Reasonable automotive insurance coverage in Fortress Lauderdale is a need for drivers navigating the world’s distinctive insurance coverage panorama. Figuring out the criteria influencing premiums, from using data to automobile varieties, is a very powerful for securing probably the most inexpensive coverage. This complete information will stroll you in the course of the technique of discovering the most efficient offers and navigating the complexities of auto insurance coverage in Fortress Lauderdale.

Fortress Lauderdale’s colourful way of life comes with a undeniable price of dwelling, and automotive insurance coverage is not any exception. Top visitors and probably increased twist of fate charges can give a contribution to the associated fee. This information will empower you to check quotes, perceive reductions, and negotiate the most efficient imaginable charges on your wishes.

Advent to Reasonable Automobile Insurance coverage in Fortress Lauderdale

The Fortress Lauderdale automotive insurance coverage marketplace is a dynamic panorama formed through more than a few components, together with the town’s distinctive demographics, visitors patterns, or even the native climate prerequisites. Navigating this marketplace to seek out inexpensive protection calls for cautious attention and comparability. Figuring out the contributing components and the other coverage choices is essential to securing the most efficient imaginable deal.The price of automotive insurance coverage in Fortress Lauderdale, like different spaces, is influenced through numerous parts.

Those components ceaselessly engage, developing a posh image. Using file, automobile sort, or even location throughout the town can all have an effect on premiums. Components reminiscent of twist of fate charges in explicit spaces and the superiority of positive forms of injuries throughout the town additionally give a contribution.

Components Affecting Automobile Insurance coverage Prices in Fortress Lauderdale

A number of key parts affect the price of automotive insurance coverage in Fortress Lauderdale. A motive force’s historical past, together with previous injuries and visitors violations, considerably impacts premiums. A blank using file normally ends up in decrease premiums, whilst a historical past of injuries or violations may end up in increased charges. Moreover, the kind of automobile insured performs a task. Sports activities automobiles or high-performance automobiles ceaselessly have increased premiums than more cost effective fashions because of perceived increased threat of wear and tear or robbery.

Location inside Fortress Lauderdale too can have an effect on charges. Spaces with increased twist of fate charges or explicit visitors patterns would possibly have fairly increased premiums. Finally, coverage possible choices, reminiscent of the extent of protection desired and the deductible decided on, additionally affect the overall top class.

Comparability of Automobile Insurance coverage Coverage Varieties

Choosing the proper automotive insurance plans in Fortress Lauderdale comes to figuring out the various kinds of protection to be had. Other insurance policies be offering various levels of coverage and fiscal safety. This desk illustrates commonplace coverage varieties, their protection, and standard top class levels. It is a very powerful to rigorously overview your wishes and fiscal scenario to make a choice the coverage that perfect aligns together with your cases.

| Coverage Sort | Protection | Top class Vary (Instance) |

|---|---|---|

| Legal responsibility Best | Covers damages you purpose to people’s belongings or accidents to others in an twist of fate. Does now not quilt your personal automobile or clinical bills. | $500-$1500 in line with yr |

| Collision | Covers injury for your automobile without reference to who’s at fault in an twist of fate. | $500-$1500 in line with yr |

| Complete | Covers injury for your automobile from occasions rather then collisions, reminiscent of robbery, vandalism, hail, or fireplace. | $200-$800 in line with yr |

| Uninsured/Underinsured Motorist | Protects you if you’re interested by an twist of fate with a motive force who does now not have insurance coverage or does now not have sufficient insurance coverage to hide the damages. | $100-$400 in line with yr |

| Non-public Harm Coverage (PIP) | Covers clinical bills and misplaced wages for you and your passengers in an twist of fate, without reference to fault. | $100-$400 in line with yr |

| Hole Insurance coverage | Covers the adaptation between the real money price of your automobile and the quantity you continue to owe at the mortgage. Very important if you happen to finance your automobile. | $50-$200 in line with yr |

Figuring out Components Affecting Insurance coverage Premiums

Securing inexpensive automotive insurance coverage in Fortress Lauderdale comes to figuring out the criteria that affect premiums. Those components don’t seem to be arbitrary; they’re in keeping with statistical research of dangers related to other demographics, automobile varieties, and using conduct. Figuring out those parts empowers you to make told selections about your protection and probably scale back your prices.Quite a lot of parts give a contribution to the price of automotive insurance coverage.

Your using file, the kind of automobile you personal, your location inside Fortress Lauderdale, or even the reductions you qualify for play a very powerful roles. By way of spotting those components, you’ll proactively paintings against securing probably the most aggressive charges imaginable.

Using Data and Insurance coverage Prices

Using data are a major factor in figuring out insurance coverage premiums. A blank using file, characterised through a historical past of secure using practices, generally interprets to decrease premiums. Conversely, injuries, visitors violations, or transferring violations build up your threat profile, main to raised premiums. Insurance coverage corporations analyze your using historical past to evaluate your probability of long term claims. As an example, a motive force with a historical past of rushing tickets or injuries will most likely face increased premiums than a motive force with a blank file.

Car Sort and Style in Insurance coverage Premiums

The sort and type of your automobile considerably affect your insurance coverage top class. Positive automobiles are extra liable to robbery, injury, or injuries. That is mirrored in increased insurance coverage premiums for those fashions. Sports activities automobiles, luxurious automobiles, and high-performance automobiles normally include increased premiums because of their perceived increased threat of wear and tear and robbery. Conversely, elementary, usual automobiles ceaselessly have decrease premiums.

The price of the automobile additionally performs an element, as higher-value automobiles will generally price extra to insure.

Location Inside of Fortress Lauderdale and Insurance coverage Charges

Location inside Fortress Lauderdale can have an effect on insurance coverage charges. Spaces with increased crime charges or a better frequency of injuries have a tendency to have increased insurance coverage premiums. It is because insurance coverage corporations wish to issue within the greater threat related to the ones spaces. In Fortress Lauderdale, some neighborhoods would possibly have increased charges in comparison to others. Insurance coverage corporations use information on reported incidents, twist of fate statistics, and different components to evaluate the chance of insuring automobiles in numerous spaces of the town.

Commonplace Reductions Presented through Insurance coverage Suppliers in Fortress Lauderdale

Insurance coverage suppliers in Fortress Lauderdale ceaselessly be offering more than a few reductions to incentivize shoppers to make a choice their services and products. Those reductions ceaselessly quilt a variety of things, reminiscent of excellent using conduct, security features in your automobile, or even your age or occupation. By way of figuring out the to be had reductions and assembly the eligibility standards, you’ll ceaselessly scale back your insurance coverage prices.

Conventional Reductions and Prerequisites

| Bargain Sort | Prerequisites | Financial savings Doable |

|---|---|---|

| Defensive Using Path Of completion | Of completion of a licensed defensive using route | Doubtlessly 10-20% or extra |

| More than one Car Bargain | Insuring a couple of automobiles with the similar corporate | Doubtlessly 5-15% or extra |

| Excellent Scholar Bargain | Keeping up a excellent educational status whilst enrolled at school | Doubtlessly 5-15% or extra |

Methods for Discovering Reasonable Automobile Insurance coverage

Securing inexpensive automotive insurance coverage in Fortress Lauderdale calls for a strategic method. Figuring out the marketplace dynamics and using efficient comparability ways is a very powerful to discovering the most efficient imaginable charges. This phase delves into sensible methods for attaining that purpose.Discovering the precise automotive insurance coverage supplier comes to a multifaceted procedure. From evaluating quotes to figuring out coverage specifics, every step performs an important position in securing probably the most aggressive charges.

Evaluating Insurance coverage Quotes

A scientific option to evaluating quotes is very important for locating the most efficient deal. Start through collecting details about more than a few insurance coverage suppliers within the Fortress Lauderdale house. This contains researching corporations that provide aggressive charges and feature a powerful recognition for customer support. Use on-line comparability gear to streamline the method, coming into related information about your automobile, using historical past, and protection wishes.

The use of On-line Comparability Gear Successfully

On-line comparability gear are priceless assets for locating reasonable automotive insurance coverage. Those platforms let you enter your individual data and obtain quotes from a couple of insurers concurrently. This potency saves effort and time in comparison to contacting every supplier personally. When the use of those gear, make sure that accuracy in offering main points, as erroneous data may end up in erroneous quotes. Take note of the particular standards utilized by every software and tailor your searches accordingly to acquire related effects.

Advantages of Bundling Insurance coverage Insurance policies

Bundling insurance coverage insurance policies, reminiscent of combining automotive insurance coverage with house or renters insurance coverage, ceaselessly leads to discounted charges. This can be a commonplace technique hired through insurance coverage suppliers to praise shoppers who make a selection a couple of services and products. The cut price quantity varies in keeping with the insurer and the particular insurance policies being bundled.

Studying the Fantastic Print of Insurance coverage Insurance policies

In moderation reviewing the effective print of insurance coverage insurance policies is a very powerful. This comes to figuring out the phrases and prerequisites, exclusions, and boundaries of the protection. Do not merely settle for the preliminary be offering; totally assessment the coverage record to keep away from any ugly surprises later. Paying shut consideration to main points reminiscent of deductibles, protection limits, and coverage exclusions is important. Search rationalization on any clauses which can be unclear.

Commonplace Insurance coverage Coverage Phrases

| Time period | Definition | Instance |

|---|---|---|

| Deductible | The volume you pay out-of-pocket ahead of your insurance coverage corporate starts paying for damages. | A $500 deductible on a collision declare manner you pay $500 ahead of the insurance coverage covers the rest prices. |

| Top class | The common rate you pay on your insurance plans. | Per month bills for automotive insurance coverage are the top class. |

| Protection Limits | The utmost quantity the insurance coverage corporate pays for a lined loss. | A $100,000 legal responsibility protection prohibit manner the insurance coverage pays as much as $100,000 to hide damages brought about through an twist of fate. |

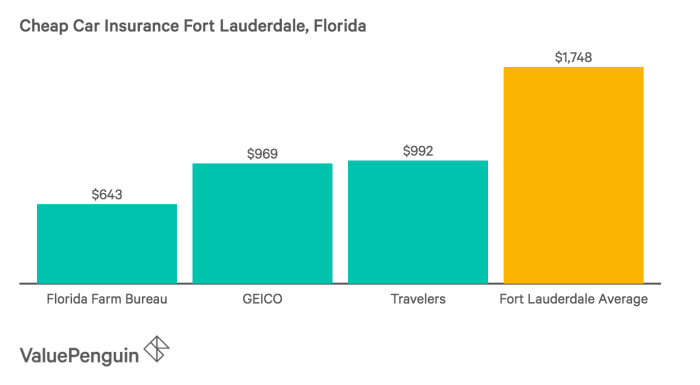

Insurance coverage Suppliers in Fortress Lauderdale

Discovering the precise automotive insurance coverage supplier in Fortress Lauderdale is a very powerful for securing inexpensive protection and peace of thoughts. This comes to figuring out the recognition and fiscal steadiness of various corporations, in addition to evaluating their services and products and contours. Opting for a credible supplier with a powerful monetary status guarantees your claims shall be treated successfully and successfully.Fortress Lauderdale’s various using inhabitants and sundry wishes necessitate a wide array of insurance coverage choices.

Other suppliers cater to other using profiles, reminiscent of younger drivers, the ones with explicit using histories, or the ones in the hunt for further protection choices. Figuring out the strengths and weaknesses of every supplier can empower you to make an educated determination.

Respected Insurance coverage Corporations in Fortress Lauderdale

A number of respected insurance coverage corporations perform in Fortress Lauderdale, providing a variety of insurance policies and services and products. Those corporations have established observe data, demonstrating monetary power and dedication to buyer delight.

- State Farm: A well-established nationwide logo, State Farm enjoys a forged recognition for its intensive community of brokers and readily to be had buyer improve. Their robust monetary status guarantees well timed declare processing. They ceaselessly be offering bundled reductions, combining automotive insurance coverage with different services and products like house insurance coverage.

- Geico: Identified for its aggressive pricing and wide selection of protection choices, Geico ceaselessly goals more youthful drivers and the ones with explicit wishes. Geico’s digital-first method provides comfort, even though customer support interactions might range. Their monetary power is constantly assessed and reported definitely.

- Innovative: A big, nationwide supplier, Innovative ceaselessly provides reductions for secure using and accident-free data. Their on-line platform permits for simple coverage control and quotes. Innovative’s customer support is well-regarded for its potency.

- Allstate: Some other primary participant within the insurance coverage marketplace, Allstate maintains a popular presence in Fortress Lauderdale. Their customer support community, whilst from time to time perceived as much less responsive than some competition, ceaselessly provides a much wider vary of coverage possible choices, specifically for specialised wishes.

- Farmers Insurance coverage: Identified for its native presence and customized provider, Farmers Insurance coverage is well-liked by shoppers in the hunt for complete and adapted insurance coverage answers. Their monetary power is constantly demonstrated thru their operational steadiness and declare processing potency.

Monetary Steadiness and Popularity Research

Insurance coverage corporations’ monetary power is a vital issue. Robust monetary scores from unbiased businesses like A.M. Highest, Usual & Deficient’s, and Moody’s are signs of an organization’s skill to maintain claims and take care of monetary solvency. A powerful monetary place assures shoppers that says shall be processed slightly and promptly. An organization’s recognition could also be a key indicator, derived from buyer critiques and business research.

Comparability of Services and products and Options

Insurance coverage suppliers range of their provider choices. Some focal point on electronic platforms, whilst others prioritize in-person interactions. The variability of add-on coverages, reminiscent of roadside help, condominium automotive protection, or complete injury coverage, varies as effectively. The provision of specialised services and products for explicit wishes (like explicit automobile varieties or using conduct) will have to even be thought to be.

Buyer Evaluations and Rankings

The next desk supplies an outline of purchaser critiques and scores for make a choice insurance coverage corporations in Fortress Lauderdale. Notice that buyer delight scores can range, so it’s smart to believe a couple of resources and views.

Pointers for Negotiating Decrease Charges

Securing inexpensive automotive insurance coverage in Fortress Lauderdale ceaselessly comes to extra than simply evaluating quotes. Proactive verbal exchange and strategic negotiation can considerably affect your premiums. Figuring out the criteria insurers believe and using efficient negotiation ways empowers you to probably decrease your charges.Negotiation is not about arguing; it is about presenting a compelling case that aligns together with your wishes and cases. By way of figuring out the insurance coverage supplier’s point of view and highlighting your favorable attributes, you build up your possibilities of securing a decrease top class.

Figuring out Insurance coverage Supplier Views

Insurance coverage corporations assess threat components to decide premiums. Components like your using file, automobile sort, and placement all play a task. Insurers need to establish low-risk shoppers to reduce their monetary liabilities. A powerful figuring out of your personal profile and the way it aligns with the insurance coverage corporate’s threat overview may also be wonderful all over negotiation. A blank using file, a secure automobile, and a accountable way of life all translate to a decrease threat profile.

Speaking Your Wishes Successfully

Transparent verbal exchange is paramount in any negotiation. Articulating your wishes and cases at once and concisely demonstrates your dedication to discovering an answer that works for each events. Obviously mentioning your willingness to take steps to cut back your threat profile (e.g., keeping up a excellent using file) is usually a tough software. Being ready to speak about any mitigating components or fresh enhancements on your using conduct is essential.

As an example, if you happen to’ve not too long ago finished a defensive using route, emphasize this to the insurance coverage supplier.

Efficient Negotiation Tactics

Using efficient negotiation ways can build up your possibilities of securing a decrease price. Be ready to speak about any reductions it’s possible you’ll qualify for, reminiscent of the ones presented for secure using or for keeping up a undeniable credit score rating. Figuring out the present marketplace charges and researching identical insurance coverage insurance policies presented through competition can give a powerful foundation for negotiation. In case you have a historical past of paying your premiums on time, emphasize this consistency.

Highlighting your sure using file and any further protection measures taken too can support your place.

Instance Negotiation Situations

Consider a motive force with a blank using file who not too long ago upgraded to a more recent, more secure automobile. On this state of affairs, they might spotlight their secure using historical past and the automobile’s enhanced security features. This mix of things suggests a decrease threat profile and gives a powerful argument for a discounted top class. A motive force who has persistently maintained a low twist of fate frequency and paid premiums promptly can successfully use this observe file to suggest for a decrease price.

Abstract of Negotiation Issues, Reasonable automotive insurance coverage in citadel lauderdale

| Negotiation Level | Technique | Instance |

|---|---|---|

| Figuring out Chance Components | Acknowledge and articulate your favorable attributes (e.g., secure using file, more recent automobile). | Highlighting a blank using file, defensive using lessons, and a contemporary automobile improve. |

| Transparent Communique | Articulate your wishes and cases at once. | Obviously state your dedication to keeping up a secure using file and constant top class bills. |

| Marketplace Analysis | Analysis present marketplace charges and competitor insurance policies. | Evaluating quotes from other insurance coverage suppliers to know the existing marketplace charges. |

Figuring out Protection Choices

Choosing the proper automotive insurance plans is a very powerful for safeguarding your self and your automobile. Figuring out the other choices to be had and their implications is secret to meaking told selections. Other coverages be offering various levels of coverage, impacting each your monetary accountability and the reassurance you revel in at the street.Complete and collision protection are two number one choices, however more than a few different coverages, reminiscent of legal responsibility, uninsured/underinsured motorist, and clinical bills, additional support your coverage.

Figuring out the nuances of every protection is very important to choosing a coverage that aligns together with your wishes and finances.

Other Protection Choices To be had

Quite a lot of protection choices are to be had for automotive insurance coverage, every designed to handle explicit dangers. Legal responsibility protection is obligatory in maximum states, protective you from monetary accountability if you happen to purpose an twist of fate. Uninsured/underinsured motorist protection steps in if the at-fault motive force is uninsured or underinsured, safeguarding you from important monetary losses. Clinical bills protection addresses the clinical bills of the ones interested by an twist of fate, without reference to fault.

Complete protection protects in opposition to injury for your automobile from occasions rather then collisions, reminiscent of climate occasions, vandalism, or robbery. Collision protection, alternatively, covers injury for your automobile attributable to a collision, without reference to fault.

Implications of Each and every Protection Sort

Legal responsibility protection, ceaselessly the minimal required through legislation, protects you from monetary accountability if you are at fault in an twist of fate. Uninsured/underinsured motorist protection fills an opening in coverage if the opposite motive force is not adequately insured. Clinical bills protection addresses the clinical bills of twist of fate sufferers, without reference to fault. Complete protection is essential for safeguarding your automobile from non-collision injury, whilst collision protection safeguards your automobile in opposition to injury from collisions.

Figuring out the specifics of every protection sort is a very powerful to be sure that your coverage adequately protects your pursuits.

Complete vs. Collision Protection

Complete and collision protection are each necessary however deal with various kinds of injury. Complete protection protects your automobile in opposition to injury from occasions rather then collisions, reminiscent of vandalism, hail, fireplace, or robbery. Collision protection, conversely, covers injury for your automobile attributable to a collision, without reference to who’s at fault. A key distinction lies in the reason for the wear.

Complete protection addresses exterior, non-collision injury, whilst collision protection specializes in injury at once associated with a crash.

Examples of Scenarios The place Explicit Coverages Would Be Really helpful

A state of affairs the place complete protection is really useful is that if your automotive is broken through a falling tree all over a typhoon. This kind of injury, now not associated with a collision, is roofed through complete protection. Conversely, if you are interested by a fender bender, collision protection pays for the upkeep. Moreover, if a hit-and-run motive force damages your automobile, each complete and collision coverages may also be really useful, relying at the nature of the wear.

Protection Choices Comparability Desk

| Protection Sort | Description | Value |

|---|---|---|

| Legal responsibility | Protects you from monetary accountability if you happen to purpose an twist of fate. | Usually, the bottom price. |

| Complete | Covers injury for your automobile from occasions rather then collisions (e.g., vandalism, climate). | Variable, depends upon automobile sort and coverage. |

| Collision | Covers injury for your automobile in a collision, without reference to fault. | Variable, depends upon automobile sort and coverage. |

| Uninsured/Underinsured Motorist | Protects you if the at-fault motive force is uninsured or underinsured. | Variable, depends upon coverage and state necessities. |

| Clinical Bills | Covers clinical bills for the ones interested by an twist of fate, without reference to fault. | Variable, depends upon coverage and protection limits. |

Reviewing and Opting for the Proper Coverage

In moderation reviewing your automotive insurance plans is a very powerful to making sure you are adequately safe and keeping off expensive surprises down the street. It is not near to getting the bottom value; it is about figuring out the particular phrases and prerequisites that govern your protection. An intensive assessment permits you to establish possible gaps in coverage and make told selections about the precise coverage on your wishes.

Significance of Thorough Coverage Evaluation

A complete assessment of your automotive insurance plans is very important to figuring out the entire scope of your protection. This contains figuring out any possible boundaries or exclusions that will not be straight away obvious. Failing to entirely assessment the coverage may end up in important monetary penalties if a declare is denied because of an unexpected exclusion. Moreover, figuring out your coverage is helping you proactively deal with possible dangers and customise your protection for explicit scenarios, like greater mileage or using conduct.

Key Components to Glance For in a Coverage

A number of vital parts will have to be scrutinized when reviewing your automotive insurance plans. Those come with the coverage’s definition of lined perils, the specifics of legal responsibility protection, the level of complete and collision protection, and any deductibles or limits. Figuring out the precise main points of your protection guarantees that your coverage aligns together with your monetary expectancies and using wishes. As an example, a coverage with a excessive deductible would possibly prevent cash on premiums, however it additionally manner you can endure a bigger monetary burden within the match of an twist of fate.

Commonplace Coverage Exclusions

Insurance coverage insurance policies ceaselessly include exclusions that prohibit protection. Those exclusions can range considerably between insurers and insurance policies, and a cautious assessment is essential. Commonplace exclusions come with injury brought about through put on and tear, pre-existing injury to the automobile, injury brought about through negligence or intentional acts, or injury attributable to explicit occasions like battle or nuclear incidents. You must perceive those boundaries to keep away from possible disputes when submitting a declare.

A very powerful Coverage Provisions

| Coverage Provision | Description | Affect |

|---|---|---|

| Protection Limits | Specifies the utmost quantity the insurer pays for a declare. | Exceeding those limits can lead to underpayment for injury. |

| Deductibles | The volume you pay out-of-pocket ahead of the insurance coverage corporate covers the declare. | Decrease deductibles imply increased premiums, whilst increased deductibles imply decrease premiums however larger out-of-pocket bills. |

| Exclusions | Explicit scenarios or occasions that don’t seem to be lined beneath the coverage. | Figuring out exclusions is a very powerful to keep away from claims being denied because of excluded cases. |

| Coverage Length | The length for which the coverage stays energetic. | Guarantees protection is legitimate for the supposed time frame. |

| Coverage Territory | Specifies the geographic house the place the coverage supplies protection. | A very powerful for drivers who commute ceaselessly or go state strains. |

Figuring out those coverage provisions empowers you to make told possible choices and make sure your automotive insurance plans aligns together with your wishes and cases.

Ultimate Ideas

In conclusion, securing inexpensive automotive insurance coverage in Fortress Lauderdale calls for a proactive method. By way of figuring out the criteria that affect premiums, using comparability gear, and exploring negotiation methods, you’ll considerably scale back your insurance coverage prices. Take into accout, a well-informed client is a savvy client, and this information supplies the gear you want to seek out the most efficient automotive insurance plans adapted for your explicit wishes in Fortress Lauderdale.

FAQ Information

What are the commonest reductions presented through insurance coverage suppliers in Fortress Lauderdale?

Many suppliers be offering reductions for secure using data, a couple of coverage bundling, and for putting in anti-theft gadgets. Explicit reductions and their phrases range between suppliers.

How does my using file have an effect on my automotive insurance coverage premiums in Fortress Lauderdale?

A blank using file normally leads to decrease premiums. Injuries and violations will build up your premiums considerably.

Are there explicit spaces inside Fortress Lauderdale with increased insurance coverage charges?

Spaces with increased visitors density or twist of fate charges could have fairly increased insurance coverage charges than different places throughout the town.

What are some on-line comparability gear I will be able to use to seek out reasonable automotive insurance coverage in Fortress Lauderdale?

A number of web pages specialise in evaluating automotive insurance coverage quotes. The use of those gear permit you to in finding probably the most aggressive charges.