Reasonable automotive insurance coverage Waco TX is a very powerful for drivers on this area. Working out the marketplace, figuring out inexpensive suppliers, and realizing the criteria affecting prices is essential to securing the most productive deal. This information supplies actionable methods, main points on protection choices, and treasured pointers to economize in your insurance coverage premiums. Liberate the secrets and techniques to securing the most productive imaginable charges in Waco, TX.

The Waco, TX automotive insurance coverage marketplace items a various panorama of suppliers and insurance policies. This complete information will can help you navigate the choices and to find essentially the most appropriate protection in your wishes and funds. Examine pricing fashions, discover reductions, and achieve perception into the criteria influencing your premiums.

Assessment of Reasonable Automotive Insurance coverage in Waco, TX

The auto insurance coverage marketplace in Waco, TX, like different spaces, is pushed by means of components influencing premiums. Working out those components and to be had reductions can assist drivers to find extra inexpensive protection. Festival amongst insurers performs a task in shaping the whole charge construction.

Automotive Insurance coverage Prices in Waco, TX, Reasonable automotive insurance coverage waco tx

Automotive insurance coverage premiums in Waco, TX, in most cases fall inside a spread similar to the state reasonable. Diversifications exist in response to particular person riding information, car sorts, and selected protection ranges. Components reminiscent of age, gender, and placement inside Waco too can rather impact charges.

Components Influencing Automotive Insurance coverage Charges

A number of components give a contribution to the price of automotive insurance coverage in Waco, TX. Riding file, together with injuries and site visitors violations, is an important determinant. Car sort and fashion additionally impact charges, with high-performance or luxurious cars frequently wearing upper premiums because of perceived chance. Protection alternatives, reminiscent of liability-only as opposed to complete protection, considerably affect the whole charge.

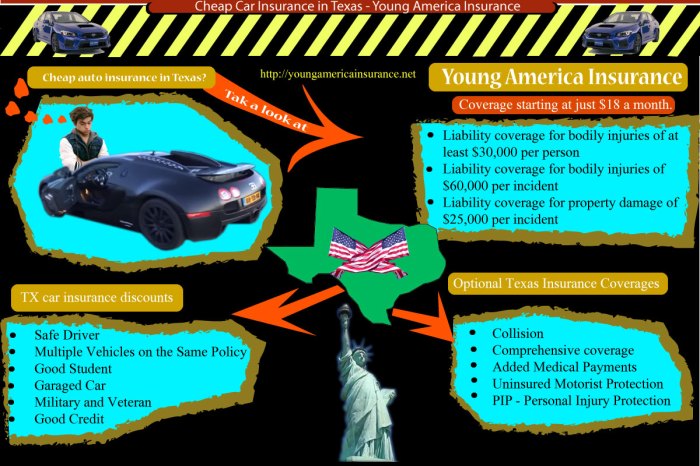

Reductions To be had to Waco Drivers

More than a few reductions are to be had to scale back automotive insurance coverage premiums in Waco. Protected riding reductions, reminiscent of accident-free riding information, are not unusual. Bundling insurance coverage insurance policies (e.g., automotive and residential insurance coverage) too can result in reductions. Scholars enrolled in licensed motive force education schemes would possibly qualify for reductions. Those reductions are introduced by means of other insurance coverage suppliers to inspire protected riding practices and coverage bundling.

Comparability of Insurance coverage Suppliers in Waco, TX

| Insurance coverage Supplier | Pricing Fashion | Conventional Reductions |

|---|---|---|

| State Farm | In most cases gives aggressive charges, frequently incorporating components like credit score ratings and riding historical past into their pricing fashions. | Protected motive force reductions, multi-policy reductions, and reductions for particular car sorts. |

| Modern | Identified for its usage-based insurance coverage methods, which modify premiums in response to exact riding conduct. | Excellent scholar reductions, multi-policy reductions, and reductions for particular car sorts. |

| Allstate | Most often gives aggressive pricing, making an allowance for components like car utilization and placement inside Waco. | Protected motive force reductions, multi-policy reductions, and reductions for particular car sorts. |

| Geico | Incessantly makes use of a mix of things like riding file and car sort to set premiums. | Multi-policy reductions, reductions for protected riding behavior, and particular car reductions. |

| USAA | Normally supplies aggressive charges for army individuals and their households. | Reductions for army individuals, multi-policy reductions, and protected motive force reductions. |

This desk supplies a normal evaluate. Explicit pricing fashions and reductions can range in response to particular person cases and the selected coverage. The desk showcases the overall pricing construction and cut price choices for a choice of primary insurance coverage suppliers.

Figuring out Reasonably priced Insurance coverage Suppliers

Figuring out inexpensive automotive insurance coverage suppliers in Waco, TX calls for a strategic means that considers more than one components. Comparative research of more than a few insurers and their products and services is a very powerful for making knowledgeable selections. This comes to comparing now not solely worth but in addition the breadth of protection, customer support recognition, and monetary balance of every corporate. Working out the native marketplace context is very important on this procedure.Comparative research of insurance coverage suppliers is very important for acquiring essentially the most appropriate protection at a aggressive worth.

This procedure comes to comparing more than a few suppliers in response to a spread of standards, together with protection choices, pricing constructions, and customer support opinions. A complete way to discovering inexpensive insurance coverage comes to comparing various factors past simply worth, such because the scope of protection and the supplier’s total recognition.

Insurance coverage Corporations Identified for Aggressive Pricing in Waco, TX

A number of insurance coverage corporations constantly show aggressive pricing in Waco, TX. Those corporations frequently leverage more than a few components to succeed in aggressive charges, reminiscent of usage-based insurance coverage methods, chance evaluate fashions, and particular reductions adapted to the native marketplace. Components influencing insurance coverage premiums in Waco, TX, are numerous and require an intensive research to decide the most productive choices.

Comparability of Products and services Presented by means of More than a few Corporations in Waco, TX

Other insurance coverage suppliers in Waco, TX, be offering various ranges of protection and products and services. Some corporations would possibly concentrate on particular forms of protection, reminiscent of twist of fate advantages or complete protection. Others would possibly supply further products and services, like roadside help or car repairs reductions, that may considerably affect the whole charge and price proposition of the coverage. Every corporate’s distinctive carrier package deal must be thought to be when comparing their suitability for particular person wishes.

Popularity of Corporations Referring to Buyer Provider in Waco, TX

Customer support recognition performs a a very powerful function within the variety procedure. Insurers with a historical past of certain interactions with consumers in Waco, TX, show a dedication to resolving claims successfully and addressing policyholder issues successfully. A competent supplier with a powerful customer support file is very important for a favorable enjoy all over the insurance coverage lifecycle.

Desk of Moderate Charges in Waco, TX

The desk underneath supplies an illustrative evaluate of reasonable charges for various protection sorts from more than a few insurance coverage suppliers in Waco, TX. Those charges are indicative and must be verified with every supplier. Exact charges would possibly range in response to particular person cases and riding historical past.

| Insurance coverage Supplier | Legal responsibility Protection (in step with twist of fate) | Collision Protection (in step with twist of fate) | Complete Protection (in step with twist of fate) |

|---|---|---|---|

| State Farm | $1,200 | $1,500 | $1,000 |

| Modern | $1,000 | $1,300 | $800 |

| Geico | $900 | $1,200 | $750 |

| Allstate | $1,100 | $1,400 | $900 |

| Farmers Insurance coverage | $1,050 | $1,350 | $850 |

Significance of Evaluating Quotes from A couple of Suppliers

Evaluating quotes from more than one insurance coverage suppliers is very important for reaching essentially the most aggressive worth in Waco, TX. This tradition guarantees policyholders get right of entry to the most productive imaginable charges and protection adapted to their particular wishes. This means avoids the opportunity of overpaying for insurance policy, a not unusual prevalence with out thorough comparability. A scientific comparability throughout more than a few suppliers is a important element in acquiring essentially the most inexpensive and suitable protection.

Components Affecting Automotive Insurance coverage Prices in Waco, TX

Auto insurance coverage premiums in Waco, TX, like different areas, are influenced by means of a lot of components. Working out those parts is a very powerful for shoppers looking for inexpensive protection. Insurance coverage corporations use actuarial knowledge and statistical fashions to evaluate chance and decide suitable top rate ranges.

Have an effect on of Riding Report on Automotive Insurance coverage Premiums

Riding historical past is an important determinant of vehicle insurance coverage charges. A blank riding file, freed from injuries and site visitors violations, in most cases interprets to decrease premiums. Conversely, a historical past of injuries or violations, in particular critical ones, results in upper premiums. This displays the higher chance related to drivers with a historical past of injuries or violations. Insurance coverage corporations assess the frequency and severity of incidents to decide the possibility of long term claims.

Function of Car Sort and Fashion in Figuring out Insurance coverage Prices

The sort and fashion of a car play a important function in insurance coverage premiums. Prime-performance or luxurious cars frequently include upper insurance coverage prices. It’s because those cars have a tendency to be costlier to fix or substitute in case of an twist of fate. Additionally, the insurance coverage corporate would possibly imagine components such because the car’s make, fashion, yr, and security measures in figuring out the top rate.

As an example, cars with complicated security measures, reminiscent of airbags and anti-lock brakes, can have decrease premiums. Insurance coverage corporations weigh the possible loss and service prices when surroundings the premiums.

Comparability of Insurance coverage Prices In response to Age and Gender

Age and gender also are correlated with automotive insurance coverage prices. More youthful drivers in most cases pay upper premiums than older drivers. That is frequently attributed to statistically upper twist of fate charges amongst more youthful drivers. Moreover, gender variations in insurance coverage prices would possibly exist in some areas, however the pattern is in most cases in keeping with twist of fate statistics. Insurance coverage corporations have seen that positive demographics have a better propensity for injuries.

Elaboration at the Results of Location and Riding Conduct on Insurance coverage Prices

Location and riding behavior considerably impact automotive insurance coverage premiums. Spaces with upper twist of fate charges or a better focus of dangerous riding behaviors generally tend to have upper insurance coverage prices. In a similar fashion, drivers who show protected riding behavior, reminiscent of constant use of seatbelts or heading off dangerous riding eventualities, would possibly qualify for decrease premiums. For example, rural spaces with decrease site visitors volumes can have decrease insurance coverage prices in comparison to city spaces.

Insurance coverage corporations additionally imagine native site visitors patterns and street stipulations when calculating premiums.

Components Influencing Automotive Insurance coverage Charges in Waco, TX

| Issue | Have an effect on on Charges | Instance |

|---|---|---|

| Riding Report | Blank information lead to decrease charges; injuries and violations building up charges. | A motive force with more than one dashing tickets pays greater than a motive force and not using a violations. |

| Car Sort | Prime-performance or luxurious cars in most cases have upper charges because of higher restore prices. | A sports activities automotive will most likely have upper charges than a compact sedan. |

| Age and Gender | More youthful drivers in most cases pay greater than older drivers; gender variations would possibly exist. | A 16-year-old motive force pays greater than a 30-year-old motive force. |

| Location | Spaces with upper twist of fate charges or dangerous riding behaviors have upper charges. | Insurance coverage charges in a high traffic city space might be upper than in a rural space. |

| Riding Conduct | Protected riding behavior, reminiscent of constant seatbelt use, can decrease charges. | A motive force who steadily drives defensively will most likely pay not up to a motive force who engages in dangerous riding behaviors. |

Methods for Securing Reasonable Insurance coverage

Securing inexpensive automotive insurance coverage in Waco, TX, calls for a proactive means. More than a few methods can considerably have an effect on premiums. Working out those methods empowers folks to make knowledgeable selections and optimize their protection.

Evaluating Quotes from Other Suppliers

Complete comparability of quotes from more than one insurance coverage suppliers is a very powerful for acquiring essentially the most aggressive charges. This procedure comes to accumulating quotes from other insurers, comparing protection choices, and examining coverage phrases. Insurance coverage corporations frequently modify their pricing fashions in response to components like riding historical past, car sort, and protection choices. Thorough comparability guarantees you might be now not overpaying for a similar protection.

Bundling Insurance coverage Insurance policies

Bundling more than one insurance coverage insurance policies, reminiscent of automotive insurance coverage and residential insurance coverage, with the similar supplier, can frequently lead to discounted charges. This technique leverages the primary of economies of scale. Insurers frequently praise purchasers who care for more than one insurance policies with a supplier thru a bundled cut price. This means can result in really extensive financial savings.

The use of On-line Comparability Gear

On-line comparability gear supply a streamlined way for evaluating automotive insurance coverage quotes from more than a few suppliers in Waco, TX. Those gear frequently combine with more than one insurance coverage suppliers’ methods, permitting customers to get right of entry to a large number of quotes unexpectedly. This era allows environment friendly research of various choices and is helping establish essentially the most favorable pricing constructions. Examples come with Insurify, Policygenius, and Examine.com.

Keeping up a Excellent Riding Report

Keeping up a blank riding file is very important for securing favorable insurance coverage charges. Insurance coverage corporations assess riding historical past to decide chance profiles. A blank file demonstrates accountable riding conduct, leading to lowered premiums. Examples come with heading off site visitors violations, reminiscent of dashing tickets, or keeping up a low twist of fate historical past. Insurance coverage corporations frequently be offering reductions for drivers with accident-free information.

Settling on Suitable Protection

Settling on suitable protection is paramount to balancing coverage with affordability. Working out protection sorts, reminiscent of legal responsibility, collision, and complete, is very important. Adjusting protection ranges to compare particular person wishes and monetary constraints lets in for tailoring insurance policy. As an example, a tender motive force would possibly prioritize legal responsibility protection to start with and progressively building up protection as their monetary state of affairs improves. Opting for the right kind protection stage in your car and private cases can result in charge financial savings with out compromising coverage.

Working out Insurance coverage Protection Choices: Reasonable Automotive Insurance coverage Waco Tx

Auto insurance policy choices in Waco, TX, are designed to give protection to policyholders from monetary losses related to car injury or legal responsibility claims. Working out the more than a few forms of protection to be had is a very powerful for making knowledgeable selections and making sure ok coverage. Other coverages cater to distinct dangers, and the choice relies on particular person wishes and cases.

Complete and Collision Protection

Complete protection protects in opposition to injury to a car led to by means of perils rather than collision or overturn. Those perils can come with fireplace, vandalism, robbery, hail, and climate occasions. Collision protection, however, covers injury because of a collision with some other car or object. In Waco, TX, each are essential. A complete coverage is helping mitigate monetary dangers from unexpected occasions that won’t contain some other car.

Collision protection protects in opposition to losses because of injuries the place the policyholder is at fault or is keen on a collision with some other car. Failure to hold ok complete and collision protection can lead to really extensive out-of-pocket bills for upkeep or replacements.

Legal responsibility Insurance coverage

Legal responsibility insurance coverage is obligatory in Waco, TX, and covers damages to someone else or their belongings because of an twist of fate involving the insured car. It protects the policyholder from monetary accountability in the event that they motive an twist of fate that results in accidents or belongings injury to others. The coverage will pay for scientific expenses, misplaced wages, and belongings injury, as much as the coverage limits.

Upper legal responsibility limits supply better monetary coverage for the ones keen on injuries.

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist protection is a very powerful in Waco, TX, as it protects the policyholder and their passengers if keen on an twist of fate with a motive force who’s uninsured or underinsured. This protection compensates for accidents and damages if the at-fault motive force does now not have enough insurance coverage to hide the losses. This protection supplies crucial protection internet in eventualities the place the at-fault motive force is uninsured or underinsured, mitigating possible monetary hardship.

Upload-on Coverages

A large number of add-on coverages are to be had, bettering the fundamental coverage. Those can come with apartment compensation, which covers the price of a apartment car whilst the insured car is being repaired. Hole insurance coverage covers the adaptation between the true money price of a car and the exceptional mortgage steadiness in case of a complete loss. Different add-ons, like roadside help, supply make stronger for problems like flat tires or lifeless batteries.

The price of those add-ons varies considerably in response to the particular protection and the coverage limits.

Desk of Insurance coverage Protection Choices and Prices

| Protection Sort | Description | Conventional Price Vary in Waco, TX (Instance) |

|---|---|---|

| Complete | Covers injury from perils rather than collision or overturn. | $100-$500 yearly |

| Collision | Covers injury from a collision with some other car or object. | $150-$700 yearly |

| Legal responsibility | Covers damages to others in case of an twist of fate. | $50-$300 yearly |

| Uninsured/Underinsured Motorist | Protects in opposition to injuries involving uninsured or underinsured drivers. | $50-$250 yearly |

| Apartment Repayment | Covers apartment car prices all through upkeep. | $25-$100 yearly |

| Hole Insurance coverage | Covers the adaptation between car price and mortgage steadiness in a complete loss. | $25-$150 yearly |

Word: Prices are examples and will range considerably in response to components like car sort, riding file, and protection limits. Seek advice from an insurance coverage agent for personalised charge estimates.

Pointers for Saving Cash on Automotive Insurance coverage

Optimizing riding behavior and insurance coverage alternatives are key methods for lowering automotive insurance coverage premiums in Waco, TX. Imposing those methods can result in vital charge financial savings through the years, taking into consideration higher monetary control.

Making improvements to Riding Report

Keeping up a blank riding file is paramount to securing decrease automotive insurance coverage premiums. Injuries and site visitors violations immediately have an effect on insurance coverage charges. Fending off injuries and adhering to site visitors rules are a very powerful for a positive riding file. Riding defensively, expecting possible hazards, and keeping up protected following distances can assist save you injuries. Incessantly reviewing native site visitors rules and rules can additional give a contribution to protected riding practices.

The avoidance of dashing tickets and reckless riding behaviors is very important. The frequency of site visitors violations and their severity each affect top rate calculations.

Keeping up a Protected Riding Surroundings

A protected riding surroundings is a very powerful for minimizing the danger of injuries. Common car repairs is essential in combating mechanical screw ups. Making sure right kind tire force, functioning brakes, and well-maintained lighting can considerably cut back the possibility of injuries. Car repairs information is usually a really useful think about acquiring favorable insurance coverage charges. A proactive way to car repairs is significant to verify protection and decrease insurance coverage prices.

Environmental components, like street stipulations, climate, and site visitors, can affect the danger of injuries. Working out and adjusting riding behaviors accordingly can assist mitigate possible dangers.

Opting for Suitable Protection Ranges

Working out protection wishes is a very powerful for settling on suitable insurance coverage choices with out overpaying. Complete protection supplies coverage in opposition to damages past collisions, reminiscent of robbery, vandalism, or weather-related occasions. Legal responsibility protection safeguards in opposition to monetary accountability within the tournament of inflicting an twist of fate that leads to damages to someone else or belongings. The choice of suitable protection ranges relies on particular person cases, together with the worth of the car and private monetary assets.

The protection ranges must be aligned with the person’s monetary capability to soak up possible losses and the hazards related to the car. Comparing the desire for collision protection, relying at the car’s situation and the driving force’s chance profile, can assist decide the optimum protection stage.

Paying Premiums on Time

Suggested cost of premiums is significant for keeping up insurance policy and heading off consequences. Overdue or ignored bills can result in suspension or cancellation of protection, expanding the complexity and value of acquiring insurance coverage one day. Keeping up a constant cost agenda, both thru automated bills or surroundings reminders, can assist steer clear of overdue bills. This self-discipline guarantees uninterrupted protection and is helping care for a positive insurance coverage historical past.

Constant top rate bills show accountable monetary control, which is able to undoubtedly affect long term top rate calculations.

Further Tactics to Save on Automotive Insurance coverage

- Bundling Insurance coverage Merchandise: Combining automotive insurance coverage with different insurance coverage merchandise, reminiscent of householders or renters insurance coverage, frequently leads to discounted premiums. This technique leverages the primary of economies of scale and may give really extensive charge financial savings. Insurance coverage corporations would possibly be offering bundled reductions for patrons with more than one insurance policies.

- Reductions for Protected Riding Techniques: Collaborating in protected riding methods can earn really extensive reductions. Those methods frequently require of entirety of classes and/or repairs of a blank riding file, demonstrating a dedication to protected riding practices. Those methods can considerably decrease insurance coverage prices.

- Reductions for Excellent Scholars or Seniors: Reductions could also be to be had for college students with just right educational information or senior drivers with a blank riding file and a historical past of protected riding. Insurance coverage corporations frequently acknowledge and praise accountable riding behaviors.

- Reductions for Defensive Riding Classes: Finishing touch of defensive riding classes demonstrates a dedication to bettering riding talents and lowering twist of fate chance. Insurance coverage corporations frequently be offering reductions to inspire drivers to take those classes.

- Reductions for Anti-theft Gadgets: Putting in anti-theft gadgets can frequently lead to lowered insurance coverage premiums. The presence of those gadgets reduces the danger of robbery, which is a big fear for insurance coverage corporations. Those measures can result in vital charge financial savings.

Native Assets for Automotive Insurance coverage in Waco, TX

Gaining access to aggressive automotive insurance coverage charges in Waco, TX, frequently comes to leveraging native assets. Direct interplay with insurance coverage brokers supplies treasured insights into adapted protection choices and possible reductions particular to the world. Working out the more than a few avenues for acquiring quotes and evaluating insurance policies is a very powerful for reaching optimum insurance coverage price.Native insurance coverage brokers possess in-depth wisdom of the Waco marketplace, enabling them to offer personalised suggestions in response to native riding stipulations and prevalent dangers.

This localized experience can translate into extra adapted and cost-effective insurance coverage answers than the ones introduced thru generalized on-line agents.

Figuring out Native Insurance coverage Brokers in Waco, TX

A large number of insurance coverage companies function inside the Waco, TX space. Finding those brokers can also be facilitated thru on-line searches, using search engines like google and yahoo like Google or Bing, or by means of consulting native trade directories. Using those assets lets in for the identity of possible brokers inside a specified geographical space.

Significance of Visiting A couple of Brokers in Waco, TX

Comparative buying groceries is a cornerstone of securing essentially the most favorable automotive insurance coverage charges. Visiting more than one brokers lets in for a right away comparability of quotes and protection applications. This procedure guarantees that customers don’t seem to be restricted to a unmarried point of view, and allows a complete evaluate of to be had choices. This comparative means is very important for figuring out essentially the most cost-effective answer.

Function of On-line Insurance coverage Agents in Waco, TX

On-line insurance coverage agents play an important function within the automotive insurance coverage panorama of Waco, TX. Those platforms mixture quotes from more than a few insurance coverage suppliers, enabling a handy guide a rough comparability of insurance policies and charges. This option is especially helpful for shoppers looking for a wide evaluate of to be had choices earlier than attractive with native brokers.

Process for Discovering a Dependable Insurance coverage Agent in Waco, TX

Discovering a competent insurance coverage agent comes to a number of steps. Preliminary analysis the use of on-line directories or search engines like google and yahoo is a initial step. Following this, contacting possible brokers to speak about wishes and inquire about particular protection choices is a very powerful. Verification of the agent’s licensing and recognition thru regulatory our bodies and on-line opinions may be really helpful. After all, securing quotes and evaluating the protection and pricing introduced is a vital step.

Native Insurance coverage Businesses in Waco, TX

The next desk supplies a sampling of native insurance coverage companies in Waco, TX, providing automotive insurance coverage. You will need to observe that this listing isn’t exhaustive and additional analysis is really helpful to spot further choices.

| Company Title | Cope with | Telephone Quantity | Website online |

|---|---|---|---|

| Acme Insurance coverage | 123 Major Side road, Waco, TX 76701 | (123) 456-7890 | acmeinsurance.com |

| Absolute best Price Insurance coverage | 456 Elm Side road, Waco, TX 76702 | (987) 654-3210 | bestvalueinsurance.com |

| Dependable Insurance coverage Team | 789 Oak Road, Waco, TX 76703 | (555) 123-4567 | reliableinsurance.com |

Illustrative Examples of Insurance coverage Insurance policies

Automotive insurance coverage insurance policies in Waco, TX, like the ones national, are designed to give protection to policyholders from monetary losses stemming from car injuries. Those insurance policies, structured with various ranges of protection, be offering other protections and value implications. Working out the other elements of a coverage is a very powerful for making knowledgeable selections about protection and affordability.

Elementary Automotive Insurance coverage Coverage Construction in Waco, TX

A basic automotive insurance plans in Waco, TX, in most cases contains legal responsibility protection, which protects in opposition to claims coming up from injury or damage led to to others in an twist of fate. It additionally frequently accommodates complete and collision protection, providing coverage in opposition to injury to the insured car. The particular construction and extent of protection rely at the policyholder’s wishes and funds.

Other Varieties of Deductibles in Waco, TX

Deductibles constitute the volume the policyholder is answerable for paying out-of-pocket earlier than the insurance coverage corporate covers the remainder prices. Other deductibles impact the top rate. The next deductible in most cases interprets to decrease premiums, however the policyholder bears extra accountability for preliminary bills.

- Low Deductible: A low deductible, reminiscent of $250, approach the policyholder will pay much less to start with however would possibly face upper per thirty days premiums.

- Prime Deductible: A excessive deductible, reminiscent of $1,000, normally leads to decrease per thirty days premiums however necessitates a bigger out-of-pocket expense within the tournament of a declare.

- Instance: A policyholder with a $500 deductible for collision protection could be answerable for the primary $500 of damages earlier than the insurance coverage corporate will pay. If the wear prices $1,200, the policyholder will pay $500 and the insurer will pay $700.

Significance of Studying Coverage Tremendous Print

The advantageous print of a automotive insurance plans in Waco, TX, comprises a very powerful information about protection limits, exclusions, and particular stipulations. Sparsely reviewing those clauses is essential for working out the coverage’s complete implications. Hidden clauses can considerably restrict protection or impose further obligations at the policyholder. As an example, a coverage would possibly exclude protection for injury led to by means of particular occasions, reminiscent of intentional acts.

Variations Between Coverage Sorts in Waco, TX

Coverage sorts range within the extent of protection they provide. As an example, a coverage with solely legal responsibility protection protects the policyholder just for damages or accidents led to to others in an twist of fate. A coverage with complete and collision protection, then again, supplies broader coverage, together with injury to the insured car from more than a few occasions, reminiscent of vandalism or injuries.

- Legal responsibility Best: This fundamental coverage gives coverage for injury or damage to others, however now not for injury to the insured car. It normally gives the bottom premiums however supplies minimum coverage for the policyholder’s car.

- Complete Protection: This sort of protection safeguards the car in opposition to occasions reminiscent of robbery, vandalism, hail, fireplace, and different non-collision-related incidents. This sort of coverage supplies better coverage for the insured car.

- Collision Protection: This protection protects the policyholder’s car from injury because of a collision with some other object or car, irrespective of who’s at fault. It’s frequently bought together with legal responsibility protection to offer whole coverage.

- Uninsured/Underinsured Motorist Protection: This protection protects the policyholder if they’re keen on an twist of fate with a motive force who lacks or has inadequate insurance coverage. This protection is a very powerful for extra coverage in opposition to monetary accountability for damages.

Ultimate Conclusion

In conclusion, securing reasonable automotive insurance coverage in Waco, TX comes to a mix of good comparisons, working out protection choices, and enforcing saving methods. By way of taking a proactive means and using the assets supplied on this information, you’ll be able to with a bit of luck to find essentially the most inexpensive and complete insurance plans that aligns together with your riding wishes and monetary state of affairs. Empower your self to make knowledgeable selections and get monetary savings in your automotive insurance coverage in Waco, TX.

Questions Incessantly Requested

What are the standard prices of vehicle insurance coverage in Waco, TX in comparison to the state reasonable?

Insurance coverage prices in Waco, TX frequently fall inside a spread very similar to the state reasonable, however permutations exist relying on components like riding file, car sort, and protection choices. Examine quotes to get an exact image.

How can I strengthen my riding file to get reductions?

Keeping up a blank riding file thru accountable riding behavior is a very powerful. Fending off site visitors violations and keeping up a protected riding file will undoubtedly have an effect on your insurance coverage premiums.

What are some not unusual reductions to be had to drivers in Waco, TX?

Reductions range by means of supplier, however not unusual examples come with reductions for protected riding, multi-policy holders, and just right scholar standing. Discover other supplier choices to spot essentially the most fantastic reductions to be had.

What are some components affecting automotive insurance coverage prices in Waco, TX?

Components like your riding file, car sort, location, and age all have an effect on insurance coverage premiums in Waco, TX. Working out those components is helping you assess your particular wishes and make a selection suitable protection.