Automotive insurance coverage in port st lucie fl – Automotive insurance coverage in Port St. Lucie, FL: Navigating the native marketplace can really feel overwhelming, but it surely does not need to be. This information breaks down the whole thing you want to learn about discovering the most efficient coverage on your wishes. We will quilt coverage sorts, pricing elements, or even learn how to document a declare.

Working out the native marketplace is vital. Port St. Lucie, FL has a selected mixture of demographics and riding conduct that have an effect on insurance coverage charges. We will discover the ones nuances and spotlight the most efficient suppliers within the house, serving to you examine insurance policies and in finding probably the most reasonably priced choices whilst making sure good enough protection.

Creation to Automotive Insurance coverage in Port St. Lucie, FL

The automobile insurance coverage marketplace in Port St. Lucie, Florida, like many different spaces, is a fancy panorama formed via more than a few elements. Working out those elements is the most important for acquiring appropriate protection and managing monetary dangers related to proudly owning a automobile. This review supplies a glimpse into the to be had insurance policies, commonplace price influences, and very important protection choices.The insurance coverage panorama in Port St.

Lucie, just like the encompassing spaces, is pushed via a mixture of state rules, native financial stipulations, and the particular traits of the neighborhood. Those traits, mixed with the will for dependable coverage, resolve the kind and value of insurance coverage to be had.

Commonplace Varieties of Automotive Insurance coverage Insurance policies

Quite a lot of kinds of automotive insurance coverage insurance policies cater to other wishes and possibility tolerances. Those insurance policies typically come with legal responsibility, collision, and complete protection. Legal responsibility insurance coverage protects policyholders from monetary accountability within the tournament of an coincidence the place they’re at fault. Collision insurance coverage covers damages to the insured automobile on account of an coincidence, irrespective of who’s at fault.

Complete insurance coverage covers damages to the insured automobile from occasions rather then collisions, similar to vandalism, robbery, or weather-related injury.

Elements Influencing Automotive Insurance coverage Charges in Port St. Lucie

A number of elements affect automotive insurance coverage charges in Port St. Lucie, FL. Demographics, similar to age and riding historical past, considerably have an effect on premiums. Upper possibility drivers, regularly more youthful folks, generally tend to stand greater charges because of a perceived larger chance of injuries. The native riding atmosphere and coincidence statistics additionally play a task.

Spaces with greater coincidence charges regularly see corresponding will increase in insurance coverage premiums.

Conventional Insurance coverage Protection Choices

The usual insurance plans choices to be had in Port St. Lucie, FL, come with legal responsibility, collision, and complete protection. Legal responsibility protection protects policyholders from monetary accountability within the tournament of an coincidence the place they’re at fault. Collision protection covers damages to the insured automobile from injuries, irrespective of who’s at fault. Complete protection protects the automobile from non-collision occasions, similar to vandalism, robbery, or herbal screw ups.

Minimal Insurance coverage Necessities in Port St. Lucie, FL

The next desk Artikels the everyday minimal insurance coverage necessities in Port St. Lucie, FL. Those necessities are the most important for felony compliance and would possibly range relying at the explicit coverage and the insurance coverage supplier.

| Protection Kind | Description | Minimal Requirement |

|---|---|---|

| Legal responsibility Physically Damage | Covers accidents to others in an coincidence the place the insured is at fault. | $10,000 according to particular person, $20,000 according to coincidence |

| Legal responsibility Belongings Harm | Covers injury to the valuables of others in an coincidence the place the insured is at fault. | $10,000 according to coincidence |

| Uninsured/Underinsured Motorist | Protects the insured and their automobile if considering an coincidence with an at-fault motive force missing good enough insurance coverage. | Required typically |

Evaluating Insurance coverage Suppliers in Port St. Lucie, FL

Navigating the varied panorama of vehicle insurance coverage suppliers in Port St. Lucie, FL, can really feel overwhelming. Working out the pricing methods, fashionable alternatives, buyer comments, and repair reviews is the most important for making an educated determination. This research targets to offer a complete review of those key elements, enabling citizens to make a choice probably the most appropriate protection.

Pricing Methods of Insurance coverage Suppliers

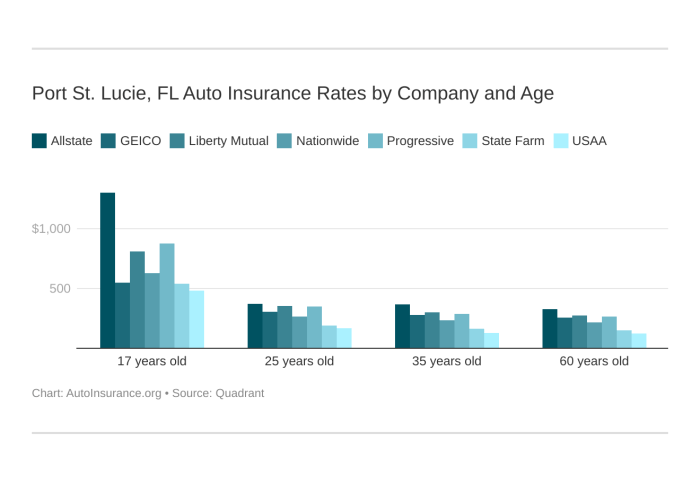

Quite a lot of elements affect the pricing methods hired via insurance coverage suppliers in Port St. Lucie. Premiums are regularly made up our minds via elements similar to the motive force’s age, riding document, automobile sort, and placement. Insurance coverage firms regularly use refined actuarial fashions to evaluate possibility and modify premiums accordingly. As an example, a motive force with a historical past of injuries or visitors violations would possibly revel in greater premiums in comparison to a secure motive force with a blank document.

Fashionable Insurance coverage Firms in Port St. Lucie, FL

A number of insurance coverage firms are prevalent in Port St. Lucie. Those firms continuously be offering aggressive charges and intensive protection choices to cater to the varied wishes of citizens. Native firms, at the side of nationwide giants, compete for marketplace percentage, regularly using other methods to draw shoppers. One of the vital distinguished firms regularly known for his or her presence and visibility within the house come with State Farm, Geico, Revolutionary, and Allstate.

Buyer Critiques and Rankings

Buyer evaluations and scores supply treasured insights into the reviews of Port St. Lucie citizens with more than a few insurance coverage suppliers. On-line platforms and impartial evaluation websites be offering aggregated comments, enabling possible shoppers to achieve a broader point of view at the services and products introduced via other firms. As an example, State Farm would possibly obtain excessive marks for its responsive customer support, whilst Revolutionary could be lauded for its user-friendly on-line platform.

Buyer Provider Stories

Customer support reviews play an important function in shaping perceptions of insurance coverage suppliers. The potency, helpfulness, and responsiveness of shopper provider representatives can affect buyer pleasure. Other suppliers would possibly make the most of various channels for buyer strengthen, similar to telephone, e-mail, and on-line portals. Certain reviews give a contribution to logo loyalty and favorable suggestions.

Comparability of Main Insurance coverage Firms

This desk Artikels the options and advantages of 3 distinguished insurance coverage firms working in Port St. Lucie, FL. The tips offered right here supplies a initial comparability and must now not be thought to be a complete analysis.

| Insurance coverage Corporate | Options | Advantages |

|---|---|---|

| State Farm | Wide selection of protection choices, robust native presence, intensive community of brokers, superb customer support popularity. | Aggressive charges, personalised provider, claims dealing with potency, and powerful strengthen machine. |

| Geico | Easy on-line platform, simple insurance policies, reasonably priced premiums, reductions for more than a few standards. | Handy virtual revel in, doubtlessly decrease prices, ease of coverage control, and number of reductions. |

| Revolutionary | Complex era integration, cutting edge gear for coverage control, a couple of reductions, responsive customer support choices. | Virtual accessibility, streamlined processes, aggressive charges, and possible for more than a few reductions. |

Elements Affecting Automotive Insurance coverage Premiums

Within the colourful Port St. Lucie neighborhood, securing the suitable automotive insurance coverage is the most important for peace of thoughts. Working out the criteria that affect premiums permits citizens to make knowledgeable selections and doubtlessly cut back their prices. This information empowers drivers to navigate the complexities of the insurance coverage panorama and in finding probably the most appropriate protection for his or her wishes.

Using Information and Insurance coverage Premiums, Automotive insurance coverage in port st lucie fl

Using data are an important determinant in Port St. Lucie, FL, automotive insurance coverage premiums. A blank riding document, loose from injuries and visitors violations, generally interprets to decrease premiums. Conversely, a historical past of injuries or shifting violations, similar to rushing tickets or reckless riding, regularly results in greater premiums. Insurance coverage firms assess the chance related to every motive force according to their previous riding conduct.

This possibility review is helping them resolve the chance of long run claims, which at once affects the top rate. The severity and frequency of previous incidents play a the most important function in calculating the top rate.

Automobile Kind and Style Affect on Insurance coverage Prices

The kind and fashion of a automobile considerably affect insurance coverage premiums in Port St. Lucie. Luxurious cars and sports activities vehicles regularly have greater premiums because of their perceived greater possibility of wear or robbery in comparison to usual fashions. Moreover, cars with complex security measures or distinctive design parts can impact insurance coverage prices. The worth of the automobile additionally influences the price of insurance coverage, as higher-value cars generally incur greater premiums to catch up on the larger monetary possibility to the insurance coverage corporate.

Location-Primarily based Diversifications in Insurance coverage Charges

Insurance coverage charges in Port St. Lucie, FL, can range relying at the explicit location. Spaces with greater crime charges or greater incidences of injuries will have correspondingly greater insurance coverage premiums. This displays the insurance coverage corporate’s review of the relative possibility of claims in explicit spaces throughout the town. Proximity to high-traffic spaces, accident-prone intersections, or spaces with a historical past of car thefts too can affect charges.

Age and Gender’s Affect on Premiums

Age and gender are elements that affect automotive insurance coverage premiums. More youthful drivers, regularly perceived as greater possibility because of inexperience, typically face greater premiums in comparison to older, extra skilled drivers. In a similar way, in some spaces, insurance coverage firms would possibly imagine gender as an element of their possibility review. This isn’t at all times the case, and insurance policies would possibly range from corporate to corporate.

Elements like riding revel in and conduct can nonetheless considerably have an effect on premiums, irrespective of age or gender.

Correlation Between Using Historical past and Insurance coverage Premiums

| Using File | Top class Affect |

|---|---|

| No injuries or violations | Decrease premiums |

| Minor coincidence (fender bender) | Quite greater premiums |

| A couple of injuries | Considerably greater premiums |

| Severe coincidence | Very excessive premiums |

| Visitors violations (rushing, reckless riding) | Upper premiums |

| DUI/DWI | Extraordinarily excessive premiums, regularly with obstacles or exclusions |

Claims Procedure and Assets

Navigating the claims procedure is usually a the most important facet of securing repayment within the tournament of an coincidence. Working out the stairs concerned and the sources to be had can considerably streamline the method, making sure a smoother revel in for all events concerned. This phase main points the everyday procedures and timelines related to submitting a automotive insurance coverage declare in Port St. Lucie, FL.The method for submitting a automotive insurance coverage declare in Port St.

Lucie, FL, is designed to be honest and environment friendly, with established procedures to deal with more than a few kinds of claims. This phase supplies a complete review of the declare procedure, together with the stairs concerned, timelines, and to be had sources.

Declare Submitting Procedure Review

Submitting a automotive insurance coverage declare comes to a sequence of steps designed to verify a recommended and correct solution. A transparent figuring out of those steps is very important for a easy and environment friendly declare procedure.

| Step | Process |

|---|---|

| 1. File the Coincidence | Straight away file the coincidence to the police and your insurance coverage corporate. Accumulate data such because the names and make contact with main points of all events concerned, witness statements, and an outline of the wear to cars. This preliminary file is the most important for the following declare procedure. |

| 2. Accumulate Documentation | Bring together all related documentation, together with the police file, scientific data (if acceptable), restore estimates, and another supporting proof. Thorough documentation strengthens the declare and aids within the review procedure. |

| 3. Touch Your Insurance coverage Corporate | Touch your insurance coverage corporate to start up the declare procedure. Give you the important data and documentation accrued within the earlier steps. Adhering to the corporate’s explicit declare procedures is significant for a easy procedure. |

| 4. Supply Evidence of Loss | Put up proof of the damages, similar to pictures, movies, or restore estimates, to the insurance coverage corporate. This documentation is very important to strengthen your declare and exhibit the level of the loss. |

| 5. Review and Assess the Declare | The insurance coverage corporate will evaluation the declare, together with the validity and extent of the damages. This analysis procedure would possibly contain inspections, value determinations, and investigations to resolve the legitimacy and protection. |

| 6. Negotiate and Settle | As soon as the declare is evaluated, the insurance coverage corporate will negotiate a agreement quantity. If the agreement quantity is appropriate, the declare can also be resolved. If now not, a dispute solution procedure can also be initiated. |

Varieties of Automotive Insurance coverage Claims

Quite a lot of kinds of claims can also be filed beneath automotive insurance coverage insurance policies in Port St. Lucie, FL. Working out the other classes is very important to verify suitable dealing with of every case. Those come with:

- Belongings Harm Claims:

- Physically Damage Claims:

- Uninsured/Underinsured Motorist Claims:

Those claims cope with injury in your automobile on account of an coincidence or different lined tournament. The method comes to documentation of the wear and acquiring restore estimates. Examples come with collisions, hail injury, or vandalism.

Those claims contain repayment for accidents sustained in an coincidence. Documentation is the most important, encompassing scientific expenses, misplaced wages, and ache and struggling. Examples come with accidents sustained via drivers, passengers, or pedestrians concerned within the coincidence.

If an coincidence comes to a motive force with out insurance coverage or with inadequate protection, your coverage’s uninsured/underinsured motorist protection can lend a hand catch up on damages. Documentation of the coincidence and the at-fault motive force’s loss of insurance coverage is important.

Timeframes for Claims Processing

The time frame for claims processing in Port St. Lucie, FL, varies relying at the complexity of the declare. Elements similar to the level of the wear, the provision of documentation, and the will for additional investigation can affect the processing time. Usually, easy claims with readily to be had documentation are processed inside a couple of weeks, whilst extra complicated claims would possibly take a number of months.

Examples come with instances requiring impartial value determinations or intensive scientific reviews.

Dispute Solution Mechanisms

If a confrontation arises relating to a declare, more than a few dispute solution mechanisms are to be had. Those mechanisms purpose to get to the bottom of disputes amicably and successfully, together with negotiation, mediation, or in excessive instances, arbitration. Working out those avenues can save you disputes from escalating.

Reductions and Saving Pointers

Securing favorable automotive insurance coverage charges in Port St. Lucie, FL, hinges on savvy methods and proactive measures. Working out to be had reductions and enforcing prudent monetary conduct can considerably cut back premiums, taking into account larger monetary flexibility. Diligence in keeping up a pristine riding document and embracing secure riding practices are pivotal in attaining those financial savings.

Varieties of Reductions

Quite a lot of reductions are regularly introduced via insurance coverage suppliers in Port St. Lucie. Those would possibly come with reductions for secure riding, bundling insurance policies, and for explicit automobile options. Reductions for just right scholar drivers, anti-theft gadgets, and accident-free riding data also are prevalent. Those incentives incentivize accountable riding conduct and praise those that exhibit a dedication to protection.

Lowering Premiums

Lowering automotive insurance coverage premiums calls for a multifaceted method. Drivers can leverage reductions, handle a blank riding document, and discover bundling choices to succeed in vital financial savings. A complete figuring out of those methods is vital to securing decrease premiums.

Explicit Examples of Financial savings

A motive force with a blank riding document and a up to date, qualified anti-theft instrument put in of their automobile would possibly qualify for a considerable cut price. This interprets to a notable relief of their per 30 days insurance coverage premiums. Bundling householders or renters insurance coverage with auto insurance coverage can additional cut back the entire value. As an example, a motive force who bundles their auto, house, and lifestyles insurance coverage insurance policies would possibly see a ten% to twenty% relief of their total premiums.

Significance of Keeping up a Excellent Using File

Keeping up a pristine riding document is paramount in securing favorable automotive insurance coverage charges. A blank riding historical past indicates accountable riding conduct, decreasing the chance profile for insurance coverage firms. As a result, drivers with a blank document are regularly rewarded with decrease premiums.

Secure Using Practices

Secure riding practices are the most important in securing reductions and keeping up a just right riding document. Adhering to hurry limits, warding off distracted riding, and working towards defensive riding ways give a contribution to a more secure riding document. This, in flip, may end up in decrease insurance coverage premiums.

Bundling Insurance coverage Insurance policies

Bundling insurance coverage insurance policies, similar to auto, house, and lifestyles insurance coverage, can regularly result in vital financial savings. This method consolidates protection beneath one supplier, doubtlessly yielding considerable discounts in premiums. Insurance coverage suppliers regularly be offering reductions for patrons who package their insurance policies.

Pointers for Saving Cash on Automotive Insurance coverage

- Deal with a blank riding document. Steer clear of visitors violations and injuries to handle a low possibility profile.

- Assessment and examine charges from other insurance coverage suppliers steadily. This proactive method can unearth higher offers.

- Set up and handle anti-theft gadgets for your automobile. This demonstrates a dedication to safety and will regularly yield reductions.

- Package deal your insurance coverage insurance policies (auto, house, lifestyles) to doubtlessly protected vital reductions.

- Profit from reductions for secure drivers, just right scholars, or different related classes.

- Request quotes from a couple of insurance coverage suppliers, allowing for their popularity, provider choices, and explicit coverage main points.

- Believe including not obligatory extras, similar to complete protection, if important, to verify good enough coverage.

Pointers for Opting for the Proper Coverage

Navigating the arena of vehicle insurance coverage in Port St. Lucie, FL, can really feel like navigating a maze. Working out the intricacies of various insurance policies and suppliers is vital to securing the most efficient coverage on your automobile and monetary well-being. Choosing the proper automotive insurance plans is not only about discovering the bottom value; it is about aligning protection together with your explicit wishes and monetary scenario.Choosing the proper automotive insurance plans comes to a cautious attention of your personal cases and wishes.

The coverage you choose must be offering good enough coverage with out pointless prices. This calls for a prepared eye for element and an figuring out of the more than a few elements at play.

Working out Coverage Phrases and Stipulations

Comprehending the phrases and prerequisites of a automotive insurance plans is paramount. Those main points Artikel the specifics of protection, exclusions, and obstacles. Failing to snatch those facets may end up in unexpected problems when creating a declare. Thorough evaluation of the fantastic print is the most important to steer clear of any surprises down the street. Working out the coverage’s obstacles, similar to geographical restrictions or exclusions for explicit kinds of injuries, is very important.

Evaluating Insurance policies In accordance with Explicit Wishes

Evaluating other insurance coverage insurance policies calls for a structured method. Establish your distinctive wishes, similar to the price of your automobile, your riding historical past, and your required protection limits. Review the advantages and disadvantages of every coverage to make a choice the only that most nearly fits your scenario. A comparative research according to those standards will result in a extra knowledgeable determination.

Elements to Believe When Deciding on a Coverage

A number of the most important elements affect the choice of an appropriate automotive insurance plans. Those come with protection limits, deductibles, and coverage add-ons. Working out those elements permits for a adapted coverage that aligns together with your monetary capability and possibility tolerance. Protection limits outline the utmost quantity the insurance coverage corporate pays for damages or accidents. Deductibles constitute the volume you should pay out-of-pocket ahead of the insurance coverage corporate steps in.

Studying the Fantastic Print

In moderation scrutinizing the fantastic print is important. Hidden clauses, exclusions, and obstacles could be overpassed, doubtlessly resulting in a loss of protection in surprising cases. This tradition guarantees that the coverage as it should be displays your wishes and expectancies. Studying the fantastic print permits for a whole figuring out of the coverage’s obstacles and guarantees you are now not stuck off guard.

Comparability Desk of Protection Choices

| Protection | Description | Price (Estimated, Port St. Lucie, FL) |

|---|---|---|

| Legal responsibility Protection | Covers damages to others in case of an coincidence you reason. | $50-$200/12 months |

| Collision Protection | Covers injury in your automobile irrespective of who’s at fault. | $75-$250/12 months |

| Complete Protection | Covers injury in your automobile from occasions rather then collisions (e.g., vandalism, hearth, robbery). | $50-$150/12 months |

| Uninsured/Underinsured Motorist Protection | Protects you in case you are considering an coincidence with an uninsured or underinsured motive force. | $50-$100/12 months |

| Private Damage Coverage (PIP) | Covers scientific bills and misplaced wages for you and your passengers. | $25-$75/12 months |

“Working out your explicit wishes and evaluating insurance policies according to the ones wishes are key steps in selecting the proper automotive insurance plans.”

Final Conclusion

In conclusion, securing the suitable automotive insurance coverage in Port St. Lucie, FL comes to figuring out native elements, evaluating suppliers, and opting for a coverage that matches your wishes. Through making an allowance for the insights supplied on this information, you can be well-equipped to make an educated determination. Consider to check your coverage steadily to verify persisted coverage and modify your protection as wanted.

Solutions to Commonplace Questions: Automotive Insurance coverage In Port St Lucie Fl

What are the everyday minimal insurance coverage necessities in Port St. Lucie, FL?

Minimal necessities range via state however typically come with legal responsibility protection. Take a look at together with your native Division of Motor Cars (DMV) for probably the most up-to-date main points. It is at all times easiest to get greater than the minimal, particularly for complete protection.

How do I document a declare for automotive injury?

The method typically comes to reporting the coincidence to the police, documenting the wear, and contacting your insurance coverage corporate. Stay detailed data and apply the particular directions supplied via your insurer.

What reductions are to be had for automotive insurance coverage in Port St. Lucie, FL?

Many reductions are to be had, similar to multi-policy reductions, secure riding incentives, and reductions for positive automobile sorts or options. Ask your insurer concerning the choices to be had to you.