Low-income automotive insurance coverage Florida is a a very powerful matter for plenty of Floridians. Navigating the complexities of inexpensive insurance coverage can really feel overwhelming, however this information gives a transparent trail towards discovering the appropriate protection. We’re going to discover the demanding situations, to be had sources, and a very powerful steps to securing the most productive imaginable coverage.

This complete useful resource supplies a roadmap to inexpensive automotive insurance coverage choices in particular designed for low-income people in Florida. Working out the rules, to be had reductions, and monetary help systems will empower you to make knowledgeable choices about your protection.

Assessment of Low-Source of revenue Automobile Insurance coverage in Florida

Securing inexpensive automotive insurance coverage is usually a vital problem for low-income people in Florida, as in lots of different states. Prime premiums, restricted get right of entry to to protection choices, and a loss of monetary help can create a barrier to proudly owning and working a car. This evaluation examines the difficulties confronted by way of low-income Floridians and explores to be had sources to mitigate those stumbling blocks.Florida’s regulatory panorama, whilst aiming to verify accountable using, can on occasion inadvertently have an effect on the affordability of insurance coverage.

Strict necessities for minimal protection quantities and particular standards for figuring out premiums would possibly disproportionately impact the ones with decrease earning, main to raised out-of-pocket bills. Moreover, the state’s marketplace construction and pageant amongst insurance coverage suppliers play a task in the associated fee and availability of insurance policies.

Demanding situations Confronted by way of Low-Source of revenue Folks

The main problem is the top price of vehicle insurance coverage, steadily exceeding the monetary capability of low-income people. This top price is steadily exacerbated by way of components just like the state’s top price of site visitors injuries or the price of hospital therapy in case of an twist of fate. The absence of adapted insurance coverage merchandise or reductions designed for lower-income brackets contributes to this factor.

Rules and Rules Impacting Inexpensive Automobile Insurance coverage

Florida rules, whilst meant to advertise protection, can have an effect on affordability. Minimal legal responsibility insurance coverage necessities, despite the fact that crucial for highway protection, is usually a vital monetary hurdle for people with restricted monetary sources. Additional, the absence of particular rules addressing low-income insurance coverage choices would possibly result in upper premiums and restricted protection choices.

Monetary Help Methods for Low-Source of revenue Floridians

More than a few projects and systems supply monetary help to low-income people searching for automotive insurance coverage. Those steadily come with subsidies, reductions, and monetary strengthen from state or native govt systems. Examples come with the Florida Division of Freeway Protection and Motor Cars (FLHSMV) help systems for low-income drivers and partnerships with neighborhood organizations providing monetary help or strengthen. Those sources will not be broadly publicized, requiring proactive efforts from low-income people to find and make the most of them.

Kinds of Automobile Insurance coverage Reductions

Insurance coverage firms continuously be offering reductions to inspire accountable using conduct and advertise buyer loyalty. Working out those reductions can assist people lower your expenses on their premiums.

| Bargain Sort | Description |

|---|---|

| Multi-Automobile Bargain | A discount in premiums for people insuring a couple of cars below the similar coverage. This may give vital financial savings for households or people who personal a couple of car. |

| Scholar Bargain | A cut price for college kids who exhibit a historical past of accountable using and are enrolled in tutorial establishments. Those systems steadily praise protected using conduct amongst scholars. |

| Just right Motive force Bargain | A cut price according to a motive force’s accident-free using document. A historical past of accountable using can considerably decrease premiums. |

| Bundled Products and services Bargain | A cut price presented for combining insurance coverage with different products and services comparable to house insurance coverage. It is a commonplace apply by way of insurance coverage firms to incentivize consumers to select their products and services. |

| Army Bargain | A cut price for active-duty army group of workers or veterans, acknowledging their provider and contribution to the neighborhood. |

Evaluating Insurance coverage Suppliers

Discovering inexpensive automotive insurance coverage in Florida, particularly for low-income people, calls for cautious comparability of various suppliers. Working out the standards influencing pricing and the strategies used to evaluate affordability is a very powerful for securing the most productive imaginable protection at a manageable price. This segment main points the method of evaluating insurance coverage suppliers and acquiring quotes.Insurance coverage suppliers in Florida, like the ones national, make use of more than a few methods to decide premiums.

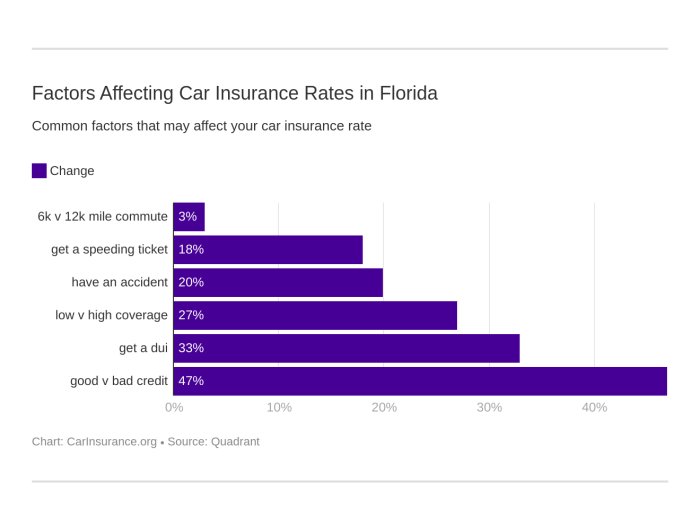

Those components can range considerably amongst insurers, impacting the overall value for policyholders. Elements influencing the price of a coverage can come with using historical past, car sort, location, and particular protection alternatives. Working out those components is helping shoppers make knowledgeable choices when settling on an insurance coverage supplier.

Elements Influencing Value Diversifications

A number of components give a contribution to the fee discrepancies amongst insurance coverage suppliers. Those components come with, however aren’t restricted to, the insurer’s monetary steadiness, underwriting practices, and the particular protection programs presented. Moreover, the insurer’s marketplace percentage and the quantity of insurance policies they set up too can have an effect on their pricing methods.

Strategies for Assessing Affordability, Low-income automotive insurance coverage florida

Insurance coverage suppliers make use of more than a few find out how to evaluation the affordability of insurance policies for low-income candidates. Those strategies would possibly come with taking into consideration components such because the applicant’s credit score ranking, employment standing, and revenue documentation. Some suppliers may additionally be offering reductions or fee plans to make insurance policies extra obtainable.

Acquiring Quotes from More than one Suppliers

Acquiring quotes from a couple of suppliers is very important to match costs and protection choices. On-line comparability gear can facilitate this procedure, permitting customers to enter their knowledge and obtain quotes from more than a few insurers. This technique can save vital effort and time within the comparability procedure.

Comparability of Protection Choices and Premiums

| Insurance coverage Supplier | Protection Choices (Instance) | Top class (Instance) |

|---|---|---|

| Insurer A | Legal responsibility, Collision, Complete, Uninsured Motorist | $1,200 in keeping with yr |

| Insurer B | Legal responsibility, Collision, Complete, Uninsured Motorist, roadside help | $1,500 in keeping with yr |

| Insurer C | Legal responsibility, Collision, Complete, Uninsured Motorist, condominium automotive | $1,100 in keeping with yr |

| Insurer D | Legal responsibility, Collision, Complete, Uninsured Motorist, twist of fate forgiveness | $1,350 in keeping with yr |

Observe: Premiums are examples and would possibly range according to person cases. This desk illustrates a simplified comparability. The protection choices and premiums offered are examples and will not be the real protection choices or premiums to be had from every insurer. Person cases will impact the real top class and to be had protection choices.

Working out Protection Choices

Selecting the proper automotive insurance plans is a very powerful for shielding your self and your car in Florida. Working out the more than a few choices to be had and their implications will empower you to make knowledgeable choices. Other protection ranges supply various levels of economic coverage, and your best option is determined by your personal cases and price range.Complete and collision protection are important facets of a complete insurance coverage.

Those coverages give protection to you in opposition to injury in your car from incidents like injuries, vandalism, or climate occasions. Legal responsibility protection, however, protects you in opposition to monetary duty for injury brought about to someone else or their assets. It is very important perceive the nuances of every protection sort to make a choice probably the most appropriate plan.

Complete and Collision Protection

Complete protection safeguards your car in opposition to damages past injuries, comparable to hail injury, fireplace, robbery, or vandalism. Collision protection, however, protects your car within the tournament of an twist of fate, without reference to who’s at fault. Each are crucial for making sure monetary coverage in case your car is broken. A complete coverage with each complete and collision protection supplies vital coverage to your car.

As an example, in case your automotive is stolen, complete protection will assist substitute it. In case your automotive is broken in a collision, collision protection will assist restore or substitute it.

Legal responsibility vs. Uninsured/Underinsured Motorist Protection

Legal responsibility protection is remitted in Florida and protects you in opposition to monetary duty for injury you motive to someone else or their assets. It is a very powerful to know the boundaries of your legal responsibility protection, as exceeding the ones limits may result in vital non-public monetary burdens. Uninsured/underinsured motorist protection protects you if you’re enthusiastic about an twist of fate with a motive force who lacks insurance coverage or whose insurance plans is inadequate to hide the damages.

This protection is important to your protection and monetary safety, particularly in states with upper charges of uninsured drivers. For example, if you’re in an twist of fate with a motive force who has no insurance coverage, your uninsured/underinsured protection would step in to assist catch up on damages.

Commonplace Kinds of Automobile Insurance coverage Protection in Florida

| Protection Sort | Description |

|---|---|

| Legal responsibility Protection | Protects you from monetary duty in case you motive injury to someone else or their assets. |

| Collision Protection | Covers injury in your car in an twist of fate, without reference to who’s at fault. |

| Complete Protection | Covers injury in your car from occasions rather than collisions, comparable to robbery, vandalism, or climate. |

| Uninsured/Underinsured Motorist Protection | Protects you if you’re enthusiastic about an twist of fate with an uninsured or underinsured motive force. |

Implications of Opting for Other Protection Ranges

The collection of protection stage immediately affects the top class you pay and the monetary coverage you obtain. Decrease protection ranges would possibly lead to decrease premiums, however additionally they prohibit the quantity of economic help to be had in case of an twist of fate. Upper protection ranges be offering larger coverage however generally include upper premiums. In moderation comparing your monetary scenario and doable dangers is a very powerful when settling on the precise protection stage.

As an example, in case you have a treasured sports activities automotive, you may want upper collision and complete protection to verify a complete alternative price in case of wear or robbery.

Eventualities Requiring Other Coverages

Selecting the proper protection is determined by your distinctive cases. In case you are enthusiastic about an twist of fate the place the opposite motive force is at fault, legal responsibility protection will give protection to you. In case your car is broken by way of a typhoon, complete protection is essential. In case you are enthusiastic about an twist of fate with a motive force who has inadequate insurance coverage, uninsured/underinsured motorist protection is a very powerful.

Working out those other eventualities and their implications may end up in a extra knowledgeable choice when buying insurance coverage. This guarantees you’re adequately secure in more than a few scenarios and will safeguard your monetary well-being.

Navigating the Software Procedure

Securing low-income automotive insurance coverage in Florida calls for cautious navigation of the appliance procedure. Working out the stairs, documentation necessities, and doable pitfalls will assist be sure that a clean and a success software. This segment main points the important thing facets of the appliance procedure, together with crucial documentation and commonplace problems to steer clear of.

Software Steps and Procedures

The appliance procedure for low-income automotive insurance coverage in Florida in most cases comes to a number of key steps. Each and every step is a very powerful to the a success of entirety of the appliance. Those steps steadily require cautious attention and adherence to precise procedures to verify a well timed and environment friendly software.

- Preliminary Inquiry and Analysis: Start by way of researching other insurance coverage suppliers providing low-income choices. Evaluate protection choices, premiums, and buyer critiques to make knowledgeable choices. Contacting suppliers immediately for rationalization on particular necessities and to be had reductions is extremely really helpful.

- Accumulating Important Documentation: Documentation necessities range relying at the insurer and the particular software. Usually, candidates will wish to supply evidence of id, evidence of Florida residency, and monetary documentation demonstrating their low-income standing. Examples come with pay stubs, tax returns, or different related monetary information.

- Finishing the Software Shape: In moderation assessment and whole the insurance coverage software shape appropriately and carefully. Supply all asked knowledge and make sure accuracy in main points comparable to car knowledge, using historical past, and private main points. Incomplete or faulty paperwork can considerably extend the appliance procedure.

- Submission of Documentation: Publish the desired documentation in conjunction with the finished software shape. Make certain that all paperwork are correctly arranged and in the proper layout as laid out in the insurance coverage supplier. Stay copies of all submitted paperwork to your information.

- Assessment and Approval: The insurance coverage supplier will assessment the appliance and supporting documentation to evaluate eligibility for low-income automotive insurance coverage. The supplier would possibly touch you for additional rationalization or additional info if essential. A suggested reaction to any inquiries is very important for a clean software procedure.

Crucial Documentation Examples

The forms of documentation required for low-income automotive insurance coverage programs range relying at the insurer and person cases. Usually, documentation must test the applicant’s id, residency, and monetary standing.

- Evidence of Identification: Legitimate Florida motive force’s license, state-issued identity card, or passport are conventional types of evidence of id. Make certain those paperwork are present and legitimate.

- Evidence of Florida Residency: Application expenses (electrical energy, water, gasoline), hire agreements, or loan statements can function evidence of Florida residency. Fresh expenses or statements are in most cases most popular.

- Monetary Documentation: Pay stubs, tax returns, or different monetary paperwork are repeatedly asked to make sure low-income standing. Those paperwork must mirror the applicant’s present revenue and monetary scenario.

Coverage Phrases and Prerequisites

Working out coverage phrases and stipulations is important for making knowledgeable choices. Assessment all the coverage report in moderation, paying shut consideration to protection limits, deductibles, and exclusions.

Explain any unclear phrases with the insurance coverage supplier earlier than signing the coverage.

Commonplace Pitfalls and Doable Problems

Commonplace pitfalls all through the appliance procedure come with offering faulty knowledge, failing to post all required documentation, or misinterpreting coverage phrases. In moderation reviewing the appliance procedure and documentation necessities can assist save you those problems.

- Faulty Knowledge: Make certain that all knowledge supplied at the software shape is correct and up-to-date. Faulty knowledge may end up in denial of the appliance or next problems.

- Incomplete Documentation: Filing all required documentation is a very powerful for a a success software. Make certain all essential paperwork are whole and correct.

- Coverage Misinterpretation: In moderation assessment the coverage phrases and stipulations. If any phrases are unclear, touch the insurance coverage supplier for rationalization earlier than signing the coverage.

Step-by-Step Software Information

| Step | Motion |

|---|---|

| 1 | Analysis and evaluate low-income insurance coverage suppliers. |

| 2 | Collect essential documentation (evidence of id, residency, and monetary standing). |

| 3 | Entire the appliance shape appropriately. |

| 4 | Publish the appliance shape and required documentation. |

| 5 | Assessment and reply to any follow-up inquiries from the insurance coverage supplier. |

| 6 | In moderation assessment the coverage phrases and stipulations. |

Assets and Help

Securing inexpensive automotive insurance coverage will also be difficult, particularly for low-income people in Florida. Thankfully, more than a few sources and help systems are to be had to assist navigate this procedure and make insurance coverage extra obtainable. Working out those choices can considerably ease the monetary burden and make sure accountable car possession.

Organizations Providing Monetary Help

A number of organizations supply monetary help or subsidies for automotive insurance coverage premiums. Those organizations steadily paintings with people going through monetary hardship, making automotive insurance coverage extra manageable. This help can come with direct monetary help, reductions, or referrals to inexpensive insurance coverage suppliers.

- Group-Based totally Organizations: Many neighborhood facilities, non-profit organizations, and social provider businesses in Florida be offering monetary help systems adapted to low-income people. Those organizations will have partnerships with insurance coverage suppliers or be offering grants and subsidies to offset insurance coverage prices. They steadily have a deep figuring out of native wishes and may give personalised strengthen to assist people get right of entry to to be had sources.

- State Companies: Florida’s Division of Monetary Products and services (DFS) would possibly be offering systems to help low-income drivers. Their sources would possibly come with details about eligibility standards and to be had strengthen choices. Those sources would possibly supply direct monetary help or referrals to different help systems.

- Insurance coverage Corporations: Some insurance coverage firms have particular systems or projects for low-income people. Those systems steadily supply reductions or help with premiums to be sure that people have get right of entry to to essential protection.

Advantages of Using Those Assets

Using those sources gives a number of benefits. Those advantages come with decreasing the monetary burden of vehicle insurance coverage, making sure get right of entry to to essential protection, and selling accountable car possession.

- Diminished Monetary Pressure: Monetary help can considerably scale back the price of automotive insurance coverage, making it extra inexpensive and obtainable for low-income people. This permits people to allocate price range in opposition to different crucial wishes.

- Get entry to to Protection: Those sources may give get right of entry to to automotive insurance plans that can in a different way be unimaginable because of monetary constraints. This protection guarantees protection and protects people and their property.

- Selling Accountable Possession: Get entry to to inexpensive insurance coverage encourages accountable car possession by way of permitting people to care for insurance plans, thus decreasing dangers and complying with Florida’s felony necessities.

Having access to Monetary Help

The method for having access to monetary help varies relying at the group. Usually, people wish to exhibit monetary want and eligibility thru software paperwork and supporting documentation.

- Documentation: Supporting paperwork would possibly come with evidence of revenue, identity, and different related monetary knowledge. The precise necessities would possibly range relying at the group.

- Software Procedure: Each and every group has a novel software procedure. Those processes in most cases contain filling out paperwork, offering required paperwork, and present process an eligibility review. Folks must in moderation assessment the directions supplied by way of every group to verify they post the proper documentation.

- Touch Knowledge: Direct touch with the group is steadily required to begin the appliance procedure and inquire in regards to the eligibility necessities. This knowledge is in most cases to be had at the group’s web page or thru their touch main points.

Executive Methods

Florida has a number of govt systems that offer help to low-income people. Those systems would possibly quilt bills associated with more than a few products and services, together with automotive insurance coverage. It will be important to analyze the systems to be had in Florida to decide if any have compatibility the person’s wishes.

| Group | Touch Knowledge | Products and services Supplied |

|---|---|---|

| Florida Division of Monetary Products and services (DFS) | (Touch knowledge to be incorporated) | Details about eligibility standards and strengthen choices. Would possibly come with referrals to different help systems. |

| [Example Community-Based Organization] | (Touch knowledge to be incorporated) | Monetary help systems, subsidies, and referrals to inexpensive insurance coverage suppliers. |

| [Example Insurance Company] | (Touch knowledge to be incorporated) | Particular systems or projects for low-income people, together with reductions or help with premiums. |

Illustrative Case Research: Low-income Automobile Insurance coverage Florida

Navigating the complexities of vehicle insurance coverage will also be daunting, particularly for low-income people in Florida. Working out the to be had choices, evaluating suppliers, and effectively navigating the appliance procedure can really feel overwhelming. On the other hand, with cautious making plans and analysis, people can safe inexpensive protection that meets their wishes. This segment gifts illustrative case research to exhibit the demanding situations and answers encountered by way of low-income Floridians.Those examples spotlight the significance of economic literacy in making knowledgeable insurance coverage choices, emphasizing that even with restricted sources, securing ok protection is achievable.

The tales show off the particular demanding situations confronted by way of low-income people, the answers they hired, and the certain have an effect on of the selected insurance coverage choices.

Case Find out about 1: Maria’s Adventure to Inexpensive Protection

Maria, a unmarried mom operating a couple of part-time jobs in Miami, confronted vital monetary constraints. She wanted automotive insurance coverage to shuttle to paintings, however the conventional insurance coverage choices appeared prohibitively dear. She researched more than a few choices, together with reductions for protected drivers, usage-based insurance coverage, and inexpensive protection thru specialised suppliers. She came upon a program that supplied reductions for low-income drivers in Florida.

By means of bundling her insurance coverage with different products and services, Maria used to be in a position to safe a complete coverage at a far cheaper price than she expected. This answer no longer simplest secure her financially but in addition gave her peace of thoughts, permitting her to concentrate on her profession and circle of relatives.

Case Find out about 2: A Circle of relatives’s Selection for Finances-Pleasant Coverage

The Rodriguez circle of relatives, a small circle of relatives residing in Orlando, had a budget-conscious way to automotive insurance coverage. They understood the significance of coverage however known the monetary burden of conventional protection. After thorough analysis, they came upon a specialised insurance coverage corporate fascinated with offering inexpensive charges. This corporate presented more than a few protection choices, permitting the Rodriguez circle of relatives to select protection ranges that aligned with their particular wishes and price range.

Their choice to concentrate on crucial protection, coupled with usage-based reductions, led to an important relief of their per 30 days insurance coverage premiums, enabling them to allocate price range to different vital circle of relatives bills.

Case Find out about 3: Navigating the Software Procedure with Restricted Assets

This hypothetical case learn about demonstrates the method a low-income person may face when making use of for insurance coverage. A tender skilled, David, lives in Tampa and commutes day-to-day for paintings. His price range restricts him to probably the most inexpensive insurance coverage choices. David’s scenario highlights the significance of figuring out more than a few insurance coverage choices and benefiting from sources that may help with the appliance procedure.

By means of the use of on-line gear and sources in particular designed for low-income people, David effectively carried out for and received protection. This demonstrates the a very powerful position of accessibility and sources in making the insurance coverage software procedure manageable for the ones with restricted monetary sources.

Hypothetical Case Find out about: David’s Software

David, a tender skilled residing in Tampa, commutes day-to-day for paintings. His price range is tight, and he prioritizes inexpensive insurance coverage choices. David wishes complete protection that comes with legal responsibility, collision, and complete insurance coverage. His car is a used automotive, including an element to the insurance coverage choice. To be had choices come with:

- Conventional Insurance coverage Suppliers: Those suppliers would possibly be offering reductions for protected using or bundled products and services, however top class prices could be top.

- Specialised Low-Source of revenue Insurance coverage Suppliers: Those suppliers be offering adapted insurance policies for people with decrease earning, steadily with obtainable software processes and decrease premiums.

- Utilization-Based totally Insurance coverage: Those systems praise protected using conduct with decrease premiums, probably saving David cash if he maintains a protected using document.

David’s selection is determined by his using historical past, car sort, and desired protection ranges. The precise protection ranges shall be a very powerful for figuring out his premiums and affordability.

Long run Traits in Florida’s Low-Source of revenue Automobile Insurance coverage

The Florida automotive insurance coverage marketplace is continuously evolving, presenting each demanding situations and alternatives for low-income people. Working out those long run tendencies is a very powerful for navigating the complexities of obtaining inexpensive protection. Predicting exact results is tricky, however inspecting rising patterns and doable regulatory shifts gives treasured insights into the way forward for insurance coverage accessibility.

Doable Adjustments within the Automobile Insurance coverage Panorama

The auto insurance coverage panorama in Florida is topic to more than a few components, together with adjustments in state rules, developments in generation, and shifts in shopper personal tastes. Insurance coverage suppliers are more likely to adapt to those influences, probably resulting in each certain and adverse results for low-income drivers. Festival amongst suppliers will proceed to form pricing methods, whilst using generation would possibly streamline the claims procedure.

Executive intervention, despite the fact that unsure, would possibly play a task in addressing affordability problems.

Rising Traits and Applied sciences Affecting Accessibility

A number of tendencies are impacting insurance coverage accessibility for low-income people. Telematics-based insurance coverage systems, which make the most of motive force conduct knowledge to evaluate chance, are becoming more popular. Whilst probably providing decrease premiums for protected drivers, those systems would possibly create a barrier for the ones missing get right of entry to to generation or constant web connectivity. Moreover, the upward thrust of usage-based insurance coverage (UBI) fashions, the place premiums are adjusted according to exact using conduct, gifts each benefits and drawbacks for low-income drivers.

Predictions About Doable Executive Rules or Insurance policies

Executive rules play an important position in shaping the insurance coverage marketplace. Doable long run insurance policies may come with projects aimed toward expanding pageant amongst insurance coverage suppliers, offering subsidies for low-income drivers, or imposing stricter rules on pricing practices. Florida has a historical past of addressing insurance coverage affordability problems, and the longer term would possibly see equivalent movements aimed toward protective susceptible populations. Those movements may vary from monetary help systems to legislative adjustments aimed toward making sure equity in pricing.

The Function of Era in Streamlining the Insurance coverage Procedure

Era gives vital doable to streamline the insurance coverage procedure for low-income people. On-line platforms and cellular programs can simplify the appliance procedure, permitting people to get right of entry to quotes and set up their insurance policies from any place with an web connection. Progressed virtual gear may considerably improve get right of entry to to insurance coverage, in particular for the ones with restricted mobility or get right of entry to to conventional insurance coverage places of work.

Additional building of user-friendly on-line portals and cellular programs will most likely make insurance coverage extra obtainable.

Projected Adjustments in Insurance coverage Prices (Subsequent 5 Years)

| Yr | Projected Trade in Price (Estimate) | Reasoning |

|---|---|---|

| 2024 | Slight Building up (2-3%) | Higher twist of fate charges and doable inflationary pressures on similar prices. |

| 2025 | Average Building up (3-5%) | Doable upward push in restore prices, upper call for for insurance coverage, and larger claims frequency. |

| 2026 | Average Lower (1-3%) | Anticipated enlargement of telematics-based systems providing reductions for protected drivers and larger pageant amongst insurers. |

| 2027 | Slight Building up (1-2%) | Doable for upper gasoline costs impacting restore prices and claims frequency. |

| 2028 | Slight Lower (1-2%) | Additional developments in generation and probably favorable legislative adjustments that incentivize affordability for low-income drivers. |

Observe: Those are estimates and exact adjustments would possibly range. Elements like financial prerequisites, twist of fate charges, and legislative movements can considerably affect those projections.

Finish of Dialogue

In conclusion, securing low-income automotive insurance coverage in Florida is achievable with the appropriate wisdom and sources. By means of figuring out the to be had choices, monetary help, and alertness processes, you’ll hopefully give protection to your self and your car. This information empowers you to make the most productive alternatives to your monetary scenario, and we inspire you to hunt the help of the sources supplied.

FAQs

What are the typical demanding situations confronted by way of low-income people searching for automotive insurance coverage in Florida?

Prime premiums, restricted get right of entry to to protection choices, and issue assembly the monetary necessities for more than a few insurance policies are steadily vital hurdles.

What monetary help systems are to be had for low-income Floridians?

More than a few organizations and govt systems be offering monetary help and strengthen to assist offset the price of automotive insurance coverage. Those sources would possibly come with sponsored insurance coverage systems, help with down bills, and reductions on premiums.

What documentation is in most cases required for low-income automotive insurance coverage programs?

Documentation would possibly range relying at the supplier and program. On the other hand, repeatedly required paperwork steadily come with evidence of revenue, identity, and car main points.

How can I evaluate insurance coverage suppliers providing low-income automotive insurance coverage in Florida?

Evaluate protection choices, premiums, and buyer critiques to spot probably the most appropriate suppliers. Search for suppliers in particular designed for lower-income people, and believe the use of on-line comparability gear to streamline this procedure.