Safety Nationwide Insurance coverage Corporate automobile insurance coverage supplies complete protection adapted on your wishes. Working out how nationwide insurance coverage impacts your premiums, protection choices, and declare processes is an important. This information will delve into the specifics of Safety Nationwide Insurance coverage Corporate automobile insurance coverage, from coverage main points to supplier comparisons, serving to you’re making knowledgeable choices.

Navigating the complexities of vehicle insurance coverage, specifically when nationwide insurance coverage components in, will also be daunting. This information simplifies the method, providing a transparent and out there evaluation of the more than a few facets that affect your insurance coverage prices and claims. We will read about the whole thing from the have an effect on of using historical past to the various kinds of protection to be had.

Nationwide Insurance coverage and Automobile Insurance coverage Protection

Nationwide insurance coverage contributions play a vital position in figuring out automobile insurance coverage premiums. This affect stems from the truth that insurers assess the danger profile of drivers, and nationwide insurance coverage data supply precious insights into using historical past and monetary balance. Working out the interaction between those two components is an important for shoppers in the hunt for to regulate their automobile insurance coverage prices successfully.Insurers make the most of nationwide insurance coverage contributions to gauge a driving force’s monetary scenario and doable declare historical past.

Drivers with increased nationwide insurance coverage contributions, regularly indicating a strong employment report, might qualify for decrease premiums. Conversely, drivers with decrease contributions, specifically those that are self-employed or unemployed, might face increased premiums because of perceived greater menace.

Affect of Nationwide Insurance coverage on Automobile Insurance coverage Premiums

Nationwide insurance coverage data supply a key indicator of economic balance and doable declare frequency. Insurers use this information to evaluate the chance of a driving force creating a declare. Drivers with a constant report of nationwide insurance coverage contributions are regularly noticed as lower-risk, resulting in decrease premiums. It is because a constant contribution historical past suggests a extra strong monetary scenario, doubtlessly lowering the chance of economic difficulties that may result in claims.

Conversely, the ones with gaps in contributions or inconsistent data could be considered as increased menace, doubtlessly main to better premiums.

Kinds of Automobile Insurance coverage Protection Choices

Complete automobile insurance policy choices are designed to cater to various wishes and budgets. Those choices generally come with third-party legal responsibility, which covers damages to different events within the tournament of an coincidence the place the driving force is at fault. Past this, some insurance policies be offering complete protection, encompassing injury to the insured automobile irrespective of who’s at fault.

Collision protection supplies coverage towards injury to the insured automobile within the tournament of a collision. Further choices come with uninsured/underinsured motorist protection, which safeguards towards damages brought about by means of drivers with out ok insurance coverage.

Price Comparability of Automobile Insurance coverage Insurance policies

The price of automobile insurance coverage insurance policies varies considerably relying on a number of components, together with the selected protection choices, the driving force’s age, using report, and automobile sort. Nationwide insurance coverage standing is a key part in figuring out the price of insurance coverage. Insurance policies with complete protection, together with injury to the insured automobile, generally include the next top class in comparison to insurance policies with restricted protection.

Standard Exclusions in Automobile Insurance coverage Insurance policies Associated with Nationwide Insurance coverage

Automobile insurance coverage insurance policies regularly exclude explicit occasions or instances associated with nationwide insurance coverage contributions. For instance, insurance policies won’t duvet damages on account of intentional acts, reckless using, or using drunk or medication, without reference to the nationwide insurance coverage standing. Moreover, some insurance policies might exclude damages coming up from injuries involving cars with expired or invalid nationwide insurance coverage.

Particular exclusions will have to be reviewed sparsely within the coverage paperwork.

Comparability of Protection Choices In line with Nationwide Insurance coverage Standing

| Nationwide Insurance coverage Standing | Standard Top class Affect | Protection Concerns |

|---|---|---|

| Hired | Typically decrease premiums because of constant contributions and perceived decrease menace. | Complete protection choices is also extra inexpensive. |

| Self-Hired | Doubtlessly increased premiums because of variability in source of revenue and contributions. | Would possibly want to believe increased deductibles or restricted protection choices to mitigate prices. |

| Unemployed | Typically increased premiums because of perceived increased menace and doable for monetary difficulties. | Would possibly require further protection to mitigate the upper menace profile. |

Elements Influencing Nationwide Insurance coverage Automobile Insurance coverage Prices

Automobile insurance coverage premiums are advanced, influenced by means of a mess of things past merely the kind of automobile. Working out those components is an important for each shoppers and insurance coverage suppliers to verify truthful and correct pricing. This research delves into the important thing components that form nationwide insurance coverage automobile insurance coverage prices, encompassing using historical past, demographics, location, and automobile traits.Nationwide insurance coverage standing, using historical past, and automobile sort all considerably have an effect on automobile insurance coverage premiums.

Those components, along location and age, give a contribution to the full menace review undertaken by means of insurers. This review immediately affects the premiums charged to policyholders.

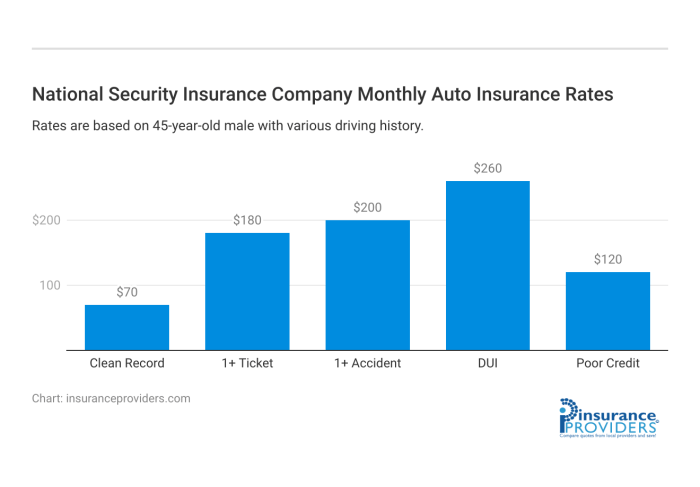

Affect of Riding Historical past on Automobile Insurance coverage Prices

Riding historical past is a number one determinant of vehicle insurance coverage premiums. A blank using report, devoid of injuries or visitors violations, generally interprets to decrease premiums. Conversely, a historical past of injuries or violations alerts increased menace, resulting in greater premiums. Insurers make the most of statistical information and actuarial fashions to evaluate menace in accordance with using conduct. For instance, a driving force with more than one dashing tickets or at-fault injuries will face considerably increased premiums in comparison to a driving force without a infractions.

Affect of Age on Automobile Insurance coverage Prices

Age is a major factor influencing automobile insurance coverage premiums. More youthful drivers are regularly thought to be increased menace because of their inexperience and perceived increased probability of injuries. This increased menace review ends up in increased premiums for more youthful drivers. Conversely, older drivers, specifically the ones with a confirmed observe report of protected using, might qualify for decrease premiums. That is regularly because of the decrease coincidence charges related to drivers with extra enjoy.

Position of Location in Figuring out Automobile Insurance coverage Premiums

Geographic location performs a an important position in automobile insurance coverage prices. Spaces with increased coincidence charges, greater visitors density, or explicit forms of climate stipulations are related to increased premiums. Insurers alter premiums in accordance with components like coincidence frequency and severity, which range significantly throughout more than a few geographical spaces. For instance, spaces vulnerable to critical climate occasions, corresponding to hailstorms or flooding, may have increased insurance coverage prices because of the greater probability of car injury.

Affect of Nationwide Insurance coverage Standing on Automobile Insurance coverage Prices

Nationwide insurance coverage standing, specifically in international locations with complete social protection nets, can affect the price of automobile insurance coverage. People with a confirmed report of accountable contributions to nationwide insurance coverage schemes is also perceived as decrease menace by means of insurers, doubtlessly resulting in decrease premiums. Conversely, the ones with a historical past of non-compliance or low contribution could be considered as increased menace.

It is because insurers regularly assess general monetary accountability and reliability, together with components associated with compliance with nationwide insurance coverage laws.

Dating Between Coincidence Historical past and Nationwide Insurance coverage Premiums

Coincidence historical past immediately correlates with nationwide insurance coverage automobile insurance coverage premiums. A historical past of injuries, specifically at-fault injuries, considerably will increase the price of automobile insurance coverage. Insurers use ancient coincidence information to type the chance of long run injuries for explicit drivers. This review is an important for figuring out suitable premiums. Injuries with critical accidents or belongings injury result in considerably increased premiums because of the greater monetary legal responsibility for the insurer.

Affect of Car Sort and Price on Automobile Insurance coverage Premiums

Car sort and price are key components in figuring out automobile insurance coverage premiums. Top-performance sports activities vehicles or cars with complicated options are regularly perceived as increased menace because of their doable for injury or robbery. Likewise, dear cars generally command increased premiums because of the greater monetary loss if the automobile is broken or stolen. Insurance coverage corporations issue within the price of the automobile when calculating premiums.

A luxurious automobile, as an example, carries the next top class than a normal compact automobile, even with equivalent using histories.

Desk Illustrating the Affect of Elements on Automobile Insurance coverage Premiums

| Issue | Description | Affect on Top class |

|---|---|---|

| Riding Historical past | Blank report, injuries, violations | Decrease premiums for blank data, increased for injuries/violations |

| Age | Younger driving force, mature driving force | Upper premiums for younger drivers, doubtlessly decrease for mature drivers |

| Location | Top-accident spaces, visitors density | Upper premiums in high-accident/visitors spaces |

| Nationwide Insurance coverage Standing | Compliance, non-compliance | Decrease premiums for compliance, increased for non-compliance |

| Car Sort | Sports activities automobile, same old automobile | Upper premiums for high-performance cars |

| Car Price | Top-value automobile, low-value automobile | Upper premiums for high-value cars |

Claims and Nationwide Insurance coverage Automobile Insurance coverage

The method of submitting a automobile insurance coverage declare, specifically when nationwide insurance coverage is implicated, comes to explicit procedures and issues. Working out those nuances is an important for each claimants and insurance coverage suppliers to verify an excellent and environment friendly answer. Nationwide insurance coverage implications can considerably have an effect on the declare’s agreement and long run premiums.The agreement of a automobile insurance coverage declare involving nationwide insurance coverage is ruled by means of established criminal frameworks and insurance coverage provisions.

The specifics of those frameworks range relying at the jurisdiction and the character of the declare. Insurance coverage corporations meticulously review the declare’s validity, the level of damages, and the involvement of nationwide insurance coverage to decide suitable reimbursement.

Declare Procedure Evaluate

The declare procedure for automobile insurance coverage, when nationwide insurance coverage is an element, calls for cautious documentation and adherence to precise protocols. Claimants will have to meticulously record all facets of the incident, together with witness statements, images, and police experiences if acceptable. This complete report is an important for the insurance coverage corporate’s review.

Affect on Declare Agreement

Nationwide insurance coverage considerably influences declare agreement. If a occasion excited by a automobile coincidence holds nationwide insurance coverage, the specifics of the coverage and the phrases of the coincidence might have an effect on the volume of reimbursement and the legal responsibility for damages. The insurer’s analysis of legal responsibility in accordance with the proof and criminal framework will dictate the agreement quantity.

Affect on Long run Premiums

A declare involving nationwide insurance coverage can doubtlessly have an effect on long run automobile insurance coverage premiums. The character of the declare, the level of damages, and the stage of fault assigned to the events concerned can all affect the premiums. Insurance coverage corporations analyze declare historical past to evaluate menace profiles. As an example, a declare involving vital damages or more than one injuries might lead to the next top class for the claimant.

Documentation Required

Complete documentation is very important when submitting a declare that comes to nationwide insurance coverage. This contains, however isn’t restricted to: the police document (if acceptable), scientific data, witness statements, restore estimates, and the related nationwide insurance coverage main points. Accuracy and completeness are paramount to verify a easy declare processing.

Declare Submitting Steps

- Preliminary Reporting: In an instant document the coincidence to the insurance coverage corporate and any related government. This comes to offering vital main points of the incident, together with the opposite driving force’s data and the positioning of the coincidence. This step is an important for beginning the declare procedure and protecting proof.

- Accumulating Proof: Gather all pertinent proof, together with images of the wear to the cars, witness statements, and scientific data. This guarantees an entire report of the incident for the insurance coverage corporate’s review.

- Declare Shape Submission: Entire and publish the declare shape to the insurance coverage corporate, offering all vital main points and supporting documentation. This step comes to correct and thorough reporting to keep away from delays.

- Review and Analysis: The insurance coverage corporate assesses the declare in accordance with the supplied proof and coverage phrases. The review comes to comparing legal responsibility and damages.

- Agreement Negotiation: The insurance coverage corporate negotiates a agreement quantity in accordance with the review and coverage phrases. This procedure comes to discussions with each events concerned to achieve a mutually agreeable answer.

- Cost and Finalization: The agreement quantity is paid to the events entitled to reimbursement, and the declare is finalized. This step concludes the declare procedure.

Instance Situation

A driving force with nationwide insurance coverage is excited by a fender-bender collision. The declare procedure comes to reporting the coincidence to their insurer, collecting proof (e.g., images, witness statements), and filing the declare shape. The insurer assesses the declare, together with the nationwide insurance coverage, and negotiates a agreement in accordance with the stage of wear and tear and fault. This agreement might have an effect on long run premiums for each events concerned.

| Step | Description |

|---|---|

| Preliminary Reporting | Document coincidence to insurer and related government. |

| Accumulating Proof | Gather footage, witness statements, scientific data. |

| Declare Shape Submission | Entire and publish the declare shape with supporting paperwork. |

| Review and Analysis | Insurer assesses declare, together with nationwide insurance coverage facets. |

| Agreement Negotiation | Negotiate agreement in accordance with review and coverage phrases. |

| Cost and Finalization | Agreement paid, declare finalized. |

Insurance coverage Supplier Comparisons

Insurance coverage suppliers play a an important position in figuring out the fee and protection of vehicle insurance coverage insurance policies, specifically when taking into consideration nationwide insurance coverage standing. Working out how other suppliers alter their premiums and insurance policies in accordance with this standing is very important for shoppers to make knowledgeable choices. This phase examines the various choices of more than a few insurance coverage suppliers, specializing in their approaches to nationwide insurance coverage.Comparative research of vehicle insurance coverage insurance policies unearths diversifications in protection, premiums, and customer support responsiveness, particularly when nationwide insurance coverage is an element.

This necessitates a cautious analysis of supplier strengths and weaknesses to spot essentially the most appropriate coverage for person wishes and instances. Other suppliers might be offering various ranges of protection and advantages, impacting the full value and coverage presented to policyholders.

Coverage Permutations Relating to Nationwide Insurance coverage Standing, Safety nationwide insurance coverage corporate automobile insurance coverage

Working out how other insurance coverage suppliers alter premiums in accordance with nationwide insurance coverage standing is an important. Insurance policies might be offering differing ranges of protection and advantages, doubtlessly impacting the full value and coverage presented. Some suppliers might be offering explicit reductions or incentives for people with exemplary nationwide insurance coverage data. Conversely, others may alter premiums in accordance with perceived menace related to a specific nationwide insurance coverage standing.

Top class Changes In line with Nationwide Insurance coverage

Premiums are regularly adjusted in accordance with components like nationwide insurance coverage standing. Suppliers might use ancient information and menace exams to decide the chance of a declare, influencing the top class calculation. It is a advanced procedure, taking into consideration the various vary of nationwide insurance coverage eventualities and person menace profiles. A better menace profile, as perceived by means of the insurance coverage supplier, will most probably lead to increased premiums.

Conversely, a decrease menace profile may yield a decrease top class. For instance, a driving force with a constant and sure nationwide insurance coverage report might obtain a decrease top class in comparison to a driving force with a historical past of violations.

Buyer Provider for Nationwide Insurance coverage-Comparable Problems

Environment friendly and responsive customer support is an important when coping with nationwide insurance-related problems. A supplier’s recognition for dealing with those eventualities can considerably have an effect on the policyholder enjoy. A well-regarded supplier will be offering transparent communique channels and supply recommended help for coverage inquiries or claims involving nationwide insurance coverage. This may increasingly come with devoted customer support representatives an expert about nationwide insurance-related insurance policies.

Additionally, a supplier’s dealing with of claims involving nationwide insurance coverage is a key facet of comparing their general customer support high quality.

Comparative Research of Main Insurance coverage Suppliers

| Insurance coverage Supplier | Top class Adjustment for Nationwide Insurance coverage | Protection Particular to Nationwide Insurance coverage | Buyer Provider Method for Nationwide Insurance coverage Problems | Strengths | Weaknesses |

|---|---|---|---|---|---|

| Corporate A | Premiums adjusted in accordance with nationwide insurance coverage rating, with reductions for sure data. | Particular protection add-ons for drivers with outstanding nationwide insurance coverage historical past. | Devoted nationwide insurance coverage claims group with 24/7 give a boost to. | Aggressive pricing for robust data. | Restricted protection choices for the ones with much less favorable data. |

| Corporate B | Premiums range in accordance with nationwide insurance coverage magnificence, providing tiered reductions. | Same old protection for all nationwide insurance coverage categories. | Complete on-line portal with FAQs explicit to nationwide insurance coverage. | Wide variety of protection choices. | Won’t be offering vital reductions for exemplary data. |

| Corporate C | Premiums adjusted in line with nationwide insurance coverage rating and using historical past. | Specialised nationwide insurance coverage help for claims. | Devoted telephone line for nationwide insurance coverage inquiries. | Customized way to menace review. | Possible for increased premiums in comparison to different suppliers. |

Nationwide Insurance coverage and Younger Drivers: Safety Nationwide Insurance coverage Corporate Automobile Insurance coverage

Younger drivers face distinctive demanding situations in securing inexpensive automobile insurance coverage, regularly leading to increased premiums in comparison to older drivers. Nationwide Insurance coverage, a an important element of a complete insurance coverage, performs a vital position in figuring out those premiums. This phase examines the interaction between nationwide insurance coverage and automobile insurance coverage for younger drivers, outlining influencing components and to be had give a boost to.

Affect of Nationwide Insurance coverage on Younger Driving force Premiums

Nationwide Insurance coverage contributions replicate a person’s employment historical past and tax contributions. This report, accessed during the driving force’s nationwide insurance coverage quantity, supplies insurers with a measure of economic balance and menace review. Younger drivers, regularly with restricted or no employment historical past, is also perceived as increased menace, resulting in increased insurance coverage premiums. Insurers use this information to guage the chance of claims, and this issue can considerably have an effect on premiums.

Elements Influencing Premiums for Younger Drivers

A number of components give a contribution to the insurance coverage premiums for younger drivers, with nationwide insurance coverage standing being a distinguished one. Those components come with, however don’t seem to be restricted to, using enjoy, automobile sort, location of place of dwelling, and the driving force’s claims historical past. Younger drivers without a or restricted nationwide insurance coverage contributions may face increased premiums because of the perceived increased menace. Conversely, the ones with a strong employment historical past and corresponding nationwide insurance coverage contributions may see decrease premiums.

Give a boost to for Younger Drivers

More than a few organizations and tasks supply give a boost to to younger drivers relating to nationwide insurance coverage and automobile insurance coverage. Govt-funded schemes and insurance coverage suppliers regularly be offering explicit applications designed for younger drivers, making an allowance for their restricted using enjoy and monetary scenario. Those give a boost to methods might come with discounted charges or adapted insurance coverage choices.

Insurance coverage Choices for Younger Drivers Taking into account Nationwide Insurance coverage

A number of insurance coverage choices are to be had to younger drivers, taking into consideration their nationwide insurance coverage standing. Those choices can vary from fundamental duvet to complete applications. Particular methods or reductions adapted for younger drivers with restricted nationwide insurance coverage contributions is also to be had. Insurers regularly be offering adapted applications for college kids or the ones with restricted employment historical past, which may replicate the drivers’ explicit monetary and using enjoy profiles.

Desk: Insurance coverage Choices and Pricing for Younger Drivers

| Nationwide Insurance coverage Standing | Insurance coverage Possibility | Estimated Top class (Instance) |

|---|---|---|

| Low/No Nationwide Insurance coverage Contributions | Elementary Automobile Insurance coverage with Younger Driving force Bargain | £1,200 – £1,500 in keeping with 12 months |

| Restricted Nationwide Insurance coverage Contributions | Complete Automobile Insurance coverage with Younger Driving force Package | £1,500 – £1,800 in keeping with 12 months |

| Strong Nationwide Insurance coverage Document | Complete Automobile Insurance coverage with Multi-Driving force Bargain | £1,000 – £1,200 in keeping with 12 months |

Be aware: Premiums are estimates and will range considerably in accordance with explicit automobile, location, and different components. This desk supplies illustrative examples and will have to no longer be thought to be definitive pricing.

Nationwide Insurance coverage and Particular Automobile Sorts

Nationwide insurance coverage standing performs a vital position in figuring out the price of automobile insurance coverage, and this dating is additional nuanced by means of the kind of automobile. Other automobile varieties provide various ranges of menace, impacting premiums. This phase examines how nationwide insurance coverage standing interacts with the pricing for more than a few automobile varieties, from on a regular basis cars to high-performance fashions.

Elements Influencing Insurance coverage Prices for Particular Automobile Sorts

Insurance coverage premiums for explicit automobile varieties are influenced by means of a number of key components, with nationwide insurance coverage standing enjoying a vital position. The inherent menace related to other automobile varieties is a number one driving force.

- Sports activities Vehicles: Top-performance sports activities vehicles, because of their doable for increased coincidence severity and related restore prices, generally command increased insurance coverage premiums. That is regularly compounded by means of the truth that drivers of those cars could have the next propensity for risk-taking behaviors.

- Luxurious Cars: Luxurious vehicles, ceaselessly focused by means of robbery and vandalism, regularly have increased insurance coverage premiums than related fashions in a lower cost bracket. The greater price of those cars immediately correlates with the price of alternative or restore within the tournament of wear and tear or robbery.

- Vintage Vehicles: Vintage vehicles, regularly that includes distinctive or uncommon options, provide a novel insurance coverage problem. Their rarity and doubtlessly excessive price necessitate specialised insurance coverage insurance policies that regularly come with increased premiums to account for doable injury, robbery, or recovery prices.

- On a regular basis Cars: Insurance coverage prices for on a regular basis cars are usually less than for higher-risk cars. That is because of their decrease doable for injury and service prices, regularly related to their extra commonplace designs and production requirements.

Interplay of Nationwide Insurance coverage Standing with Automobile Sort Pricing

Nationwide insurance coverage standing immediately influences insurance coverage premiums for all automobile varieties. A driving force with the next menace profile (e.g., a contemporary dashing price tag or coincidence) can pay the next top class for any automobile, however this impact is amplified when blended with the inherent menace of a particular automobile sort.

- Upper Possibility Drivers: Drivers with a historical past of injuries or visitors violations face considerably increased premiums for all automobile varieties, with sports activities vehicles and comfort cars experiencing a good better top class building up because of their related dangers.

- Decrease Possibility Drivers: Conversely, drivers with a blank using report generally see decrease premiums for all cars, despite the fact that this receive advantages remains to be moderated by means of the precise automobile sort.

Evaluating Insurance coverage Prices for Equivalent Fashions with Differing Nationwide Insurance coverage Statuses

Insurance coverage corporations use more than a few standards to evaluate menace. The nationwide insurance coverage standing of the driving force is a significant factor in figuring out the premiums.

- Instance: A driving force with a blank using report insuring a normal sedan will most probably have decrease premiums than a driving force with more than one dashing tickets insuring the similar type. The have an effect on of the nationwide insurance coverage standing at the value is extra pronounced for higher-risk cars. As an example, a driving force with a blank report insuring a sports activities automobile can pay lower than a driving force with more than one violations insuring the similar automobile.

Insurance coverage Price Comparability Desk

The next desk illustrates the possible variation in insurance coverage prices in accordance with automobile sort and nationwide insurance coverage standing. Be aware that those figures are illustrative and might range relying at the explicit insurer, location, and person instances.

| Automobile Sort | Nationwide Insurance coverage Standing (Instance) | Estimated Insurance coverage Top class (Illustrative) |

|---|---|---|

| Same old Sedan | Blank Document | $1,000 – $1,500 in keeping with 12 months |

| Same old Sedan | A couple of Violations | $1,500 – $2,500 in keeping with 12 months |

| Sports activities Automobile | Blank Document | $1,500 – $2,500 in keeping with 12 months |

| Sports activities Automobile | A couple of Violations | $2,500 – $4,000 in keeping with 12 months |

| Luxurious SUV | Blank Document | $1,800 – $2,800 in keeping with 12 months |

| Luxurious SUV | A couple of Violations | $2,800 – $4,500 in keeping with 12 months |

Illustrative Situations for Nationwide Insurance coverage and Automobile Insurance coverage

Nationwide insurance coverage contributions, a an important part of an individual’s monetary profile, can considerably have an effect on automobile insurance coverage premiums. This phase items illustrative eventualities highlighting more than a few sides of this dating, encompassing value implications, claims procedures, insurer comparisons, and the precise demanding situations confronted by means of younger drivers and homeowners of specific automobile varieties. Those eventualities goal to offer a realistic working out of the way nationwide insurance coverage interacts with automobile insurance coverage insurance policies.Working out the correlation between nationwide insurance coverage and automobile insurance coverage prices is an important for knowledgeable decision-making.

Insurance coverage suppliers make the most of nationwide insurance coverage data to evaluate menace profiles, thereby impacting premiums. The following examples element how this interaction impacts other eventualities.

Situation: Nationwide Insurance coverage Affecting Automobile Insurance coverage Prices

Nationwide insurance coverage contributions immediately affect a driving force’s menace review. A driving force with a constantly excessive nationwide insurance coverage report, demonstrating accountable monetary control and a decrease probability of non-payment, will usually qualify for a decrease automobile insurance coverage top class. Conversely, a driving force with a historical past of inconsistencies or non-payment may face increased premiums because of the perceived increased menace. This displays the insurance coverage business’s observe of associating monetary accountability with a decrease likelihood of claims.

Insurers make the most of nationwide insurance coverage data as one issue amongst many to guage the possibility of long run claims.

Situation: Claims Procedure with Nationwide Insurance coverage as a Issue

In a state of affairs the place a declare is filed, nationwide insurance coverage data play a an important position within the claims procedure. If a driving force has a historical past of important and constant nationwide insurance coverage contributions, this may favorably affect the declare’s dealing with. Conversely, if the driving force’s data point out inconsistent or low contributions, it might rather have an effect on the claims procedure. The insurance coverage corporate may require further documentation or scrutiny of the declare, reflecting the perceived increased menace.

Insurers are certain to observe explicit regulatory frameworks relating to claims dealing with and are prohibited from discriminatory practices in accordance with nationwide insurance coverage data.

Situation: Insurance coverage Supplier Comparisons Relating to Nationwide Insurance coverage

Evaluating insurance coverage suppliers in accordance with nationwide insurance coverage issues is a key think about securing essentially the most appropriate coverage. Insurance coverage corporations regularly make use of other algorithms and weighting methods when comparing nationwide insurance coverage data. A driving force with a robust nationwide insurance coverage historical past may in finding one insurer gives a extra aggressive top class than some other. Comparative research throughout more than a few suppliers, taking into consideration their explicit insurance policies and nationwide insurance coverage review strategies, is an important to optimize insurance coverage prices.

Situation: Affect of Nationwide Insurance coverage on Insurance coverage for Younger Drivers

Younger drivers regularly face increased insurance coverage premiums because of their perceived increased menace profile. Alternatively, a tender driving force with a constantly sure nationwide insurance coverage report may doubtlessly protected a extra favorable top class. A historical past of accountable monetary conduct and constant contributions may just point out a decrease probability of long run claims. This showcases the possibility of nationwide insurance coverage to mitigate the generally increased menace related to younger drivers.

Situation: Nationwide Insurance coverage Affecting Insurance coverage for Particular Automobile Sorts

Insurance coverage prices for explicit automobile varieties will also be influenced by means of nationwide insurance coverage. A driving force with a robust nationwide insurance coverage report may protected a extra aggressive top class for a high-performance automobile. It is because insurers may understand a accountable driving force as much less more likely to have interaction in dangerous behaviors whilst using a high-performance automobile. The insurance coverage supplier’s review of the driving force’s menace profile, which incorporates their nationwide insurance coverage report, influences top class calculation for all automobile varieties.

For prime-risk cars, insurers will most probably use a extra stringent review in accordance with driving force profiles and nationwide insurance coverage data.

Ultimate Wrap-Up

In conclusion, Safety Nationwide Insurance coverage Corporate automobile insurance coverage gives a spread of choices to fit various wishes. Working out the affect of nationwide insurance coverage, using historical past, and automobile sort for your premiums is essential to securing the most efficient conceivable protection. This information supplies an in depth evaluation, empowering you to check insurance policies and make knowledgeable choices. Have in mind to completely analysis and evaluate other insurance coverage suppliers ahead of opting for a coverage.

Detailed FAQs

What components affect automobile insurance coverage premiums but even so nationwide insurance coverage?

Riding historical past, age, location, and automobile sort all give a contribution to the full value of your automobile insurance coverage. A blank using report usually ends up in decrease premiums, whilst older drivers and the ones in high-risk spaces may face increased prices. The worth and form of your automobile additionally have an effect on your premiums.

How does my nationwide insurance coverage standing have an effect on my automobile insurance coverage declare procedure?

Your nationwide insurance coverage standing may affect the declare procedure by means of impacting your protection limits or the specified documentation. Be sure you perceive the specifics of your coverage in terms of your nationwide insurance coverage.

What forms of automobile insurance policy choices are to be had?

Safety Nationwide Insurance coverage Corporate gives more than a few protection choices, together with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. Every choice supplies other ranges of coverage towards doable damages.

Are there any reductions to be had for automobile insurance coverage with Safety Nationwide Insurance coverage Corporate?

Safety Nationwide Insurance coverage Corporate may be offering reductions for more than a few components, corresponding to protected using conduct, accident-free data, or bundling different insurance coverage merchandise. Touch them immediately to be informed about to be had reductions.