Canadian automobile insurance coverage in america – Canadian automobile insurance coverage in america gifts a posh panorama for drivers crossing the border. Navigating the intricacies of US laws along Canadian insurance coverage insurance policies calls for cautious attention. Drivers wish to perceive the nuances of protection, criminal necessities, and possible charge variations. This in-depth exploration clarifies the complexities, serving to Canadians make knowledgeable selections when insuring their cars to be used in the USA.

From evaluating protection ranges and premiums to figuring out coincidence claims procedures, this complete information empowers Canadians to with a bit of luck navigate the method. This information examines the various choices, from using Canadian suppliers to choosing US insurers, to verify seamless and cost-effective protection whilst on American roads.

Evaluate of Canadian Automotive Insurance coverage in america

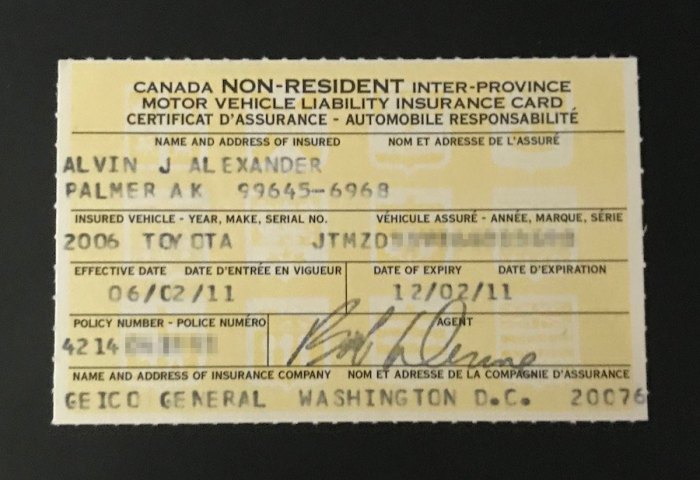

Yo, you Canucks lookin’ to cruise stateside? Looked after insurance coverage on your trip is vital, ‘motive america ain’t precisely a pleasant zone for overseas plates. Navigating the insurance coverage panorama can get just a little murky, so let’s spoil it down.Using a Canadian-registered automobile in america is just a little of a hoops sport. Other states have other laws, however usually, you’ll be able to want evidence of monetary duty, like a US-issued insurance coverage.

Failing to conform can land you with hefty fines and a possible boot on your automobile. You might be no longer simply by yourself, you gotta you’ll want to’re coated.

Prison Necessities for Using in america

The criminal hoops for using a Canadian automobile in america contain demonstrating evidence of monetary duty, steadily a US-based insurance coverage. Because of this should you motive an coincidence, you might be coated and you might be no longer leaving the state with an unpaid invoice. It is the legislation, and it is best to be at the proper aspect of it.

Demanding situations in Buying Insurance coverage

Canadians steadily face demanding situations discovering insurance coverage for his or her vehicles pushed in america. The insurance policies in Canada steadily do not prolong to US territory, which means you might be uncovered. Other protection ranges and insurance policies, to not point out various charges, make the choice procedure just a little extra of a maze. US insurers may have other standards for assessing chance, which will impact your premiums.

Varieties of Insurance coverage Choices

There are quite a lot of insurance coverage choices adapted for Canadian-registered cars in america. A regular coverage covers legal responsibility, which is an important for criminal compliance. Complete protection could also be an choice, protective your automobile towards injury from quite a lot of perils, like injuries or robbery. Collision protection is another option, paying for injury for your automobile if it is taken with a crash, without reference to fault.

Keep in mind, those choices are not as regards to the fundamentals, however in regards to the peace of thoughts that includes understanding your trip is secure.

Top rate Comparability

| Protection Degree | Canadian Insurer Top rate (Instance) | US Insurer Top rate (Instance) |

|---|---|---|

| Legal responsibility Handiest | CAD $500 – $1000 | USD $600 – $1200 |

| Legal responsibility + Complete | CAD $800 – $1500 | USD $1000 – $1800 |

| Legal responsibility + Collision | CAD $1000 – $2000 | USD $1200 – $2500 |

Be aware: Premiums are estimates and will range considerably in line with components like automobile sort, using historical past, and placement. This desk supplies a basic concept of the prospective value variations.

Insurance coverage Choices for Canadian Drivers

Proper, so you are a Canuck cruising Stateside. Insurance coverage ain’t precisely a breeze when you find yourself at the different aspect of the border. You gotta know the ropes to steer clear of getting nicked via hidden fees and awkward scenarios. That is your information to navigating the American insurance coverage maze.This segment dives deep into the quite a lot of insurance coverage choices to be had for Canadian drivers in america.

We’re going to quilt the professionals and cons of the usage of Canadian insurers, the method of having protection from US corporations, and the prices and advantages of each and every method. Plus, we will have a look at any possible boundaries on protection.

The usage of Canadian Insurers for US Automobiles, Canadian automobile insurance coverage in america

Canadian insurers steadily be offering insurance policies that quilt cars in america, however it is a bit of a minefield. They won’t be offering complete protection, particularly if you are out at the open highway, and protection ranges may well be less than what US corporations be offering. It is steadily a inexpensive choice should you keep on with the similar town or state you might be aware of, however there is a catch.

Some insurance policies have boundaries, like decrease payout quantities or exclusions for particular US states or spaces.

Acquiring US Insurance coverage for Canadian Automobiles

Getting US insurance coverage for a Canadian-registered automobile is usually simple, despite the fact that it will include a better top class than should you used a Canadian corporate. You’ll be able to typically wish to supply evidence of car registration, evidence of possession, and doubtlessly, your using document. Some corporations have particular necessities for cars imported into america. A excellent tip is to buy round with quite a lot of US insurance coverage suppliers, as charges can differ.

Price Comparability: US vs. Canadian Insurance coverage

US insurers steadily rate upper premiums than Canadian insurers for Canadian-registered cars, however they could be offering extra complete protection, particularly for cars utilized in america. Believe the whole charge, together with premiums, deductibles, and possible claims. Canadian insurance coverage may appear inexpensive to begin with, however a better declare may just devour into your financial savings if you are no longer cautious. It is all about discovering the candy spot.

Protection Boundaries of Canadian Insurance coverage in america

Canadian insurance policies may exclude sure states or areas, have limits on legal responsibility protection for US injuries, or have decrease protection limits in comparison to US insurance policies. At all times take a look at the high-quality print, and do not think protection is similar throughout all US states. Remember to perceive the bounds and exclusions earlier than hitting the street.

Desk of US Insurers Catering to Canadian Drivers

| Insurer | Professionals | Cons |

|---|---|---|

| Geico | Widely known, steadily aggressive charges. | Will have upper premiums for non-US citizens. |

| State Farm | Robust native presence, identified for customer support. | Charges may range in line with the particular automobile and motive force profile. |

| Innovative | Virtual platform, user-friendly on-line services and products. | Attainable for upper premiums in comparison to different insurers, particularly for particular cars. |

| Allstate | In depth community of brokers and declare facilities. | Will have much less aggressive charges in comparison to different insurers. |

| Liberty Mutual | Excellent buyer critiques, versatile insurance policies. | May require further documentation to verify motive force standing. |

Components Affecting Insurance coverage Prices

Insurance coverage on your trip around the pond is usually a proper ache within the neck. Figuring out the standards that inflate the ones premiums is vital to getting the most efficient deal. Understanding what is using up the price will can help you navigate the murky waters of US automobile insurance coverage, particularly if you are coming over from Canada.

Car Kind and Worth

The sort and price of your motor are a significant component in the fee tag. A souped-up sports activities automobile, or a vintage antique trip, typically comes with a better insurance coverage top class in comparison to a elementary circle of relatives hatchback. That is steadily because of the perceived chance of wear or robbery, in addition to the prospective restore prices. Insurance coverage corporations assess the automobile’s marketplace worth, its make, type, and 12 months of manufacture to estimate possible restore prices.

Using Historical past

A blank using document is a large plus. If you have got a historical past of injuries or violations, your premiums can be upper. This is not as regards to US using infractions; Canadian using information also are factored in. Insurance coverage corporations have a look at each your Canadian and any possible US using historical past when calculating your chance profile. A blank slate is your perfect wager for decrease premiums.

Location and Utilization

The place you park your trip and the way steadily you utilize it topic. Top-crime spaces generally have upper premiums because of the higher chance of robbery or injury. Insurance coverage corporations steadily believe the positioning of your garaging and the frequency of use. For those who essentially force quick distances, your chance is less than any individual who commutes lengthy distances day-to-day.

Claims Historical past

A historical past of claims can dramatically build up your premiums. Whether or not it is a fender bender or a complete loss, earlier claims sign a better probability of long term claims. A declare historical past can stick with you for years, even after the coincidence is settled. So, a blank historical past is essential.

Fee Approach and Reductions

Insurance coverage corporations steadily be offering reductions for paying premiums on time and in complete, as an example, thru automated bills. Those reductions can range relying at the supplier. Reductions also are to be had for secure using behavior, anti-theft gadgets, or even for sure memberships. It is price investigating those reductions to peer in the event that they follow to you.

Comparability of Canadian and US Twist of fate Claims Processes

The declare procedure in america and Canada can range considerably. Canadian coincidence claims are typically easier, with transparent processes and procedures. In america, the method can once in a while be extra advanced, with a much broader vary of things to believe, from criminal illustration to third-party involvement. A Canadian motive force will have to familiarize themselves with america claims procedure.

| Car Kind | Estimated Top rate Have an effect on |

|---|---|

| Luxurious Sports activities Automotive | Top |

| Compact Sedan | Medium |

| Small SUV | Medium-Low |

| Vintage Automotive | Top |

| Truck | Medium-Low |

Claims and Dispute Answer

Navigating the maze of cross-border automobile insurance coverage claims is usually a proper ache, particularly when your wheels are spinning in a special nation. Understanding the ropes for submitting a declare and resolving disputes when your Canadian trip will get right into a jam on US soil is an important. This segment will spoil down the method for you, so you might be no longer left stranded with a hefty restore invoice and a mountain of bureaucracy.

Twist of fate Procedures for Canadian-Registered Automobiles in america

Figuring out the procedures for injuries involving Canadian-registered cars in america is vital to getting issues taken care of out briefly and successfully. At first, right away following the coincidence, you want to assemble all essential data: police record main points, witness statements, and footage of the wear. Then, contacting your Canadian insurer and US insurer (if acceptable) is an important. Your insurer may have particular directions for reporting injuries in another country, and america insurer may require a declare record.

Submitting a Declare with a US Insurer

Submitting a declare with a US insurer when your automobile is registered in Canada calls for cautious consideration to element. The insurer wishes proof of the coincidence, together with the police record, clinical information, and injury checks. You must all the time retain all documentation associated with the declare. Offering correct and complete data to the insurer is very important to verify a clean declare procedure.

Additionally, understanding the particular insurance policies and procedures of america insurer concerned is vital for fending off any delays or headaches.

Not unusual Disputes in Pass-Border Insurance coverage Claims

Disputes steadily stand up because of differing interpretations of insurance coverage insurance policies throughout borders. Language limitations, cultural misunderstandings, and ranging criminal methods too can give a contribution to those conflicts. Misunderstandings about protection limits, tasks, and coincidence reporting procedures are not unusual reasons of dispute. As an example, a Canadian motive force will not be conscious about the particular necessities for reporting an coincidence in america, resulting in headaches afterward.

Likewise, US insurers may no longer absolutely perceive Canadian insurance coverage practices. Those complexities can steadily result in delays and headaches in resolving the declare.

Comparability of Declare Dealing with Procedures

| Side | Canadian Insurer | US Insurer |

|---|---|---|

| Twist of fate Reporting | Most often calls for reporting the coincidence to the Canadian insurer inside a particular time frame. | Reporting the coincidence to america government and your insurer is an important. Regularly calls for a police record. |

| Declare Evaluation | Evaluation steadily comes to Canadian requirements for upkeep and valuations. | Evaluation adheres to US requirements for upkeep and valuations. |

| Legal responsibility Decision | The method for figuring out legal responsibility generally follows Canadian rules. | The method adheres to US rules and laws. |

| Fee Procedure | Maintenance and settlements steadily practice Canadian fee constructions. | Bills steadily practice US fee constructions. |

| Dispute Answer | Canadian dispute answer procedures might follow, together with mediation or arbitration. | US dispute answer mechanisms might come with mediation or litigation. |

This desk supplies a simplified review of the declare dealing with procedures. The precise procedures and necessities can range in line with the cases of the coincidence and the particular insurance policies of each and every insurer.

Prison Concerns

Navigating the criminal panorama of US automobile insurance coverage when you find yourself a Canadian motive force is usually a proper ache. It isn’t as regards to the premiums; understanding the principles is an important to steer clear of hefty fines or worse. Figuring out the legalities guarantees you might be no longer simply coated, however you might be additionally taking part in via america gamebook.The USA has particular laws for insuring cars, even the ones registered in different nations.

This segment dives into the criminal necessities, possible penalties of non-compliance, and the way other states method cross-border insurance coverage. It is all about fending off the ones nasty surprises that would depart you stranded or worse.

Insurance coverage Necessities for Canadian-Registered Automobiles

US states require evidence of monetary duty for all cars running inside their borders. This typically approach having legal responsibility insurance coverage, a particular minimal quantity of protection. This is not only a topic of politeness; it is the legislation. For Canadian drivers, this steadily comes to acquiring a US insurance coverage or demonstrating identical protection thru a known reciprocal settlement. Failure to conform may just lead to hefty consequences.

Implications of Violating US Insurance coverage Rules

Using with out ok insurance coverage in america may end up in critical consequences, starting from fines to possible license suspension and even automobile impoundment. The precise penalties range relying at the state and the severity of the violation. This will also be extremely disruptive, particularly if you are reliant to your automobile for paintings or day-to-day lifestyles.

Particular Prison Frameworks Governing Pass-Border Insurance coverage

A number of US states have reciprocal agreements with Canada and different nations to simplify the method for drivers with overseas registrations. Those agreements steadily Artikel the particular necessities for evidence of insurance coverage and tips on how to navigate cross-border insurance coverage wishes. Then again, those agreements can range considerably, and an intensive investigation is an important. In case you are undecided, consulting a criminal knowledgeable is a great transfer.

Penalties of No longer Having Suitable Insurance coverage Protection

Using with out ok insurance coverage can lead to a variety of significant penalties, impacting no longer handiest your individual budget but additionally your talent to trip or paintings. This is not only a monetary headache; it is a criminal one that would affect your long term. Examples come with fines, suspension of your using privileges, and the potential of going through complaints from concerned events.

Moreover, should you motive an coincidence, you might want to be held responsible for any damages, even supposing you might be only a customer.

US State-Particular Rules Referring to Canadian Automotive Insurance coverage

The USA does not have a unmarried, unified machine for dealing with cross-border insurance coverage. Rules range considerably from state to state, developing a posh panorama for Canadian drivers.

| State | Particular Necessities |

|---|---|

| Instance State 1 | Evidence of minimal legal responsibility protection; reciprocal settlement with Canada; particular bureaucracy required for verification. |

| Instance State 2 | No reciprocal settlement with Canada; calls for a US coverage or identical evidence of protection; possible for upper premiums for overseas drivers. |

| Instance State 3 | Simplified procedure for drivers with legitimate Canadian insurance coverage; restricted documentation required. |

This desk is a simplified illustration; all the time seek the advice of the particular insurance coverage division of the state you might be visiting. Rules are advanced and topic to modify.

Comparability of Protection

Navigating US insurance coverage as a Canadian motive force can really feel like a maze. Figuring out the other protection ranges between Canadian and US insurance policies is an important for fending off nasty surprises down the road. This segment breaks down the important thing variations, serving to you are making the suitable alternatives on your wheels.US insurance coverage insurance policies, not like their Canadian opposite numbers, steadily have other protection ranges adapted for using in america.

This implies a coverage legitimate in Canada may no longer absolutely give protection to you within the States.

Standard Protection Ranges

Canadian insurance policies steadily focal point at the necessities, whilst US insurance policies have a tendency to supply extra complete choices. This distinction in method is at once tied to the various criminal frameworks and coincidence charges between the 2 nations. Canadian protection has a tendency to be extra curious about legal responsibility and elementary protections. US insurance policies, however, may be offering a broader vary of protection to deal with the upper probability of injuries, collisions, and assets injury.

Legal responsibility Protection

Legal responsibility protection in america is typically extra considerable than in Canada. It’s because US rules steadily hang drivers extra in command of damages brought about in injuries. Canadian legal responsibility insurance policies generally quilt damages to different events’ cars and accidents sustained via others. Then again, US insurance policies ceaselessly prolong legal responsibility protection to hide further damages or clinical bills. Figuring out the specifics of each and every coverage is an important for making sure you might be adequately secure.

Collision and Complete Protection

Collision protection in america is usually extra tough, because it steadily covers damages for your personal automobile without reference to fault in an coincidence. Canadian insurance policies will have various ranges of collision protection, steadily that specialize in the monetary affect of wear for your automobile. Complete protection in america is typically extra inclusive, encompassing injury from occasions past injuries, reminiscent of robbery, vandalism, or herbal screw ups.

Canadian insurance policies may no longer come with the similar breadth of complete protection.

Varieties of Insurance coverage Protection

Insurance coverage insurance policies be offering a variety of coverages, each and every taking part in a particular function in protective your pursuits. Legal responsibility protection is very important for safeguarding your self from claims associated with accidents or injury to different events. Collision protection is designed to handle the monetary duty for injury for your personal automobile in a collision. Complete protection supplies coverage towards quite a lot of dangers past collisions, reminiscent of robbery, hearth, or vandalism.

- Legal responsibility Protection: Protects you from monetary duty for injury to others’ assets or accidents brought about in an coincidence.

- Collision Protection: Covers injury for your automobile in a collision, without reference to who’s at fault.

- Complete Protection: Protects towards damages for your automobile from occasions like robbery, vandalism, hearth, or hail.

- Uninsured/Underinsured Motorist Protection: Supplies coverage if you are taken with an coincidence with an uninsured or underinsured motive force.

- Clinical Bills Protection: Covers clinical bills for you and your passengers, without reference to fault.

- Non-public Harm Coverage (PIP): Very similar to clinical bills, however steadily covers misplaced wages and different bills.

Evaluating Protection Choices

Evaluating quite a lot of insurance coverage choices calls for cautious scrutiny of coverage main points. The precise protection ranges, deductibles, and premiums range significantly amongst other insurers. Totally reviewing coverage paperwork is very important. You must search for protection that adequately protects you in america whilst ultimate reasonably priced.

| Insurance coverage Supplier | Legal responsibility Protection | Collision Protection | Complete Protection |

|---|---|---|---|

| Insurer A | $100,000/$300,000 | $10,000 Deductible | Complete Protection |

| Insurer B | $250,000/$500,000 | $5,000 Deductible | Partial Protection |

| Insurer C | $500,000/$one million | $2,500 Deductible | Complete Protection with extras |

Pointers and Suggestions for Canadians

Navigating america automobile insurance coverage panorama as a Canadian motive force is usually a little bit of a maze. Figuring out the nuances of protection, laws, and possible pitfalls is an important to steer clear of expensive surprises. This segment gives sensible recommendation for Canadians taking a look to safe the suitable insurance coverage for his or her wheels whilst stateside.

Actionable Pointers for Canadians

Insurance coverage is not just a field to tick; it is a essential a part of your trip and possession plan within the States. Do your homework and do not simply accept the primary coverage you spot. Evaluate other suppliers, coverages, and premiums to seek out the most efficient deal adapted for your wishes.

Dependable Assets for Data

Discovering faithful data on Canadian automobile insurance coverage in america is vital. Get started with respected insurance coverage comparability internet sites and search for assets particularly catering to Canadian drivers. Do not depend on generic on-line searches; search for websites devoted to cross-border insurance coverage. Checking together with your Canadian insurer or their US associates too can supply precious insights.

Minimizing Insurance coverage Prices

Preserving your premiums down with out compromising protection is a will have to. Believe components like your using document, automobile sort, and placement when opting for a coverage. A blank using document is steadily a major factor in decreasing premiums. Researching reductions introduced via insurers too can result in considerable financial savings.

Figuring out Particular Rules

Rules range via state. Remember to totally perceive the particular laws governing your preferred state for automobile insurance coverage. Other states have differing necessities for minimal protection. As an example, some states may require legal responsibility protection, whilst others may call for complete protection.

Suggestions for Canadians

- Totally analysis insurance coverage suppliers providing protection particularly for Canadian drivers in america. This steadily yields higher premiums and adapted toughen.

- Download a couple of quotes from other insurers to check costs and protection programs. Do not simply accept the primary quote you in finding.

- Be ready to reveal your blank using document, as this steadily results in diminished premiums.

- Perceive and conform to all state-specific laws for automobile insurance coverage. Other states have various necessities for protection.

- Believe including extras like roadside help or emergency clinical quilt, particularly if you are travelling.

Wrap-Up

In conclusion, securing the suitable automobile insurance coverage when using a Canadian-registered automobile in america is an important. Figuring out the original demanding situations, choices, and components impacting premiums empowers Canadians to make knowledgeable alternatives. By means of totally reviewing protection, evaluating insurers, and taking into consideration criminal implications, drivers can be sure that their automobile is sufficiently secure and navigate the method with self assurance. The information has equipped a transparent review of the complexities, making all of the procedure much less daunting.

Very important Questionnaire: Canadian Automotive Insurance coverage In United states of america

What are the criminal necessities for using a Canadian-registered automobile in america?

Evidence of insurance coverage, steadily within the type of a US-compliant coverage, is generally required. Particular laws range via state. At all times check necessities with the state’s Division of Motor Automobiles.

How do I examine premiums for identical protection ranges between Canadian and US insurers?

Evaluating quotes at once from insurers, whilst taking into consideration protection main points and exclusions, is an important. Believe the usage of on-line comparability gear. Be aware that automobile sort, motive force profile, and placement inside america affect premiums.

What are the typical disputes coming up from cross-border insurance coverage claims?

Disputes steadily focus on legal responsibility, protection limits, and declare processing procedures. Figuring out the variations in declare processes between Canadian and US insurers is essential.

What are the effects of no longer having suitable insurance plans whilst using a Canadian-registered automobile in america?

Consequences can vary from fines to automobile impoundment. Additionally, with out ok protection, drivers might face important monetary liabilities in case of injuries. At all times be sure that the automobile is roofed.