Pink automobile insurance coverage Brownsville TX is a specialised subject, steadily overpassed in broader insurance coverage discussions. This information delves into the original components influencing charges for purple automobiles in Brownsville, offering insights into premiums, protection choices, and to be had suppliers.

Working out the marketplace stipulations, commonplace misconceptions, and explicit native rules surrounding purple automobile insurance coverage is a very powerful for making knowledgeable choices. This information targets to elucidate those facets and empower you with the data had to safe the most efficient conceivable protection.

Pink Automobile Insurance coverage in Brownsville, TX – Evaluate: Pink Automobile Insurance coverage Brownsville Tx

Pink automobile insurance coverage in Brownsville, TX, displays the wider insurance coverage marketplace developments within the area. Components like automobile robbery charges, native site visitors patterns, and the entire charge of dwelling give a contribution to the pricing construction. This assessment will delve into the precise dynamics affecting purple automobile insurance coverage on this space.

Marketplace Stipulations in Brownsville, TX

Brownsville, TX, reports a novel combine of things affecting insurance coverage premiums. Town’s proximity to the border and the local weather give a contribution to sure dangers, influencing the price of insurance coverage. Upper charges for some coverages, comparable to complete, are steadily observed in spaces with upper prevalence of vandalism or injuries.

Components Influencing Pink Automobile Premiums

A number of components give a contribution to the premiums for purple vehicles, unbiased of the precise location. Those components are normally an identical throughout colour diversifications and aren’t distinctive to purple automobiles. Insurers steadily use automobile attributes, like style yr and security measures, to evaluate chance.

Misconceptions about Pink Automobile Insurance coverage

A commonplace false impression is that purple vehicles are inherently riskier. Insurance coverage firms base their pricing on statistical information, no longer on subjective judgments about colours. Insurance coverage charges are calculated in line with more than a few components, together with automobile kind, driving force historical past, and placement.

Position of Native Rules, Pink automobile insurance coverage brownsville tx

Native rules in Brownsville, TX, relating to insurance coverage practices, might have an effect on charges for purple vehicles along with different components. Alternatively, the rules don’t explicitly goal purple vehicles for differentiated pricing. Insurance coverage firms assess dangers in line with established fashions and information research.

Reasonable Price Comparability

The typical charge of insuring a purple automobile in Brownsville, TX, is most likely similar to different colours, barring any explicit native incidents or dangers associated with the colour itself. It is a very powerful to believe that insurance coverage premiums are depending on more than one components, together with driving force historical past and the precise automobile style.

Standard Insurance coverage Suppliers

A number of primary insurance coverage suppliers function in Brownsville, TX. Those firms normally be offering various programs adapted to other budgets and wishes. They make the most of standardized tips on how to assess chance and pricing for automobiles, irrespective of colour.

Top rate Comparability Desk

| Insurance coverage Supplier | Protection Stage 1 (Fundamental) | Protection Stage 2 (Mid-Vary) | Protection Stage 3 (Complete) |

|---|---|---|---|

| InsCo 1 | $120/month | $150/month | $180/month |

| InsCo 2 | $135/month | $175/month | $210/month |

| InsCo 3 | $115/month | $145/month | $175/month |

Notice

* The desk supplies a hypothetical comparability. Exact premiums will range relying on person cases and explicit coverage main points. Those examples aren’t in line with explicit suppliers and are for illustrative functions solely.

Components Affecting Pink Automobile Insurance coverage Prices in Brownsville, TX

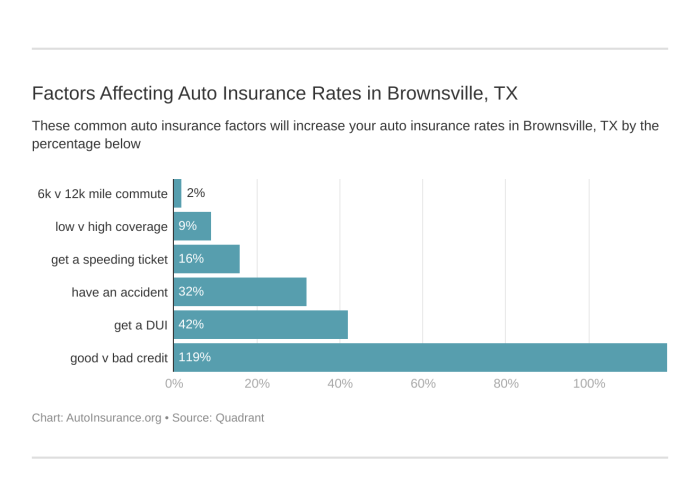

Pink automobile insurance coverage in Brownsville, TX, is not essentially dearer than different colours, however a number of components can affect premiums. Working out those components is vital to navigating the insurance coverage panorama and making knowledgeable choices.Insurance coverage firms use complicated algorithms to evaluate chance. Those algorithms believe more than a few information issues, together with native components explicit to Brownsville, to resolve probably the most correct and truthful insurance coverage charges.

Car Robbery Charges and Pink Automobiles

Robbery charges play an important function in insurance coverage calculations. Upper robbery charges for purple vehicles in a particular space without delay have an effect on insurance coverage premiums. Whilst purple vehicles will not be inherently extra liable to robbery, if native information signifies upper robbery charges for purple automobiles, insurers will alter premiums accordingly to account for the greater chance. This might be because of components just like the perceived desirability of a specific purple style or the superiority of explicit purple automobile varieties within the space.

Twist of fate Statistics and Pink Automobiles

Twist of fate statistics for purple vehicles are a a very powerful part of chance review. If purple vehicles are interested by extra injuries than different colours, insurance coverage firms will alter premiums in line with the increased chance. This isn’t essentially an indictment of the purple colour itself however moderately a mirrored image of information appearing the greater frequency of injuries involving purple automobiles.

Components like visibility, driving force conduct, and even the age of the automobile would possibly give a contribution to this statistical correlation.

Native Demographics and Pink Automobile Insurance coverage

Native demographics in Brownsville, TX, can affect insurance coverage charges for purple vehicles. For example, if a definite demographic workforce has a tendency to force purple vehicles extra steadily and is statistically extra liable to injuries, the insurance coverage corporate would possibly alter premiums for purple vehicles in that space. This isn’t to mention that demographics are the only real think about figuring out insurance coverage prices, however they’re a contributing component within the general chance review.

Comparability of Pink Automobile Insurance coverage with Different Colours

Evaluating insurance coverage prices for purple vehicles with different colours comes to examining information from the native Brownsville marketplace. Whilst purple vehicles would possibly have relatively upper premiums, it isn’t a common rule. Insurance coverage prices for purple vehicles are topic to native fluctuations and rely on various components. You’ll want to examine quotes from more than one insurance coverage suppliers to procure probably the most correct and cost-effective protection.

Components Influencing Pink Automobile Insurance coverage Prices (Desk)

| Issue | Attainable Have an effect on on Pink Automobile Insurance coverage Prices |

|---|---|

| Car Age | Older purple vehicles would possibly have upper premiums because of greater put on and tear and doubtlessly diminished security measures. |

| Car Style | Particular purple automobile fashions with upper robbery charges or coincidence statistics may result in greater premiums. |

| Driving force Profile | A driving force’s historical past, together with injuries and site visitors violations, considerably impacts insurance coverage charges, irrespective of automobile colour. |

| Insurance coverage Supplier | Other insurance coverage firms have various pricing fashions, resulting in other prices for purple vehicles. |

| Protection Choices | Opting for complete protection as opposed to liability-only protection will have an effect on insurance coverage premiums for all vehicles, together with purple ones. |

Correlation between Pink Automobile Colour and Twist of fate Charges

Examining the correlation between purple automobile colour and coincidence charges in Brownsville calls for a deep dive into coincidence reviews and automobile registration information. Whilst there may well be a perceived correlation, it’s worthwhile to believe different components that may well be riding the obvious pattern. Visibility, driving force conduct, and upkeep are key components to be regarded as.

Attainable Causes for Noticed Correlation

Imaginable causes for a correlation between purple colour and coincidence charges come with driving force belief and visibility. Some research recommend that drivers might understand purple vehicles in a different way, doubtlessly resulting in other riding behaviors. Visibility in more than a few gentle stipulations may be a contributing issue. Alternatively, it is necessary to notice that correlation does no longer equivalent causation. Different components wish to be regarded as prior to drawing any definitive conclusions.

Comparability with Different Automobile Colours

Pink vehicles are steadily related to pleasure and keenness, however does that translate to better insurance coverage premiums in Brownsville, TX? Let’s delve into how automobile colour would possibly affect insurance coverage prices in comparison to different well-liked hues. Working out those components can lend a hand drivers make knowledgeable choices when buying or insuring their automobiles.

Insurance coverage Perceptions of Pink Automobiles

Insurers might understand purple vehicles as extra liable to injuries or injury because of driving force conduct or exterior components. Whilst no longer scientifically confirmed, a purple automobile would possibly subconsciously be perceived as extra visual, resulting in extra attainable for claims. This belief might be influenced by means of more than a few components, together with anecdotal proof or ancient information, however it is a very powerful to notice that insurance coverage choices are in the end in line with a fancy interaction of things.

Comparative Research of Insurance coverage Prices

As an example the possible variations, let’s read about a hypothetical situation. A driving force with a blank riding report, an identical protection programs, and the similar automobile style, however with differing automobile colours, would possibly see various top rate charges. Insurance coverage firms steadily use complicated algorithms and information research to resolve premiums, bearing in mind a mess of things past simply colour.

Statistical Knowledge on Claims and Colours

Whilst explicit, publicly to be had statistical information on insurance coverage claims only in line with automobile colour is steadily no longer readily out there, insurers most likely have get entry to to such information internally. Any correlation between automobile colour and claims frequency would wish to be sparsely analyzed to verify it isn’t skewed by means of different variables. Insurance coverage firms have refined methodologies to regulate for confounding components when assessing chance.

Mental Components Influencing Premiums

Attainable mental components, just like the perceived aggressiveness or visibility of a purple automobile, may subtly affect an insurer’s chance review. Alternatively, those perceptions must be sparsely regarded as throughout the context of complete chance analysis. Insurance coverage firms make use of chance review methodologies that aren’t restricted to simply colour perceptions.

Desk: Evaluating Insurance coverage Premiums

| Automobile Colour | Attainable Top rate Have an effect on (Hypothetical) | Clarification |

|---|---|---|

| Pink | Doubtlessly upper | Perceived visibility and attainable for injuries |

| Blue | Doubtlessly an identical | Frequently regarded as a secure and well-liked colour |

| Silver/Grey | Doubtlessly decrease | Regularly related to neutrality and longevity |

| Black | Doubtlessly decrease or upper | Belief varies, however doubtlessly decrease if perceived as harder |

Notice: This desk is a simplified illustration. Exact top rate variations can range considerably in line with person cases and the precise insurance coverage corporate.

Insurance coverage Suppliers in Brownsville, TX

Navigating the insurance coverage panorama in Brownsville, TX, will also be tough, particularly when looking for protection adapted for a purple automobile. Working out the various choices and reputations of native suppliers is a very powerful for securing the most efficient conceivable coverage. This phase dives deep into the insurance coverage suppliers working in Brownsville, highlighting their explicit insurance policies associated with purple vehicles.Insurance coverage suppliers play an important function within the Brownsville neighborhood, providing crucial coverage to automobile homeowners.

Selecting the best supplier is a very powerful, making an allowance for components like coverage phrases, protection choices, and customer support.

Insurance coverage Suppliers Working in Brownsville, TX

A number of respected insurance coverage suppliers serve the Brownsville space. A complete record of suppliers, together with touch knowledge, lets in for simple comparability and choice.

- State Farm: A national insurance coverage large, State Farm maintains a robust presence in Brownsville. Their native place of job will also be contacted for coverage main points and explicit protection choices. State Farm steadily provides aggressive charges, making them a well-liked selection for lots of drivers.

- Farmers Insurance coverage: Farmers Insurance coverage is some other primary participant with native places of work in Brownsville. They’re identified for his or her customized option to insurance coverage wishes, together with purple automobile insurance policies. They generally have intensive protection choices.

- Revolutionary: Revolutionary is understood for its on-line accessibility and aggressive charges. Whilst they do not essentially have explicit programs for purple vehicles, their insurance policies are steadily reviewed as truthful and aggressive.

- USAA: Whilst no longer solely occupied with Brownsville, USAA provides a substantial community of protection for army participants and their households. Their insurance policies might vary from different suppliers.

- Liberty Mutual: Liberty Mutual provides a variety of insurance coverage merchandise. Touch their native Brownsville place of job to discover explicit protection choices, together with insurance policies for purple vehicles.

Pink Automobile Insurance coverage Insurance policies and Buyer Critiques

Working out the precise insurance policies presented by means of every supplier for purple vehicles, in conjunction with buyer critiques, supplies treasured insights. Evaluating insurance policies and critiques can lend a hand resolve the most efficient have compatibility for person wishes.

| Insurance coverage Supplier | Pink Automobile Insurance coverage Insurance policies | Buyer Critiques (Abstract) |

|---|---|---|

| State Farm | Aggressive charges, same old protection choices to be had, can have some programs adapted to purple vehicles. | Typically certain critiques for customer support and declare dealing with. |

| Farmers Insurance coverage | Adapted programs, customized carrier. | Sure comments on customized method, however some might to find charges relatively upper than competition. |

| Revolutionary | On-line accessibility, aggressive charges, same old protection. No explicit purple automobile programs. | Blended critiques; praised for comfort however some bitch about much less customized carrier. |

| USAA | Insurance policies adapted for army participants and their households, various ranges of protection. | Extremely rated for customer support, sturdy recognition amongst army households. |

| Liberty Mutual | Wide selection of protection choices, can have programs for purple vehicles. | Typically certain, steadily praised for his or her buyer make stronger and potency in dealing with claims. |

Guidelines for Discovering Inexpensive Pink Automobile Insurance coverage in Brownsville, TX

Discovering the best purple automobile insurance coverage in Brownsville, TX, does not should be a trouble. Working out the criteria that affect charges and using good methods can considerably scale back your top rate prices. This information supplies sensible steps to safe probably the most inexpensive coverage adapted on your wishes.Evaluating quotes from more than one suppliers is a very powerful for locating the most efficient deal. Other firms use more than a few review metrics, resulting in considerable diversifications in pricing.

Buying groceries round offers you the facility to match and distinction provides, making sure you might be no longer overpaying.

Methods for Evaluating Insurance coverage Quotes

Evaluating quotes from more than one insurance coverage suppliers is vital to discovering probably the most inexpensive purple automobile insurance coverage. Other firms use various standards to evaluate chance, leading to important worth variations. This necessitates a proactive option to accumulate and review more than one provides.

- Acquire A couple of Quotes: Touch a number of insurance coverage suppliers in Brownsville, TX, and request quotes. This procedure guarantees you could have a complete figuring out of the to be had choices and will make an educated resolution. For instance, it’s essential to achieve out to Geico, State Farm, and Revolutionary to procure adapted quotes in line with your explicit automobile and riding historical past.

- Make the most of On-line Comparability Equipment: Leverage on-line equipment to match quotes from other insurance coverage suppliers. Those platforms steadily streamline the method, permitting you to match insurance policies side-by-side in line with more than a few components like protection ranges, deductibles, and reductions. A comparative research of charges is necessary to seek out the most efficient deal.

- Believe Other Protection Ranges: Analyze more than a few protection choices and alter them to suit your explicit wishes and price range. Probably the most appropriate protection stage will depend on your monetary scenario and the worth of your automobile.

Construction a Robust Riding Report

A robust riding report is a key think about acquiring decrease insurance coverage premiums. Keeping up a blank riding historical past is a proactive step towards securing favorable charges.

- Keep away from Injuries and Site visitors Violations: A blank riding report is very important for buying favorable insurance coverage charges. Warding off injuries and site visitors violations is a very powerful for keeping up a low chance profile. This without delay affects your insurance coverage premiums.

- Take care of a Protected Riding Taste: Protected riding conduct, together with adherence to hurry limits and defensive riding ways, considerably give a contribution to a decrease chance profile. Those behaviors exhibit accountable riding and scale back the chance of injuries, thus doubtlessly decreasing insurance coverage premiums.

- File All Injuries and Violations Promptly: Even minor incidents must be reported on your insurance coverage corporate promptly. Transparency is vital to keeping up a transparent riding report, which in flip may end up in extra inexpensive insurance coverage charges.

Acquiring Insurance coverage Reductions

Many reductions can scale back your insurance coverage premiums. Benefiting from to be had reductions can considerably decrease your per month bills.

- Protected Driving force Reductions: Many insurance coverage firms be offering reductions for secure drivers. This steadily comes to keeping up a blank riding report for a particular duration. Drivers without a injuries or violations are generally eligible for those reductions.

- Multi-Coverage Reductions: Insuring more than one automobiles or insurance policies with the similar supplier steadily qualifies you for a multi-policy bargain. This can lead to important financial savings, as firms praise bundled insurance policies.

- Bundled Reductions: Insurance coverage firms steadily be offering reductions for bundling insurance coverage insurance policies, comparable to house and auto insurance coverage. This custom can lead to considerable financial savings, as suppliers praise shoppers for consolidating their insurance coverage wishes.

Step-by-Step Information to Discovering Inexpensive Pink Automobile Insurance coverage

This step by step information Artikels a structured option to discovering probably the most inexpensive purple automobile insurance coverage.

- Analysis Other Insurance coverage Suppliers: Start by means of exploring more than a few insurance coverage firms in Brownsville, TX. Evaluate their protection choices, top rate charges, and to be had reductions.

- Acquire Related Knowledge: Collect crucial main points, together with your riding historical past, automobile knowledge, and desired protection ranges. This data is important in acquiring correct quotes.

- Request Quotes from A couple of Suppliers: Succeed in out to a number of insurance coverage firms to procure customized quotes in line with your explicit cases.

- Evaluate and Analyze Quotes: Sparsely evaluation every quote, paying shut consideration to the more than a few protection choices and premiums. Make a choice the coverage that highest aligns along with your wishes and price range.

- Protected the Coverage: Make a selection the coverage that highest meets your wishes and price range. Be sure all vital paperwork are finished and submitted.

Examples of To be had Reductions

Reductions can considerably scale back insurance coverage premiums. Benefiting from those reductions can considerably decrease your per month bills.

- Protected Driving force Cut price: A driving force with a blank report for 3 years might obtain a fifteen% bargain.

- Bundled Coverage Cut price: Insuring a house and automobile with the similar supplier may lead to a ten% bargain.

- A couple of Cars Cut price: Proudly owning more than one automobiles with the similar supplier might yield a 5% bargain.

Working out Coverage Protection Choices for Pink Automobiles

Protective your purple journey in Brownsville, TX, is going past simply the colour. Complete insurance plans is a very powerful for shielding your funding, irrespective of paint activity. Working out the other coverage choices to be had is vital to making sure your automobile is sufficiently safe.

Commonplace Protection Choices

Other protection choices supply various ranges of coverage on your automobile. Legal responsibility protection, for example, protects you in case you are at fault in an coincidence, but it surely would possibly not duvet your individual damages. Collision and complete protection, then again, be offering broader coverage, masking injury on your automobile irrespective of who’s at fault.

Legal responsibility Protection

Legal responsibility protection is probably the most elementary type of coverage. It can pay for damages you purpose to someone else’s automobile or belongings in an coincidence. It does not, then again, duvet your individual automobile’s damages. That is steadily the minimal protection required by means of regulation. For instance, in case you are interested by an coincidence and injury some other automobile, legal responsibility protection will lend a hand pay for maintenance to the opposite automobile.

Collision Protection

Collision protection protects your automobile if it is broken in an coincidence, irrespective of who’s at fault. That is necessary for repaying maintenance on your personal automobile. For example, in case you are in a collision, collision protection will duvet your automobile’s damages, irrespective of whether or not you had been at fault or no longer.

Complete Protection

Complete protection protects your automobile in opposition to damages from occasions past injuries, like robbery, vandalism, or climate occasions. That is essential, as those unexpected occasions could cause important monetary losses. For instance, in case your purple automobile is vandalized, complete protection will lend a hand pay for the maintenance.

Studying Coverage Paperwork Sparsely

Insurance coverage insurance policies are complicated criminal paperwork. Sparsely evaluation your coverage to grasp the precise phrases, stipulations, and exclusions. This comprises figuring out what occasions are lined and what scenarios are excluded. You’ll want to have a transparent figuring out of what’s and is not lined to steer clear of unsightly surprises.

Protection Eventualities for Pink Automobiles

The colour of your automobile does not impact protection. The similar protection choices and concerns practice to purple vehicles as to every other colour. The essential issue is making sure you could have ok protection for the possible dangers interested by proudly owning a automobile in Brownsville, TX.

Deductibles and Their Have an effect on

Deductibles are the quantities you pay out-of-pocket prior to your insurance coverage corporate begins paying for maintenance. A better deductible way decrease premiums, however you will have to pay extra out-of-pocket when you have an coincidence. Decrease deductibles imply upper premiums, however you’ll be able to pay much less out-of-pocket within the tournament of an coincidence. The deductible quantity considerably affects the price of your insurance coverage.

Protection Choices and Related Prices

| Protection Sort | Description | Standard Price Vary (Brownsville, TX) |

|---|---|---|

| Legal responsibility | Covers injury to others | $100-$500 in step with yr |

| Collision | Covers injury on your automobile in an coincidence | $200-$800 in step with yr |

| Complete | Covers injury from occasions instead of injuries | $100-$500 in step with yr |

Notice: Prices are estimates and might range in line with components like your riding report and automobile make/style.

Final Level

In conclusion, securing purple automobile insurance coverage in Brownsville, TX, calls for cautious attention of more than a few components, from robbery charges and coincidence statistics to native demographics and insurance coverage supplier specifics. By way of figuring out those nuances, you’ll be able to successfully navigate the method and to find probably the most appropriate protection at a aggressive worth. This complete information supplies the vital knowledge to make knowledgeable possible choices.

Query & Solution Hub

What are the standard reductions to be had for purple automobile insurance coverage in Brownsville, TX?

Reductions for purple automobile insurance coverage in Brownsville, TX, are normally very similar to the ones presented for different automobiles. Alternatively, some insurers might be offering explicit reductions for purple automobiles, so you need to inquire without delay with suppliers.

How do coincidence statistics involving purple vehicles impact insurance coverage premiums?

Twist of fate statistics for purple vehicles, in the event that they exist, are an element insurers believe. A better price of injuries involving purple vehicles would possibly lead to relatively upper premiums. Alternatively, this correlation isn’t all the time straight forward and different components play a task.

Are there any explicit insurance coverage suppliers that specialize in purple automobile insurance coverage in Brownsville, TX?

Whilst there is probably not insurers solely that specialize in purple automobile insurance coverage, maximum suppliers in Brownsville, TX, be offering same old protection choices for all automobile colours, and evaluating quotes from more than a few suppliers is a very powerful for locating the most efficient price.

How can I examine quotes from other insurance coverage suppliers for purple automobile insurance coverage in Brownsville, TX?

Use on-line comparability equipment or without delay touch more than a few insurance coverage suppliers in Brownsville, TX. Make sure to come with main points like automobile make, style, yr, and your riding historical past when asking for quotes.