduced by means of the coverage (e.g., legal responsibility, complete, collision). | Upper protection ranges lead to upper premiums. |

| Location | The geographical house the place the automobile is essentially pushed. | Spaces with upper twist of fate charges generally have upper premiums. |

| Age and Gender | Driving force’s age and gender. | More youthful drivers and male drivers incessantly have upper premiums because of upper chance belief. |

Claims Procedure

Submitting a declare for a Canadian motive force fascinated with an twist of fate in america can range considerably from the method in Canada. Figuring out the stairs and possible headaches is an important for a clean answer. The method can also be complicated, involving more than one events and doubtlessly navigating other felony and insurance coverage methods.

Steps Excited about Submitting a Declare

The claims procedure normally follows those steps:

- Reporting the Coincidence: Instantly document the twist of fate to the suitable government, together with native legislation enforcement within the U.S. and your insurance coverage supplier in Canada. Correct documentation is very important, together with police experiences, witness statements, and pictures of the wear.

- Collecting Documentation: Gather all related paperwork, akin to automobile registration, evidence of insurance coverage, clinical data, and service estimates. Those paperwork can be an important for processing the declare.

- Contacting Your Insurance coverage Supplier: Notify your Canadian insurance coverage supplier straight away concerning the twist of fate. They are going to information you via the following steps and mean you can navigate the U.S. declare procedure. Be in contact obviously and comprehensively to steer clear of delays.

- Coping with U.S. Insurance coverage (if acceptable): Relying at the instances, it’s possible you’ll wish to engage with the U.S. insurance coverage corporate of the opposite motive force concerned. Your Canadian insurer might supply steerage in this procedure.

- Negotiating Agreement: As soon as all important data is accrued, your insurance coverage supplier will paintings to settle the declare. This may occasionally contain negotiating with the opposite celebration’s insurance coverage corporate and assessing the damages.

- Declare Answer: The declare is finalized as soon as all events agree at the reimbursement quantity and the desired bills are processed.

Conventional Procedures Throughout Other Insurers

Insurers make use of quite a lot of procedures, however the core rules stay identical. They generally examine the twist of fate, assess legal responsibility, and decide the suitable reimbursement. Variations might stand up within the particular paperwork required, verbal exchange protocols, and the rate of declare processing. Some insurers might be offering expedited declare dealing with for sure sorts of injuries.

Attainable Headaches for Canadian Drivers

Canadian drivers face distinctive demanding situations within the U.S. claims procedure. Language limitations, unfamiliar felony procedures, and possible variations in insurance coverage laws can create hurdles. Loss of familiarity with U.S. rules and procedures may cause delays.

- Language Limitations: Conversation with U.S. insurance coverage corporations and felony representatives may require translation products and services, doubtlessly inflicting delays.

- Jurisdictional Problems: Other jurisdictions within the U.S. will have various rules and laws regarding injuries involving out-of-state drivers. This will impact the declare’s processing and result.

- Documentation Necessities: Figuring out and acquiring the important paperwork, akin to U.S. police experiences and service estimates, can also be difficult for drivers unfamiliar with the method.

Position of Translation Services and products

Translation products and services play a an important position in facilitating verbal exchange and working out within the claims procedure. That is particularly necessary when coping with U.S. insurance coverage corporations, felony representatives, or clinical pros. Transparent and correct verbal exchange is very important for resolving claims successfully. Qualified translation products and services can be sure that all data is accurately conveyed and understood by means of all events.

Sensible Guidelines and Recommendation

Making plans a commute around the border calls for cautious attention of insurance coverage wishes. This segment supplies sensible recommendation for Canadian drivers navigating america insurance coverage panorama. Figuring out the nuances of protection and procedures can considerably affect your trip enjoy.

An important Paperwork for US Commute

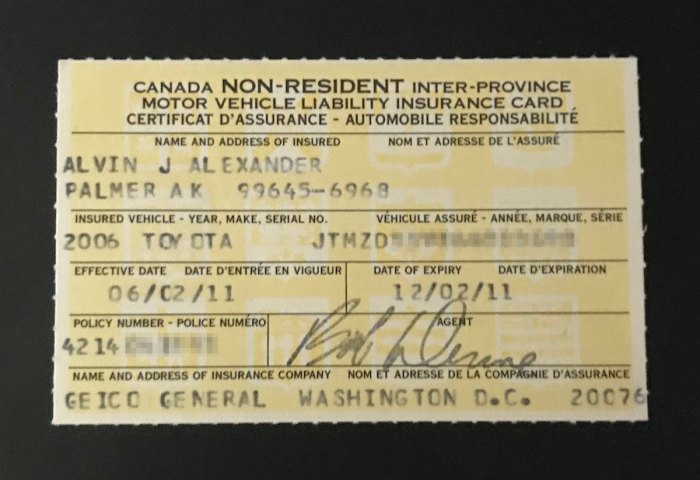

Correct documentation is paramount when riding in america. Be sure to elevate all important bureaucracy to steer clear of possible headaches. Probably the most an important report is your evidence of insurance coverage.

- Evidence of Insurance coverage: A bodily replica of your Canadian insurance plans, or a virtual replica readily obtainable for your telephone, is very important. This report must obviously state the protection main points and the policyholder’s data. Keep away from depending only on an app, as some US government might require a broadcast replica.

- Driving force’s License: A sound Canadian motive force’s license is important for riding. Be certain it’s present and correctly displayed. Lift a global riding allow for additonal peace of thoughts. Remember that some states might require further documentation.

- Car Registration: Evidence of car registration is needed in some instances. Stay this report readily to be had.

Figuring out Insurance coverage Coverage Permutations

Insurance coverage insurance policies range considerably, impacting your protection and fiscal duty within the match of an twist of fate. Comprehending the diversities is an important for making plans.

- Protection Limits: Other insurance policies have various limits for legal responsibility, collision, and complete protection. Examine those limits to grasp the monetary implications of possible claims. A coverage with decrease limits may result in vital out-of-pocket bills if fascinated with a big twist of fate.

- Deductibles: The deductible quantity is the volume you pay out-of-pocket ahead of your insurance coverage kicks in. Upper deductibles normally lead to decrease premiums. Imagine the prospective charge of a deductible in comparison to the full top rate charge.

- Exclusions: Some insurance policies exclude particular sorts of protection or actions. In moderation overview the exclusions to grasp what’s and is not coated. For instance, a coverage may exclude protection for sure sorts of leisure cars.

Affect of Insurance coverage on Commute Plans

Your preferred insurance plans can immediately affect your trip itinerary. Figuring out those implications is helping you’re making knowledgeable choices.

- Direction Making plans: Some insurance policies will have geographical boundaries on protection. Plan your course accordingly to make sure you are coated in all spaces you plan to trip. Imagine possible choices if a course falls outdoor a coverage’s protection house.

- Lodging Alternatives: Insurance policies might quilt condo automobiles, however now not all condo companies could also be appropriate with Canadian insurance coverage. Figuring out this let you make knowledgeable choices about automobile leases.

- Actions: Insurance policies will have boundaries on protection for particular actions. For instance, some insurance policies would possibly not quilt racing or excessive sports activities. Analysis the constraints ahead of attractive in such actions.

Illustrative Eventualities

Figuring out the nuances of Canadian automobile insurance coverage in america calls for inspecting particular scenarios. Other instances, akin to transient visits or prolonged remains, necessitate various insurance coverage methods. This segment supplies sensible examples to assist Canadians navigate the insurance coverage panorama when riding in america.

Canadian Customer for a Weekend

A Canadian visiting america for a weekend generally calls for minimum insurance plans. Their present Canadian coverage might supply some degree of protection, however gaps in legal responsibility and collision coverage might exist. It will be significant to test the coverage’s phrases and stipulations, in particular referring to riding in different international locations. A supplemental momentary coverage, bought on-line or via a trip agent, can bridge the protection hole.

This feature incessantly supplies complete coverage, making sure monetary safety in case of an twist of fate.

Canadian Operating Briefly in america

A Canadian running briefly in america calls for extra complete insurance coverage than a weekend customer. Prolonged remains necessitate bearing in mind possible liabilities and damages. Their present Canadian coverage may now not lengthen to america. They must acquire a coverage that particularly covers riding in america all through their keep. This coverage must align with the state rules and laws of the states they plan to talk over with or force via.

It’s important to verify protection for each legal responsibility and collision.

Situation: Prolonged Keep for a Particular Duration

Believe a Canadian, Sarah, making plans to paintings in america for 3 months. She wishes insurance coverage for her automobile right through this era. Choices come with buying a brief coverage particularly designed for the three-month duration. However, Sarah can believe a per 30 days or quarterly coverage, offering flexibility and cost-effectiveness. A complete coverage, together with legal responsibility, collision, and complete protection, must be prioritized.

The particular coverage kind is dependent upon Sarah’s person wishes and price range.

Components Impacting Insurance coverage Prices

| Issue | Affect on Value |

|---|---|

| Car Kind | Upper-value or high-performance cars incessantly lead to upper premiums because of possible for better damages. |

| Using Document | Injuries or visitors violations negatively affect the top rate. A blank riding file generally ends up in decrease premiums. |

| Location of Use | Using in high-accident spaces may end up in upper premiums. States with stricter laws for legal responsibility insurance coverage may end up in upper prices. |

| Protection Quantity | Upper protection quantities for damages and liabilities normally correlate with upper premiums. |

| Deductible Quantity | Upper deductibles generally lead to decrease premiums. |

| Credit score Historical past | Low credit historical past might lead to upper premiums because of perceived chance of non-payment. |

Upper premiums are generally related to better chance and extra intensive protection.

This desk visually represents the quite a lot of components influencing the price of Canadian automobile insurance coverage in america. Figuring out those components lets in folks to make knowledgeable choices referring to protection choices and regulate their insurance policies to suit their particular instances.

End result Abstract: Canadian Automobile Insurance coverage In U.s.a.

In conclusion, securing Canadian automobile insurance coverage in america is set greater than only a coverage; it is about peace of thoughts whilst exploring the colourful landscapes and bustling towns of america. Via working out the nuances of protection, prices, and claims processes, Canadian drivers can expectantly hit the street figuring out they are safe. So, whether or not you are a seasoned traveler or a first-time customer, this information equips you with the information to make knowledgeable choices and make sure a worry-free American journey.

Useful Solutions

What if I am solely visiting america for a weekend?

Maximum usual Canadian insurance policies will quilt you for a brief talk over with, however it is best to double-check the particular phrases and stipulations along with your insurer.

What paperwork do I wish to supply when making use of?

Be expecting to supply your motive force’s license, evidence of car possession, and doubtlessly a present VIN (Car Id Quantity) document. Your Canadian insurance plans main points may also be crucial.

What occurs if I am getting into an twist of fate whilst visiting?

Touch your insurer straight away. Acquire all related data, and if conceivable, download statements from witnesses. Be ready to navigate the method, in all probability with translation help.

Are there any particular insurance coverage suppliers for Canadians in america?

Sure, some US insurance coverage corporations focus on providing protection to Canadian drivers, even if the variety of choices might range by means of area. Examine those choices along conventional suppliers.