My automobile was once repossessed for no insurance coverage, leaving many unanswered questions and possible monetary ramifications. Navigating the prison and fiscal complexities of repossession calls for a radical working out of the method, together with the prospective prison loopholes and the more than a few monetary implications. This complete information supplies a transparent working out of the stairs concerned, the rights of the car proprietor, and the avenues for searching for recourse.

The method of auto repossession for loss of insurance coverage may also be daunting. It ceaselessly comes to a sequence of steps that may be overwhelming for people. Figuring out those steps and the prison ramifications can lend a hand mitigate the unfavourable affects on one’s credit score ranking and long term monetary potentialities.

Figuring out the Factor

Automotive repossession because of loss of insurance coverage carries important prison and fiscal implications. It is a critical subject that may seriously have an effect on a person’s credit score historical past and skill to protected long term loans or leases. Figuring out the method and possible recourse is an important.Repossession, in lots of circumstances, follows a structured prison trail. This ceaselessly comes to notification of the lender, and if the landlord fails to rectify the placement, the lender can begin prison lawsuits, which can result in the automobile being towed and brought away.

Figuring out the specifics of those processes is necessary for mitigating the results.

Prison Implications of Automotive Repossession

Repossession for loss of insurance coverage ceaselessly comes to violation of the mortgage settlement, which will cause prison motion. This motion can negatively have an effect on your credit score ranking, making it tricky to protected long term loans or leases. The severity of the have an effect on will depend on components like the quantity of debt and the specifics of your mortgage settlement.

Standard Steps Keen on a Repossession Procedure

The repossession procedure in most cases comes to a number of steps, various somewhat relying at the state and the lender. Usually, it starts with a realize of default, adopted via a length of grace. If the issue is not resolved, the lender would possibly touch a repossession company to take ownership of the car. Prison documentation is in most cases concerned, together with a written realize of the repossession.

A courtroom order is also vital in some circumstances, particularly if the landlord contests the repossession.

Causes for Repossession Because of Loss of Insurance coverage

A automobile may also be repossessed for loss of insurance coverage because of a failure to care for the desired insurance plans as Artikeld within the mortgage settlement. This failure ceaselessly triggers the lender’s proper to begin repossession procedures. In some circumstances, if the mortgage is in default, loss of insurance coverage could be a secondary explanation why for repossession, ceaselessly used as leverage to gather the debt.

State-Particular Repossession Procedures

Repossession rules range considerably via state. Some states have stricter laws on repossession procedures than others. As an example, some states require a selected realize length earlier than repossession, whilst others have extra lenient rules. Figuring out the particular rules on your state is an important in working out your rights and duties. This consciousness is helping to keep away from misunderstandings and possible prison problems.

| State | Standard Repossession Steps |

|---|---|

| California | Calls for explicit realize sessions and documentation. Attainable for prison demanding situations if procedures don’t seem to be adopted. |

| Florida | Transparent pointers on notification and timelines. Detailed procedures to give protection to each the lender and the borrower. |

| Texas | Strict laws referring to realize necessities and repossession strategies. The method would possibly contain a courtroom order. |

Attainable Loopholes or Exceptions to Repossession Procedures

There are specific scenarios the place the repossession procedure could be challenged or exceptions may just observe. Those exceptions may contain extenuating instances, corresponding to a short lived lapse in insurance coverage because of unexpected occasions, or if the mortgage settlement has a clause that permits for changes in case of this kind of lapse.

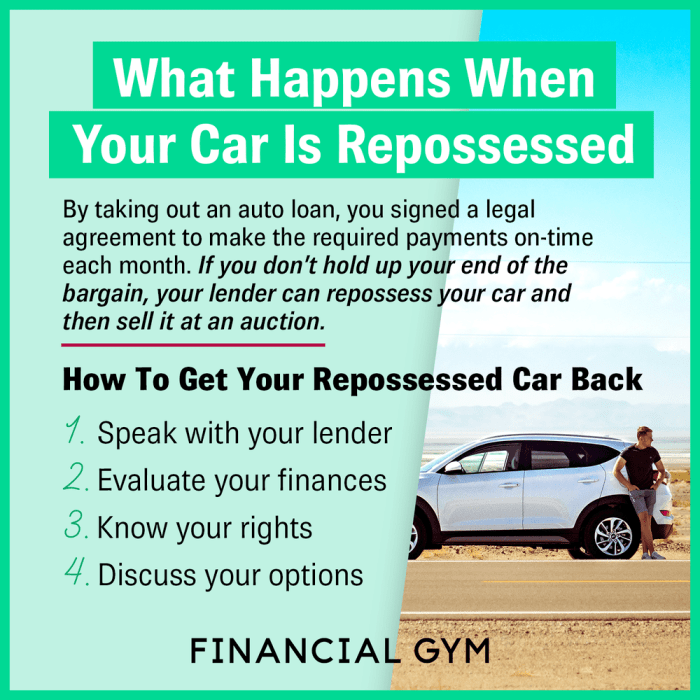

Step-by-Step Information for Repossessed Automobiles

A step by step information for addressing a repossessed car calls for cautious attention of your scenario.

- Touch the lender right away: Keep in touch with the lender to discover choices for resolving the problem, corresponding to figuring out a price plan or negotiating a short lived extension. This conversation may just probably keep away from repossession.

- Assessment the mortgage settlement: Perceive the particular phrases referring to insurance coverage necessities and repossession procedures on your mortgage settlement.

- Visit an legal professional: Search prison recommend to grasp your rights and choices, particularly in the event you consider the repossession procedure was once no longer carried out correctly.

- Discover choices for reclaiming the car: Examine tactics to regain ownership, corresponding to paying exceptional charges and insurance coverage premiums.

- Record the entirety: Stay information of all communications, bills, and prison paperwork associated with the repossession.

Monetary Ramifications

The repossession of your car because of loss of insurance coverage carries important monetary penalties that stretch a ways past the quick lack of your automobile. Those repercussions can have an effect on your talent to protected long term loans, injury your creditworthiness, and result in sudden bills. Figuring out those monetary ramifications is an important for growing a plan to mitigate the side effects and repair monetary steadiness.

Affect on Credit score Ranking

A car repossession because of non-payment, together with for loss of insurance coverage, is a major unfavourable match that considerably harms your credit score ranking. Credit score bureaus flag such incidents as a ignored price, reflecting negatively for your creditworthiness. This marks an important drop on your credit score ranking, probably via a number of hundred issues, relying for your credit score historical past. The longer this unfavourable mark stays for your credit score record, the tougher it turns into to acquire favorable mortgage phrases sooner or later.

A decrease credit score ranking manner upper rates of interest on loans, and problem in securing any loans in any respect.

Implications for Long run Mortgage Packages

Repossession considerably affects long term mortgage packages. Lenders scrutinize your credit score historical past meticulously, and a repossession is a sturdy indicator of economic instability and possible chance. This ceaselessly leads to rejection or the granting of loans with unfavourable phrases, corresponding to high-interest charges. Even supposing licensed, mortgage quantities and reimbursement phrases could be vastly diminished. This makes securing a automobile mortgage, a loan, or perhaps a private mortgage more difficult, and extra expensive.

Bills Related to Repossession

Repossession comes to extra than simply the lack of your car. You might face further bills, together with towing charges, garage charges, and broker charges. Towing charges range relying at the distance and placement. Garage charges can gather swiftly, including to the monetary burden. Sellers’ charges for processing the repossession upload to the fee.

Those bills will have to be factored into your monetary making plans. As an example, a automobile towed a substantial distance may just lead to a towing rate of $500 or extra. Garage charges may just gather to masses of greenbacks monthly. Those prices wish to be addressed right away.

Monetary Penalties Comparability

| Monetary Result | Repossession | Ignored Credit score Card Cost | Top-Hobby Mortgage Default |

|---|---|---|---|

| Credit score Ranking Affect | Important drop | Average drop | Critical drop |

| Long run Mortgage Software Affect | Top chance of rejection, unfavourable phrases | Average chance of rejection, somewhat upper curiosity | Top chance of rejection, extraordinarily excessive curiosity |

| Attainable Bills | Towing, garage, broker charges | Past due charges, curiosity fees | Top curiosity fees, possible prison motion |

This desk illustrates the various monetary penalties of various debt choices, highlighting the severity of repossession in comparison to different debt defaults. Every possibility gifts distinctive demanding situations in restoring monetary steadiness.

Attainable Per thirty days Cost Choices After Repossession, My automobile was once repossessed for no insurance coverage

After repossession, per 30 days price choices is also restricted, relying for your particular person monetary scenario and to be had assets. Negotiating with collectors for revised price plans is a chance, however this can be difficult. Choices may come with a decrease per 30 days price or a price plan adapted on your present monetary scenario. The precise choices is determined by the lender’s insurance policies and your creditworthiness.

Some lenders is also prepared to paintings with you to determine a price plan, however this isn’t at all times assured.

- Negotiated price plans with collectors may provide diminished per 30 days bills. Then again, those don’t seem to be assured and is determined by the lender’s willingness to paintings with you and your creditworthiness.

- The usage of private loans to consolidate present money owed may ease per 30 days bills if manageable. This may contain making use of for a non-public mortgage with a decrease rate of interest than your present money owed, however your creditworthiness might be assessed.

- Using price range control equipment to scrupulously observe source of revenue and bills can lend a hand create a plan for manageable per 30 days bills. This may come with developing the cheap, monitoring spending, and figuring out spaces the place bills may also be diminished.

Insurance coverage and Protection

Figuring out your automobile insurance coverage is an important after a repossession. Several types of protection be offering various ranges of coverage, and selecting the best one is important for monetary safety and prison compliance. Opting for inexpensive choices and navigating the method of acquiring insurance coverage after repossession are very important steps in regaining keep watch over of your car and your using privileges. This segment will element the varieties of automobile insurance coverage, the significance of keeping up legitimate protection, strategies for locating inexpensive charges, and the method of having insurance coverage after repossession.

Forms of Automotive Insurance coverage and Protection Choices

Quite a lot of varieties of automobile insurance coverage insurance policies exist, every with explicit coverages. Legal responsibility insurance coverage, probably the most fundamental shape, protects you from monetary duty in the event you reason injury to someone else or their assets. Collision insurance coverage covers injury on your car in an coincidence, without reference to who’s at fault. Complete insurance coverage protects your car from non-collision incidents, corresponding to robbery, vandalism, or climate injury.

Uninsured/underinsured motorist protection protects you in case you are injured via a driving force with out insurance coverage or with inadequate protection. Further choices come with roadside help and apartment automobile compensation.

Significance of Keeping up Legitimate Automotive Insurance coverage

Legitimate automobile insurance coverage is very important for prison and fiscal causes. With out it, you must face important consequences, together with hefty fines, suspension of your using privileges, or even prison motion. Keeping up protection guarantees you’re legally compliant and financially safe in case of an coincidence or injury on your car or others. Additionally, it protects your belongings and stops possible prison headaches.

Techniques to Download Reasonably priced Automotive Insurance coverage

A number of methods will let you protected inexpensive automobile insurance coverage. Evaluate charges from a couple of insurers the use of on-line comparability equipment or contacting insurance coverage brokers at once. Bundling your automobile insurance coverage with different insurance policies, corresponding to house or existence insurance coverage, ceaselessly leads to reductions. Making improvements to your using document via fending off injuries and site visitors violations too can lend a hand scale back your premiums. Imagine elevating your deductible, as it will decrease your per 30 days top rate.

Insurers additionally ceaselessly be offering reductions for excellent scholars or those that have taken defensive using classes.

Strategy of Acquiring Automotive Insurance coverage After Repossession

Acquiring automobile insurance coverage after repossession may also be difficult. You are going to most likely wish to supply evidence of possession, corresponding to a lien unlock file from the lender or the repossessing company. Your using document and any earlier claims or injuries may also be components within the insurance coverage analysis. Some insurers would possibly require a contemporary car inspection or the next deductible to mitigate possible chance.

Choices for Acquiring Brief Insurance coverage

Brief insurance coverage choices are to be had for a temporary answer. Some insurers be offering transient insurance policies, permitting you to power legally when you seek for long-term protection. Those insurance policies in most cases have upper premiums because of the fast length and the prospective dangers concerned. Another choice is to make use of a “hole” coverage for a length earlier than your long-term insurance coverage takes impact.

Evaluating Insurance coverage Suppliers and Charges

| Insurance coverage Supplier | Moderate Charge (consistent with 12 months) | Reductions Presented | Protection Choices |

|---|---|---|---|

| Insurer A | $1,200 | Multi-policy, excellent scholar, protected using | Legal responsibility, collision, complete, uninsured/underinsured |

| Insurer B | $1,500 | Multi-policy, accident-free, anti-theft instrument | Legal responsibility, collision, complete, uninsured/underinsured, roadside help |

| Insurer C | $1,000 | Multi-policy, defensive using path, no claims | Legal responsibility, collision, complete, uninsured/underinsured, apartment automobile compensation |

Word: Moderate charges are estimates and would possibly range in response to particular person components corresponding to using historical past, location, and car sort.

Prison Recourse and Rights

When a car is repossessed because of loss of insurance coverage, working out your prison rights and possible recourse is an important. This segment main points the choices to be had to you to problem the repossession and probably get better your car. It’s a must to act promptly and search prison recommend if vital.

Automobile Proprietor’s Rights in Repossession Circumstances

Repossession procedures range via jurisdiction, however typically, car homeowners have sure rights. Those rights are ceaselessly Artikeld in state and native rules, together with the main points of realize necessities and due procedure. Figuring out those rights will let you decide whether or not the repossession was once lawful. Figuring out the particular prison frameworks on your space is paramount to successfully navigating the placement.

Imaginable Prison Movements Following Repossession

Following repossession, a number of prison movements are conceivable. Those vary from disputing the repossession itself to searching for reimbursement for damages. The precise movements rely at the instances of the repossession and the appropriate rules on your space. A an important step is to file the entirety totally, together with dates, instances, and any communications with the lender or repossession company. This documentation may also be crucial proof in a prison dispute.

Procedures for Disputing the Repossession

Disputing a repossession comes to a procedure that in most cases starts with amassing proof and documenting any violations of prison procedures. Reviewing related state rules and contacting an legal professional is really useful. Visit an legal professional focusing on repossession circumstances to grasp the specifics of the prison procedures on your jurisdiction.

Time Limits for Contesting a Repossession

There are ceaselessly strict closing dates for contesting a repossession. Failing to behave inside those time limits may just end result within the lack of your proper to problem the repossession. Those closing dates range via state and rely at the explicit prison framework. It is necessary to grasp those closing dates and search prison recommend once conceivable.

An legal professional will let you perceive the particular timeframes appropriate on your scenario.

Prison Steps to Take After Repossession: Flowchart

A flowchart depicting the prison steps following repossession can’t be offered right here. As a substitute, this knowledge is equipped in a sequential listing. A flowchart can be extra illustrative however is outdoor the present textual content structure barriers.

- Record The entirety: Document all interactions with the lender, repossession company, and any related events. Come with dates, instances, and an outline of the occasions. Detailed information are very important for any possible prison motion.

- Assessment State Regulations: Analysis your state’s rules referring to car repossession. Perceive the particular necessities for realize, due procedure, and the permissible procedures for repossession. This may occasionally supply crucial knowledge in your prison technique.

- Seek the advice of an Lawyer: Touch an legal professional skilled in repossession circumstances. They are able to overview your scenario, give an explanation for your rights, and information you in the course of the prison procedure. An legal professional can give personalised recommendation and allow you to perceive the specifics of your prison choices.

- Report a Dispute: If the repossession was once illegal, report a proper dispute with the right government. This ceaselessly comes to submitting a criticism with the lender or the state company overseeing repossessions. This step will begin the formal means of difficult the repossession.

- Get ready for Courtroom: If vital, get ready for a courtroom listening to. This may contain amassing witnesses, presenting proof, and probably submitting motions with the courtroom. Attending courtroom hearings is important to successfully provide your case.

Prevention and Mitigation

Combating automobile repossession hinges on proactive measures and sound monetary control. Failing to care for insurance plans or experiencing monetary hardship can result in this critical end result. Figuring out the stairs to keep away from this kind of scenario and the assets to be had is an important.Keeping up constant insurance plans and accountable monetary conduct are important to safeguarding your car and your monetary well-being. Proactive steps, coupled with a transparent working out of to be had fortify, can mitigate the danger of repossession.

Preventive Measures to Keep away from Automotive Repossession

Proactive measures are very important to keep away from automobile repossession. A proactive way can save you monetary hardship and car loss. Those measures center of attention on keeping up monetary steadiness and making sure constant insurance plans.

- Take care of Present Insurance coverage Protection: Often overview your insurance plans and make sure your protection stays legitimate and enough. Failure to care for insurance coverage can temporarily result in repossession. This comprises well timed price of premiums and verifying protection main points.

- Identify a Finances and Stick with It: A well-defined price range permits for cautious allocation of finances. Prioritize very important bills and allocate finances for insurance coverage premiums. Growing the cheap is an very important instrument for monetary steadiness. Instance: A per 30 days price range with allotted quantities for housing, transportation, and different bills guarantees that enough finances are to be had for automobile insurance coverage premiums.

- Search Monetary Help if Wanted: Monetary demanding situations can get up rapidly. Figuring out assets and fortify methods, corresponding to debt counseling or price range control products and services, can lend a hand set up debt and care for monetary steadiness. Instance: Using debt consolidation methods or searching for recommendation from a non-profit monetary counseling company can help in managing monetary pressures.

- Keep away from Overextending Credit score: Proscribing the selection of loans and bank card money owed is helping care for monetary keep watch over. Keep away from collecting useless debt, as it will considerably building up monetary drive. Instance: In moderation overview mortgage packages and keep away from over the top borrowing.

- Often Observe Credit score Ranking: A wholesome credit score ranking can lend a hand in securing loans and bettering monetary status. Often track your credit score record for mistakes and make sure correct knowledge is recorded. Instance: Often reviewing credit score reviews and correcting any inaccuracies can save you problems with securing credit score sooner or later.

Steps to Take if Insurance coverage is Cancelled or Lapsed

Figuring out the method of restoring insurance plans after cancellation or lapse is an important. Instructed motion can lend a hand save you repossession.

- Touch Your Lender Straight away: Notify your lender of the lapse or cancellation once conceivable. Give an explanation for the placement and request a short lived extension if conceivable.

- Search Brief Insurance coverage Protection: Discover choices for transient insurance coverage, corresponding to temporary insurance policies or hole insurance coverage, to verify the car stays insured. Instance: Quick-term insurance policies can give protection for a restricted length whilst searching for a extra complete long-term coverage.

- Assessment Insurance coverage Choices: Analysis and evaluate other insurance coverage corporations and insurance policies to seek out probably the most appropriate protection at a cheap worth. Instance: Evaluate premiums, protection varieties, and deductibles from other insurance coverage suppliers to verify suitable protection.

Choices for Brief Insurance coverage Protection

Brief insurance coverage can give important coverage all over sessions of coverage trade or lapse.

- Quick-Time period Insurance policies: Those insurance policies supply protection for a selected length, permitting time to protected a extra complete coverage.

- Hole Insurance coverage: This protection addresses the variation between the car’s price and the phenomenal mortgage stability, offering a security internet if the car is totaled.

- Brief Protection Via a Lender: Some lenders be offering transient insurance coverage choices to give protection to their curiosity within the car.

Keeping up Monetary Balance to Keep away from Repossession

Monetary steadiness is vital to fending off repossession. A well-structured way to managing budget can mitigate the danger.

- Create a Detailed Finances: Monitor source of revenue and bills meticulously. Allocate finances for very important bills and automobile insurance coverage.

- Cut back Needless Bills: Determine and get rid of useless bills to liberate finances for very important wishes, together with automobile insurance coverage premiums.

- Building up Source of revenue Resources: Discover further source of revenue assets, corresponding to part-time jobs or freelancing, to strengthen monetary steadiness.

Significance of Budgeting and Monetary Making plans

A well-defined price range and fiscal plan are very important for long-term monetary steadiness.

- Monitor Source of revenue and Bills: Figuring out source of revenue and expenditure patterns permits for fine budgeting and fiscal making plans.

- Set Reasonable Targets: Setting up practical monetary objectives, corresponding to saving for a down price on a brand new car, can give path and motivation.

Monetary Sources and Help Techniques

A large number of assets can give help in fending off repossession.

| Useful resource Kind | Description |

|---|---|

| Debt Counseling Products and services | Be offering steering on managing debt and developing the cheap. |

| Non-Benefit Monetary Counseling Businesses | Supply unfastened or cheap monetary recommendation and fortify. |

| Executive Help Techniques | Be offering fortify for the ones experiencing monetary hardship, together with grants and loans. |

Selection Answers: My Automotive Used to be Repossessed For No Insurance coverage

Dropping your car to repossession because of loss of insurance coverage is usually a disturbing and disruptive enjoy. Thankfully, there are choice transportation choices and fiscal methods that can assist you navigate this difficult scenario. This segment explores more than a few answers, starting from transient transportation to long-term monetary making plans.

Selection Transportation Choices

Discovering a short lived option to get round is an important when you cope with the repossession and insurance coverage problems. Imagine those choices:

- Public Transportation: Using buses, trains, or subways is usually a cost-effective choice, particularly in case your course permits for it. Many towns have in depth public transit techniques that may get you to paintings, college, or different very important locations.

- Journey-Sharing Products and services: Products and services like Uber and Lyft be offering versatile transportation choices. Then again, take into account of the prices related to those products and services, as they are able to temporarily upload up.

- Carpooling: Taking part with buddies, circle of relatives, or coworkers to percentage transportation prices is usually a budget-friendly option to get round. This feature is particularly advisable for commutes or shared errands.

- Strolling or Biking: Relying for your day-to-day wishes, strolling or biking may also be viable choices for brief distances. This will also be a good way to include workout into your regimen.

Negotiating with the Lender

Making an attempt to barter with the lender can probably result in a positive end result. This may contain exploring choices for a short lived extension or a revised price plan. Figuring out the phrases of your mortgage settlement and the lender’s insurance policies is very important for this procedure.

Promoting the Automotive Privately

Promoting your automobile privately permits for extra keep watch over over the method and probably the next sale worth in comparison to dealerships. Then again, it additionally calls for extra effort and duty. On-line classifieds, native boards, and social media teams may also be fine platforms to succeed in possible consumers. Keep in mind to obviously divulge the car’s situation, together with any exceptional problems or upkeep.

Thorough documentation and cautious dealing with of transactions are crucial to keep away from scams or disputes.

Reasonably priced Automotive Restore Choices

In case your automobile wishes upkeep earlier than promoting it, discovering inexpensive choices is an important. Restore stores ceaselessly have other pricing buildings. Imagine evaluating quotes from a number of fix stores and researching choices like used portions. Checking on-line boards or neighborhood teams for suggestions from different automobile homeowners will also be advisable. Prioritize vital upkeep and imagine a “repair-and-sell” technique if suitable.

Acquiring a Mortgage for a New or Used Automobile

Securing financing for a brand new or used car calls for cautious making plans. Assessment your credit score record to grasp your present monetary status. Evaluate rates of interest and mortgage phrases from more than a few lenders. It is an important to decide your price range and make a choice a mortgage that aligns along with your monetary features. Pre-qualifying for a mortgage earlier than beginning your seek can streamline the method.

Benefits and Disadvantages of Other Strategies

| Way | Benefits | Disadvantages |

|---|---|---|

| Public Transportation | Value-effective, obtainable in lots of spaces | Restricted hours of operation, possible delays |

| Journey-Sharing Products and services | Flexibility, comfort | Value can temporarily upload up, possible for surge pricing |

| Carpooling | Finances-friendly, social interplay | Calls for coordination, will not be possible for all commutes |

| Promoting Privately | Doubtlessly upper sale worth | Calls for extra effort, chance of scams |

| Reasonably priced Automotive Restore | Value-effective answers | Would possibly require extra time and analysis |

| Automobile Mortgage | Get right of entry to to a brand new or used car | Calls for assembly lender necessities, possible for top rates of interest |

Sources and Fortify

Dealing with the repossession of your car because of loss of insurance coverage is usually a disturbing and overwhelming enjoy. Navigating the prison and fiscal complexities can really feel daunting. Thankfully, more than a few assets are to be had to supply steering and fortify all over this difficult time. Figuring out those assets can considerably ease the weight and allow you to regain keep watch over of the placement.

Organizations Providing Help with Automotive Repossession

A large number of organizations supply help to folks going through automobile repossession. Those assets can be offering recommendation, steering, and probably negotiate with collectors for your behalf. Discovering the fitting group is an important for fine fortify.

- Shopper Coverage Businesses: Those companies play a crucial position in safeguarding customers’ rights and pursuits. They examine lawsuits, supply details about client rights, and be offering mediation products and services to get to the bottom of disputes. Contacting them early within the procedure may also be advisable in working out your rights and choices.

- Non-profit Prison Assist Organizations: Prison help organizations ceaselessly supply unfastened or cheap prison help to people who can’t manage to pay for prison illustration. They are able to be offering steering for your prison rights and possible recourse. Many be offering explicit methods associated with client problems, together with repossessions.

- Credit score Counseling Businesses: Those companies can give precious help in growing a reimbursement plan or exploring choices for debt control. They are able to additionally supply recommendation on budgeting and fiscal making plans to stop long term problems.

Touch Data for Shopper Coverage Businesses

Shopper coverage companies range via state and jurisdiction. Direct touch with the right company is very important for personalised steering. Internet sites for those companies supply touch knowledge and information about their products and services.

- Federal Industry Fee (FTC): The FTC is a federal company that protects customers from fraud, deception, and unfair industry practices. Their site gives in depth knowledge on client rights, together with the ones associated with repossessions. Contacting them would possibly allow you to perceive your prison rights and discover conceivable treatments.

- State Lawyer Common Workplaces: Every state has an legal professional basic’s place of business accountable for client coverage. Those workplaces ceaselessly examine client lawsuits and supply steering on client rights. Their web pages will supply explicit touch knowledge and assets related on your state.

Monetary Counseling Sources

Monetary counseling is an important instrument in managing monetary difficulties. Those counselors will let you broaden the cheap, create a reimbursement plan, and perceive your monetary choices. Skilled recommendation may also be crucial in combating long term monetary issues.

- Native Group Facilities: Area people facilities ceaselessly have methods and assets for monetary counseling. Those methods would possibly supply steering and fortify to control debt and fiscal difficulties. Glance into area people facilities or non-profits for conceivable help.

- Non-profit Organizations: A large number of non-profit organizations be offering monetary counseling products and services. Those organizations would possibly supply unfastened or cheap products and services adapted to precise scenarios, corresponding to repossession.

Significance of In quest of Skilled Recommendation

In quest of skilled recommendation is very important when going through monetary hardship and automobile repossession. A monetary counselor can give personalised steering and fortify. A prison skilled can advise you for your rights and possible prison choices.

Useful Internet sites with Data on Automotive Repossession

A large number of web pages be offering precious knowledge on automobile repossession. Those assets may also be precious for working out the method, your rights, and to be had choices.

- Shopper Monetary Coverage Bureau (CFPB): The CFPB supplies detailed knowledge on client rights and duties, together with the ones relating to automobile loans and repossessions. It is a key useful resource for working out the method and possible recourse.

- Nationwide Basis for Credit score Counseling (NFCC): The NFCC supplies knowledge on debt control, monetary counseling, and client rights. Their assets may also be useful in working out your monetary scenario and exploring conceivable answers.

Desk of Native and Nationwide Organizations Providing Monetary Assist

This desk supplies a concise review of organizations providing monetary help, together with the ones particularly devoted to client problems and repossessions.

| Group | Kind | Touch Data |

|---|---|---|

| Native Group Facilities | Group-based | Test along with your area people middle or non-profit for listings |

| Nationwide Basis for Credit score Counseling (NFCC) | Nationwide Non-profit | www.nfcc.org |

| Shopper Monetary Coverage Bureau (CFPB) | Federal Company | www.consumerfinance.gov |

Conclusive Ideas

In conclusion, the repossession of a automobile because of loss of insurance coverage will have critical penalties. Figuring out the prison implications, monetary ramifications, and to be had recourse is an important. This information has supplied a complete review of the problem, providing sensible steps for prevention, mitigation, and searching for choice answers. By way of working out the main points and possible pitfalls, folks may also be higher provided to deal with this difficult scenario.

Question Solution

What are the average causes for automobile repossession?

Not unusual causes come with failure to care for legitimate insurance coverage, ignored bills, or violations of mortgage phrases.

How does automobile repossession have an effect on my credit score ranking?

A repossession considerably lowers your credit score ranking, making long term mortgage packages tougher and probably dear.

What are my rights as a car proprietor all over a repossession?

Automobile homeowners have rights in regards to the repossession procedure. Those rights would possibly range via state, and you need to perceive native laws.

What are some preventive measures to keep away from automobile repossession?

Keeping up legitimate insurance coverage, staying present on bills, and managing budget responsibly are key preventative measures.