Are you able to negotiate insurance coverage payout for totaled automotive – Are you able to negotiate insurance coverage payout for a totaled automotive? This information dives deep into the sector of vehicle insurance coverage claims, revealing the methods and techniques had to protected the most efficient imaginable payout when your trip meets its unlucky finish. From figuring out the declare procedure to mastering negotiation ways, we’re going to equip you with the data to get probably the most from your insurance coverage agreement.

Get able to degree up your insurance coverage recreation!

Navigating the complexities of a totaled automotive declare can really feel overwhelming, however with the precise data, you’ll hopefully method the method. This complete information breaks down the stairs concerned, serving to you know your rights and tasks. Let’s discover the secrets and techniques to a good and favorable agreement!

Figuring out the Insurance coverage Declare Procedure

Navigating the insurance coverage declare procedure for a totaled automobile will also be daunting, however figuring out the stairs concerned could make the enjoy much less nerve-racking. This procedure, whilst various moderately by means of insurer, generally comes to a sequence of movements that, if adopted appropriately, will result in a smoother and extra environment friendly solution. A radical figuring out of the documentation, timelines, and other coverage sorts is a very powerful for a good consequence.

Submitting a Declare for a Totaled Automotive: A Step-by-Step Procedure

The method for submitting a declare for a totaled automobile typically starts with fast documentation of the incident. This comes to contacting your insurance coverage corporate once imaginable, preferably inside 24-48 hours of the coincidence. They’ll most probably require information about the incident, together with the date, time, location, and an outline of the cases resulting in the whole loss.

Therefore, a declare shape is initiated and submitted. A police file, if to be had, is incessantly useful in supporting your declare and offering an authentic document of the incident. Following this, the insurance coverage adjuster will assess the wear and resolve the automobile’s marketplace price. This generally comes to a bodily inspection of the automobile and probably consulting with an unbiased appraiser.

As soon as the automobile is deemed a complete loss, your insurance coverage corporate will supply an estimated agreement quantity, which is generally according to the automobile’s marketplace price on the time of the coincidence. After accepting the agreement, you can want to go back the automobile’s identify and any connected documentation to the insurance coverage corporate.

Not unusual Documentation Required for a Totaled Automobile Declare

A complete declare calls for quite a lot of varieties of documentation. This comprises the police file (if appropriate), the automobile’s identify, evidence of possession, and any pre-existing injury stories. Images or movies of the wear to the automobile are a very powerful proof. You might also want to supply restore estimates from a mechanic for those who tried maintenance earlier than mentioning the automobile a complete loss.

Additional documentation might come with pre-accident inspection stories, if any exist. Those paperwork serve to ensure the main points of the incident and the automobile’s situation earlier than the coincidence. The insurer may additionally require supporting paperwork like clinical data or witness statements relying at the cases.

Standard Time frame for Processing a Totaled Automobile Declare

The time required to procedure a totaled automobile declare can range significantly. It depends upon a number of components, such because the complexity of the declare, the insurance coverage corporate’s procedures, and the supply of all required documentation. In most cases, the method can take any place from a couple of weeks to a number of months. An easy declare with readily to be had documentation could also be resolved inside a few weeks.

On the other hand, claims involving disputes over legal responsibility or in depth documentation necessities may take significantly longer. Insurance coverage firms incessantly supply estimates or timelines throughout the preliminary declare evaluation.

Other Varieties of Insurance coverage Insurance policies Protecting Totaled Cars

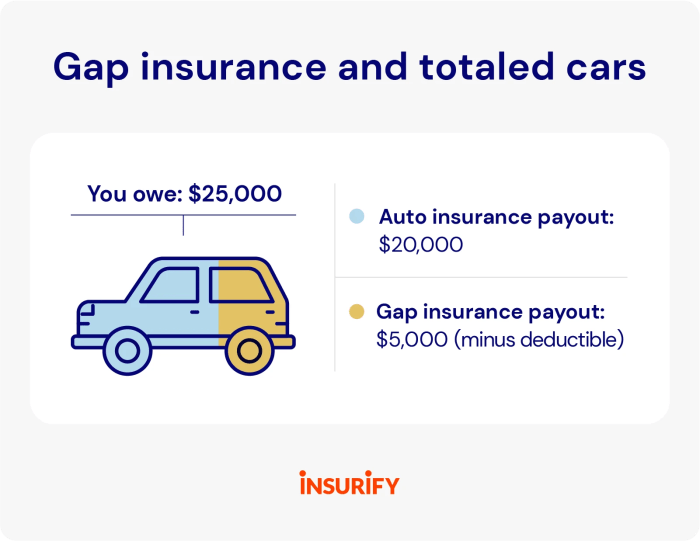

Various kinds of insurance coverage insurance policies provide various ranges of protection for totaled automobiles. Figuring out the nuances of every coverage is essential in maximizing your declare. Complete protection generally covers injury brought about by means of occasions no longer involving a collision, similar to hearth, vandalism, or weather-related injury. Collision protection, alternatively, covers injury because of an coincidence with every other automobile or object.

Comparability of Not unusual Coverage Clauses Associated with Totaled Cars

| Coverage Kind | Protection for Overall Loss | Deductibles | Further Necessities |

|---|---|---|---|

| Complete | Covers overall losses because of non-collision occasions (e.g., hearth, vandalism, hail). | Deductibles range by means of coverage; generally a share of the automobile’s price. | Might require evidence of the development inflicting the wear, similar to a police file or injury evaluation. |

| Collision | Covers overall losses because of collisions with every other automobile or object. | Deductibles range by means of coverage; generally a share of the automobile’s price. | Calls for evidence of the collision, incessantly a police file. |

Elements Affecting Negotiation

Securing a good insurance coverage payout for a totaled automobile calls for figuring out the standards that affect the agreement provide. Insurance coverage firms use established standards to resolve the reimbursement quantity, and an intensive wisdom of those components empowers you to barter successfully. A complete figuring out of those components, together with marketplace price, depreciation, and the automobile’s situation, is a very powerful to reaching a ample consequence.

Automobile Marketplace Worth

The marketplace price of a totaled automobile considerably affects the negotiation procedure. This price is incessantly made up our minds the usage of on-line sources, fresh gross sales information, and business benchmarks. Insurance coverage adjusters generally use those sources to determine a baseline price. As an example, a 2015 Honda Civic with top mileage and minor beauty injury may have a decrease marketplace price in comparison to a more moderen fashion or one in pristine situation.

The presence of fascinating options or distinctive attributes too can have an effect on the price. Realizing the best marketplace price to your particular automobile fashion, 12 months, situation, and site is important for a a hit negotiation.

Depreciation and Present Marketplace Prerequisites

Depreciation, the aid in a automobile’s price through the years, is a key attention. Present marketplace prerequisites, similar to financial downturns or surges in used automotive costs, additionally play a job. A automotive that was once price $20,000 two years in the past may well be price $15,000 lately because of depreciation. A unexpected building up in call for, probably induced by means of provide chain problems, may even lead to upper than anticipated marketplace values.

Insurance coverage firms incessantly use a mix of those components to reach at a agreement determine.

Situation of the Totaled Automobile

The situation of the totaled automobile is a very powerful. Injury extent, together with structural injury, maintenance, and general situation, without delay affects the agreement quantity. A automotive with important structural injury may have a decrease agreement than one with minor beauty injury. Images and detailed documentation of the wear are very important. A complete file from a mechanic detailing the automobile’s pre-accident situation and the level of the wear, can turn out extremely treasured within the negotiation.

Restore Estimates and Appraisal Stories

Restore estimates and appraisal stories supply a very powerful proof to your case. Those paperwork, created by means of certified pros, provide a transparent image of the automobile’s restore prices. An appraisal file is incessantly required by means of insurance coverage firms to validate the marketplace price of the automobile. Having detailed and professionally ready restore estimates and value determinations considerably strengthens your negotiation place.

Those paperwork supply function proof to counter possible undervaluations.

Insurance coverage Adjuster Techniques

Insurance coverage adjusters incessantly make use of techniques to scale back payouts. Those techniques can come with undervaluing the automobile, disputing restore prices, and the usage of pre-existing prerequisites as a controversy to attenuate reimbursement. Not unusual techniques incessantly contain wondering the accuracy of restore estimates or suggesting selection, lower-cost maintenance. It is very important to be ready to counter those techniques with verifiable proof. This comprises having detailed documentation of the automobile’s pre-accident situation, pictures, and unbiased value determinations.

Methods for Negotiating a Honest Payout: Can You Negotiate Insurance coverage Payout For Totaled Automotive

Negotiating a good insurance coverage payout for a totaled automotive calls for a strategic method, combining wisdom of the method with assertive conversation. Figuring out the price of your automobile, accumulating supporting proof, and presenting your case successfully are a very powerful steps in attaining a ample agreement. This phase delves into sensible methods for securing a simply reimbursement to your loss.Efficient negotiation hinges on an intensive figuring out of your rights and the insurance coverage corporate’s practices.

Insurance coverage firms incessantly make use of standardized procedures to guage claims, however those procedures will also be navigated effectively with meticulous preparation and a transparent figuring out of your automobile’s price.

Accumulating Proof Supporting Automobile Worth

Thorough documentation is very important to confirm your declare. This comprises keeping up data of all maintenance, upkeep, and changes in your automobile. This documentation, when correctly offered, considerably strengthens your argument for a good valuation. Authentic gross sales receipts, upkeep data, and service invoices are all vital items of proof. As well as, believe acquiring value determinations from unbiased, qualified automobile appraisers.

Those value determinations supply an independent valuation, which is able to bolster your negotiation. Moreover, footage and movies of the broken automobile, taken from a couple of angles, can provide a visible document of the level of the wear.

Approaches to Presenting Your Case

Other approaches to presenting your case to the insurance coverage adjuster can yield various effects. A right away, assertive method could also be efficient with some adjusters, whilst a extra collaborative, evidence-based method may well be extra appropriate with others. Imagine your negotiation taste and the adjuster’s demeanor to tailor your presentation for optimum effects. One vital method is to obviously and concisely articulate the price of your automobile, emphasizing all components contributing to its price.

This comprises detailing the automobile’s age, mileage, situation, and any aftermarket changes that enhanced its price.

Sturdy Arguments to Use Right through Negotiation

Sturdy arguments throughout negotiation center of attention on offering transparent and concise proof supporting the automobile’s price. Highlighting fresh marketplace tendencies for similar automobiles on your house is a formidable argument. Knowledge from respected on-line automobile marketplaces and used automotive listings can give a boost to your statement of honest marketplace price. As well as, offering unbiased value determinations or quotes from dealerships providing identical automobiles can additional enhance your case.

As an example, if the insurance coverage corporate to start with provides a considerably decrease valuation than the unbiased appraisal, you’ll use the appraisal as proof of the automobile’s exact price. Every other compelling argument is to give a complete breakdown of the automobile’s price, listing all related components like mileage, options, and upkeep historical past.

Pattern Negotiation Script for a Totaled Automobile Declare

This pattern negotiation script demonstrates a structured method for presenting your case.

“Excellent morning/afternoon [Adjuster’s Name]. I am right here lately to speak about the agreement for my totaled automobile, [Vehicle Year, Make, Model]. I have collected supporting documentation, together with upkeep data, restore invoices, and an unbiased appraisal, which puts the honest marketplace price at [Appraised Value]. I have additionally researched fresh marketplace tendencies for similar automobiles in [Your Location], which additional helps this valuation. I am open to discussing a mutually agreeable agreement.”

Keeping up Detailed Data

Detailed data are a very powerful right through all of the procedure. Keeping up correct data of all communications, correspondence, and gives gained from the insurance coverage corporate is very important. This comprises protecting copies of all emails, letters, and notes. Those data supply a transparent audit path of your declare’s growth and will also be useful if disputes stand up. This documentation let you care for a transparent figuring out of all of the negotiation procedure.

Detailed data permit for a transparent and concise presentation of your case, making sure that each one related data is quickly obtainable.

Prison Issues and Assets

Navigating a totaled automobile declare comes to figuring out your felony rights and tasks. This phase delves into the felony panorama surrounding insurance coverage claims, highlighting state rules, client coverage, and when in the hunt for felony suggest is recommended. Comprehending those facets empowers you to successfully negotiate a good agreement and give protection to your pursuits.

Prison Rights and Tasks

Your felony rights throughout a totaled automobile declare negotiation are multifaceted. You could have the precise to honest and correct exams of your automobile’s price and the precise to know the standards influencing the payout. Figuring out the phrases of your insurance plans is a very powerful, because it Artikels your tasks and the insurer’s responsibilities. Tasks might come with offering essential documentation or cooperating with the insurer’s investigation.

Those rights and tasks are essential for a easy and simply declare solution.

State Rules Referring to Insurance coverage Claims

State rules considerably have an effect on the method of negotiating a totaled automobile declare. Every state has particular rules governing insurance coverage insurance policies, declare procedures, and dispute solution mechanisms. Permutations exist within the timeframes for submitting claims, the desired documentation, and the procedures for interesting choices. As an example, some states mandate particular paperwork for appraisal or require mediation earlier than pursuing felony motion.

This variance underscores the significance of researching your state’s specific rules.

Shopper Coverage Rules

Shopper coverage rules exist to safeguard policyholders from unfair or misleading insurance coverage practices. Those rules cope with problems like misrepresentation of protection, unreasonable prolong in processing claims, and refusal to pay official claims. Examples come with rules prohibiting insurers from denying protection according to pre-existing prerequisites (in some circumstances) or for fraudulent claims. Shopper coverage rules are designed to verify equitable remedy and save you insurers from exploiting susceptible policyholders.

Function of Shopper Coverage Companies

Shopper coverage companies play a vital function in mediating disputes between shoppers and insurance coverage firms. Those companies examine proceedings, supply data to shoppers, and facilitate settlements. They incessantly act as mediators, making an attempt to unravel disputes earlier than they escalate to courtroom. As an example, they may assist resolve if an insurer’s movements violate state rules or if a agreement is honest and affordable.

The involvement of those companies will also be a very powerful in acquiring a ample solution.

Assets for Customers

A large number of sources are to be had to shoppers in the hunt for help with insurance coverage claims. Those come with state insurance coverage departments, client coverage companies, and on-line sources. Contacting your state’s insurance coverage division is a elementary step for getting access to related data and sources connected in your state’s particular rules. Shopper advocacy teams and felony assist organizations too can supply treasured give a boost to and steerage.

Those sources supply a pathway for figuring out your rights and acquiring essential help.

When to Seek the advice of a Legal professional

Consulting a attorney is suitable when the insurance coverage corporate denies a valid declare, refuses to barter relatively, or misrepresents coverage phrases. A attorney can advise you in your felony choices, overview the insurance plans and supporting documentation, and constitute your pursuits in negotiations or courtroom. When disputes escalate past amicable solution or the insurance coverage corporate’s movements appear egregious, in the hunt for felony suggest generally is a essential step in protective your rights and pursuits.

Selection Dispute Solution

Navigating a totaled automotive declare can once in a while result in disagreements between you and your insurance coverage corporate. Thankfully, a number of selection strategies exist to unravel those disputes outdoor of a long and probably pricey courtroom fight. Those strategies, incessantly faster and not more formal, can assist each events succeed in a mutually agreeable agreement.

Other Strategies of Selection Dispute Solution

Selection Dispute Solution (ADR) encompasses quite a lot of strategies for resolving conflicts with out litigation. Key strategies come with mediation and arbitration. Figuring out those strategies and their nuances is a very powerful for maximizing your possibilities of securing a good agreement.

Mediation

Mediation comes to a impartial 3rd birthday celebration, the mediator, facilitating conversation and negotiation between you and the insurance coverage corporate. The mediator is helping establish commonplace floor and encourages each side to believe every different’s views. Mediation is generally much less formal than arbitration, taking into consideration extra flexibility within the procedure.

- Mediation targets to foster a collaborative surroundings the place each events can actively take part in shaping the solution.

- The mediator guides the dialogue, making sure each side perceive every different’s considerations and positions.

- Mediation is incessantly a much less adverse procedure in comparison to litigation, fostering a spirit of compromise.

Arbitration

Arbitration comes to a impartial 3rd birthday celebration, the arbitrator, who listens to each side of the case after which makes a binding choice. This choice is generally legally enforceable, very similar to a courtroom judgment. Arbitration incessantly comes to a extra structured procedure than mediation.

- Arbitration provides a extra formal surroundings, with particular laws and procedures to practice.

- The arbitrator acts as a pass judgement on, comparing the proof and arguments offered by means of each side.

- The arbitrator’s choice is incessantly ultimate and legally binding, that means the events are obligated to stick to the result.

Advantages and Drawbacks of ADR Strategies

Each mediation and arbitration provide benefits and drawbacks. The most efficient approach depends upon the precise cases of your totaled automotive declare.

| Way | Description | Execs | Cons |

|---|---|---|---|

| Mediation | A impartial 3rd birthday celebration facilitates conversation and negotiation. | Versatile, much less adverse, probably quicker, and extra collaborative. Continuously more cost effective than litigation. | No ensure of a solution, mediator’s tips aren’t binding. The method is probably not appropriate for advanced or extremely contentious circumstances. |

| Arbitration | A impartial 3rd birthday celebration renders a binding choice. | Quicker than litigation, incessantly more cost effective than litigation, and binding choice. | Much less flexibility than mediation, the arbitrator’s choice is ultimate and would possibly not absolutely cope with all considerations. |

When ADR is Recommended in Totaled Automotive Claims

ADR strategies are incessantly advisable when coping with totaled automotive claims. The facility to unravel the dispute with out resorting to pricey and time-consuming litigation is a vital merit. As an example, if the price of the totaled automobile is fairly low or if the events have a historical past of amicable relationships, mediation may turn out extremely efficient. In a similar fashion, when a handy guide a rough and decisive solution is desired, arbitration generally is a treasured device.

Using ADR in Totaled Automotive Claims

Within the context of a totaled automotive declare, mediation will also be extremely advisable. The method can facilitate a dialogue of the quite a lot of components contributing to the declare, together with the situation of the automobile, the marketplace price, and the potential of maintenance. Arbitration, alternatively, may well be appropriate for eventualities the place there’s a important confrontation in regards to the automobile’s price or if the insurance coverage corporate is unwilling to barter relatively.

Figuring out those nuances is very important in opting for probably the greatest approach.

Not unusual Errors to Keep away from

Navigating the complexities of a totaled automotive declare will also be difficult. Figuring out possible pitfalls and find out how to steer clear of them considerably improves the possibilities of securing a good payout. This phase highlights commonplace mistakes and offers methods to avoid them.The insurance coverage declare procedure, whilst designed to be easy, can turn out to be convoluted if no longer approached with the precise wisdom and techniques.

Via spotting and proactively addressing possible errors, you’ll give protection to your pursuits and make sure a smoother, extra favorable solution.

Pitfalls in Negotiation Methods, Are you able to negotiate insurance coverage payout for totaled automotive

Misunderstandings and miscalculations can simply derail negotiations, resulting in unsatisfactory settlements. Figuring out those pitfalls means that you can get ready successfully and hopefully navigate the method.

- Failing to report the whole lot meticulously.

- Neglecting to assemble all related supporting proof.

- Underestimating the significance of thorough analysis.

- Dashing the negotiation procedure.

- Now not in the hunt for skilled felony recommendation when suitable.

Those errors can result in a decrease payout than what’s rightfully owed. Thorough documentation and proof are a very powerful to give a boost to your declare. A rushed procedure incessantly leads to overlooking vital main points or concessions.

Examples of Useless Negotiation Methods

A commonplace mistake is accepting the primary provide with out completely taking into consideration its equity. Failing to investigate similar claims or the present marketplace price of identical automobiles may end up in accepting a considerably decrease payout. As an example, if the insurance coverage corporate provides a value according to an out of date appraisal, you may well be shedding out on a considerable quantity. Negotiation comes to figuring out the marketplace price and the insurance coverage corporate’s standard payout practices.

Moreover, merely agreeing to the preliminary provide with out counter-arguments could also be destructive to securing a good agreement.

- Accepting the primary provide with out counter-offer: This incessantly ends up in accepting a decrease payout than justified.

- Failing to investigate similar claims: Loss of analysis may lead to accepting an unfair provide according to a low valuation in comparison to fresh claims for identical automobiles.

- Ignoring knowledgeable critiques: Brushing aside value determinations or estimates from unbiased mavens can considerably obstruct your skill to justify a better agreement.

- Being overly emotional throughout negotiations: Letting feelings cloud judgment can negatively have an effect on the negotiation procedure and probably result in much less favorable phrases.

Penalties of Making Errors

The results of constructing those errors can vary from a decrease payout to a chronic and probably nerve-racking negotiation procedure. Accepting an insufficient provide may end up in monetary loss. Ignoring a very powerful proof or felony facets can result in disputes and extended solution.

- Monetary Loss: Failing to barter successfully may end up in a agreement considerably not up to the automobile’s exact price.

- Extended Dispute: Loss of preparation or fallacious negotiation techniques can lengthen the declare procedure and upload to worry.

- Prison Problems: False impression felony concerns or neglecting to hunt suitable felony suggest can escalate the dispute.

Keeping off Negotiation Pitfalls

Thorough preparation and a strategic method are very important to steer clear of those errors. Development a robust case with complete documentation, analysis, and knowledgeable give a boost to considerably improves the chance of a positive consequence.

- Detailed Documentation: File each and every conversation, expense, and piece of proof associated with the declare.

- Marketplace Analysis: Analysis similar claims and present marketplace values for identical automobiles.

- Search Skilled Recommendation: Imagine consulting with a felony skilled if the declare turns into advanced.

- Take care of Professionalism: Take care of a certified demeanor right through the negotiation procedure.

- Endurance: Permit plentiful time for the negotiation procedure.

Flowchart for Keeping off Not unusual Errors

(A visible illustration of steps to steer clear of commonplace errors isn’t equipped right here, as it is past the scope of text-based content material.)

Ultimate Wrap-Up

In conclusion, negotiating a good insurance coverage payout for a totaled automotive calls for a strategic method. Via figuring out the declare procedure, inspecting the standards affecting the agreement, and mastering negotiation ways, you’ll considerably building up your possibilities of securing a positive consequence. Take into accout to report the whole lot, be ready to assemble proof, and do not hesitate to hunt skilled recommendation when wanted.

This information equips you with the data to navigate the complexities of a totaled automotive declare, in the end empowering you to offer protection to your pursuits.

Skilled Solutions

Can I negotiate if the wear is obviously my fault?

Sure, you’ll nonetheless negotiate. Whilst legal responsibility is apparent, you’ll nonetheless negotiate for a good payout quantity that considers the present marketplace price, no longer simply the declared injury.

What if I do not accept as true with the insurance coverage adjuster’s evaluation?

You could have the precise to problem the evaluation. Acquire supporting documentation like restore estimates, appraisal stories, and marketplace price information. Be ready to give your case.

How lengthy does the negotiation procedure generally take?

The time-frame varies, however it generally takes a number of weeks to achieve a agreement. Endurance and endurance are key.

What if I will’t succeed in a agreement thru negotiation?

Selection dispute solution strategies, similar to mediation or arbitration, could also be essential. Those strategies can give a impartial platform to unravel the confrontation.