Why is Michigan automotive insurance coverage so costly? This multifaceted factor stems from a posh interaction of things, together with particular Michigan-related riding conduct, demographics, and geographic location. Evaluating Michigan’s auto insurance coverage prices to these in surrounding states finds necessary insights into those variations. Working out those elements is the most important to greedy the pricing dynamics of Michigan’s auto insurance coverage marketplace.

More than a few elements give a contribution to the increased premiums in Michigan. Those come with the state’s laws, motive force demographics, automobile sorts, or even the practices of person insurance coverage firms. An in depth research of those parts is gifted beneath, providing a complete evaluate of the criteria that form Michigan’s auto insurance coverage panorama.

Elements Influencing Michigan Auto Insurance coverage Prices

Michigan’s auto insurance coverage premiums are steadily cited as some of the best within the country. This increased charge isn’t a monolithic phenomenon however quite stems from a posh interaction of more than a few elements. Working out those elements is the most important to comprehending the dynamics of the Michigan insurance coverage marketplace.

Riding Behavior and Visitors Patterns

Michigan’s roadways, together with its in depth community of highways and rural roads, revel in numerous visitors patterns and riding stipulations. Those elements affect the possibility of injuries. Prime-accident spaces, whether or not because of particular highway layouts, climate patterns, or motive force habits, give a contribution to larger insurance coverage prices for drivers in the ones areas. Upper coincidence charges at once correlate with larger insurance coverage premiums as insurers should catch up on larger claims.

Injuries in particular spaces, as an example, high-speed intersections or spaces with deficient visibility, are much more likely to lead to critical injury and expensive claims.

Demographics and Socioeconomic Elements

Michigan’s demographic profile, together with the distribution of age teams, gender, and socioeconomic standing, performs a task in figuring out insurance coverage prices. More youthful drivers, steadily with much less revel in and better coincidence charges, are most often assigned larger premiums. Conversely, older drivers, with demonstrably decrease coincidence charges, generally tend to have decrease premiums. Demographic elements, together with the focus of particular demographics in sure spaces, additionally have an effect on insurance coverage prices.

Moreover, the socioeconomic profile of a space can affect the kind of cars pushed and the extent of motive force consciousness, doubtlessly affecting insurance coverage charges. The presence of higher-risk drivers in a particular area can build up the total insurance coverage charge for everybody in that space.

Geographic Location and Local weather

Michigan’s numerous geographic panorama, encompassing city spaces, suburban areas, and rural places, introduces diversifications in riding stipulations. Particular places with excessive coincidence charges, deficient visibility, or hazardous climate stipulations steadily incur larger insurance coverage premiums. The frequency and severity of weather-related injuries, like the ones related to ice and snow, additionally give a contribution to raised premiums in Michigan. Geographic places with a excessive focus of visitors, high-speed roads, or different high-risk riding stipulations revel in larger premiums.

Rural spaces, steadily characterised through longer distances between cities, too can give a contribution to raised premiums because of larger riding distances and doubtlessly slower reaction occasions in emergency eventualities.

Automobile Utilization and Kind

The varieties of cars drivers use and the frequency in their use affect insurance coverage premiums. Prime-performance cars or the ones with excessive restore prices steadily lift larger premiums. Moreover, the frequency of car utilization, whether or not for private or industrial functions, affects charges. Drivers who use their cars for industrial or common long-distance commute steadily face larger premiums than those that essentially use their cars for private transportation.

Moreover, particular automobile fashions with a better propensity for injuries, robbery, or vandalism, will impact the price of insurance coverage.

Comparability to Different States

Michigan’s auto insurance coverage prices are steadily in comparison to the ones in neighboring states. Elements such because the state’s riding stipulations, demographics, and regulatory environments all play a task in figuring out premiums. Comparative research of neighboring states’ charges may give a relative measure of Michigan’s auto insurance coverage prices, providing a clearer working out of the contributing elements. A complete comparability throughout more than a few demographics and automobile sorts would supply a nuanced viewpoint on Michigan’s insurance coverage panorama.

Desk: Elements Influencing Michigan Auto Insurance coverage Prices

| Issue | Rationalization | Possible Affect on Charges |

|---|---|---|

| Riding Behavior | Frequency and severity of injuries, riding stipulations, and motive force habits in more than a few areas. | Upper coincidence charges at once result in larger premiums. |

| Demographics | Age, gender, socioeconomic standing, and focus of particular demographics in sure spaces. | More youthful drivers most often face larger premiums because of larger coincidence charges. |

| Geographic Location | Numerous riding stipulations, climate patterns, coincidence charges, and visitors quantity in numerous spaces. | Spaces with excessive coincidence charges or hazardous climate stipulations have larger premiums. |

| Automobile Utilization and Kind | Frequency of car utilization, form of automobile, and automobile’s restore prices. | Prime-performance cars or the ones with excessive restore prices steadily have larger premiums. |

Kinds of Automotive Insurance coverage in Michigan

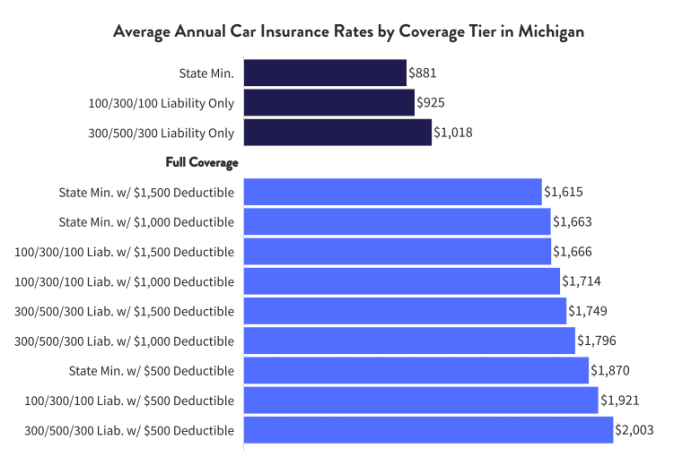

Michigan’s auto insurance coverage panorama encompasses more than a few protection choices designed to offer protection to policyholders from monetary liabilities related to automobile injuries. Working out those sorts is the most important for making knowledgeable choices relating to insurance coverage premiums and good enough coverage. Correct variety guarantees drivers are financially ready for attainable damages and felony duties.

Legal responsibility Protection

Legal responsibility insurance coverage is a elementary part of Michigan’s auto insurance coverage necessities. It safeguards policyholders in opposition to claims coming up from damages inflicted on others in injuries. This protection will pay for the opposite birthday party’s scientific bills and assets injury. Michigan mandates a minimal legal responsibility protection, pleasant statutory necessities and protective in opposition to monetary burdens.

Collision Protection

Collision insurance coverage compensates for damages to the insured automobile irrespective of fault. This protection is precipitated when the insured automobile collides with any other automobile or an object. It’s distinct from legal responsibility protection, which makes a speciality of the opposite birthday party’s damages. Collision protection gives coverage in opposition to restore or alternative prices of the insured automobile, irrespective of who led to the coincidence.

This sort of protection steadily comes with a deductible quantity, which the policyholder should pay sooner than the insurance coverage corporation reimburses the rest bills.

Complete Protection

Complete protection extends past collision protection through protective the insured automobile from non-collision incidents. This protection is precipitated through occasions corresponding to robbery, vandalism, hearth, hail, or different unexpected instances indirectly associated with a collision. It supplies monetary recourse for maintenance or replacements stemming from those occasions, shielding the policyholder from all the monetary burden.

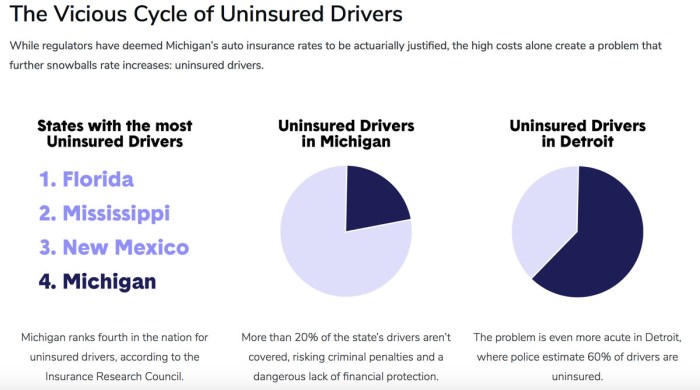

Uninsured/Underinsured Motorist Protection

Uninsured/underinsured motorist (UM) protection is a the most important side of Michigan auto insurance coverage. This protection protects the policyholder in instances the place the at-fault motive force lacks enough insurance coverage or is uninsured. It covers scientific bills, misplaced wages, and assets injury attributable to injuries involving uninsured or underinsured drivers. The supply of this protection is very important in instances the place the opposite birthday party’s insurance coverage is inadequate to hide all damages.

Protection Limits and Necessities

Michigan mandates minimal protection limits for legal responsibility insurance coverage. Exceeding those minimums gives enhanced coverage and safeguards in opposition to monetary dangers. Policyholders will have to moderately assess their wishes and make a choice protection limits that align with their monetary instances and attainable liabilities. Coverage limits and necessities range through person eventualities. Policyholders will have to visit insurance coverage suppliers to know the fitting limits for his or her wishes and fiscal status.

Comparability of Protection Sorts

| Protection Kind | Description | Implications for Insurance coverage Prices |

|---|---|---|

| Legal responsibility | Covers damages to others | Normally the bottom charge protection, however minimal necessities exist |

| Collision | Covers damages to the insured automobile, irrespective of fault | Can build up insurance coverage prices relying at the automobile’s price and deductible |

| Complete | Covers damages to the insured automobile from non-collision occasions | Can build up insurance coverage prices relying at the automobile’s price and deductible |

| Uninsured/Underinsured Motorist | Covers damages from injuries involving uninsured or underinsured drivers | Most often will increase insurance coverage prices, however is very important for defense |

Riding Behavior and Insurance coverage Premiums

Riding conduct considerably affect auto insurance coverage premiums in Michigan, as insurers assess menace profiles to decide suitable protection prices. Drivers showing high-risk behaviors face larger premiums because of the heightened probability of injuries and claims. This menace evaluation is a essential part of the insurance coverage pricing type, aiming to stability the price of protection with the predicted frequency and severity of claims.

Affect of Dangerous Riding Behaviors

Motor automobile insurance coverage premiums are steadily adjusted according to elements reflecting riding conduct and attainable coincidence dangers. It is a the most important part within the actuarial modeling utilized by insurance coverage firms to worth insurance policies appropriately. Drivers who constantly display reckless or irresponsible riding conduct are prone to incur larger premiums.

Examples of Prime-Possibility Riding Behaviors

A number of behaviors build up the danger profile of drivers, leading to larger premiums. Those behaviors come with rushing, competitive riding, and a historical past of visitors violations. Riding drunk or medicine is a in particular major factor, because it dramatically will increase the chance of injuries. Moreover, common shifting violations, corresponding to rushing tickets or reckless riding convictions, additionally considerably have an effect on insurance coverage charges.

Claims Historical past Affect

A motive force’s claims historical past is a essential think about figuring out insurance coverage premiums. A historical past of more than one injuries or claims signifies a better menace profile, resulting in larger premiums. This displays the statistical truth that drivers with a historical past of injuries are much more likely to record long term claims, impacting the total charge of insurance coverage.

Dating Between Riding Behaviors and Top class Will increase

The desk beneath illustrates the possible have an effect on of more than a few riding behaviors on Michigan auto insurance coverage premiums. It represents a normal development and person effects might range.

| Riding Conduct | Description | Possible Top class Building up (%) |

|---|---|---|

| Dashing Tickets | More than one rushing tickets inside of a particular duration | 10-30% |

| Injuries | Historical past of at-fault injuries | 20-50% |

| DUI/DWI | Riding Beneath the Affect/Riding Whilst Intoxicated | 50-100% + |

| Competitive Riding | Constant competitive riding behaviors (e.g., tailgating, unexpected lane adjustments) | 15-25% |

| Transferring Violations | More than one shifting violations, together with reckless riding, or different visitors violations | 10-40% |

| Teenager Driving force | Younger drivers, particularly the ones underneath 25, steadily face larger premiums because of larger coincidence charges. | 20-60% |

Be aware: The share build up in top class is a normal estimate. Exact will increase might range according to person instances, insurer insurance policies, and different elements corresponding to automobile sort and placement.

Demographics and Insurance coverage Prices

Demographic elements considerably affect automotive insurance coverage premiums in Michigan, along different elements like automobile sort and riding historical past. Working out those correlations is the most important for people in search of to control their insurance coverage prices successfully. Insurance coverage firms make the most of statistical fashions that believe more than a few demographics to evaluate menace profiles and modify premiums accordingly.Insurance coverage premiums don’t seem to be static and range according to a lot of elements.

Age, gender, and placement, together with riding revel in, are key determinants of menace evaluation, that are mirrored in insurance coverage charges. People with a better perceived menace profile steadily face larger premiums.

Age and Insurance coverage Premiums

More youthful drivers are most often assigned larger insurance coverage premiums than older drivers. That is because of statistically demonstrated larger coincidence charges amongst more youthful drivers, reflecting a loss of riding revel in and doubtlessly riskier riding behaviors. The upper premiums catch up on the larger menace posed through this demographic. As an example, a 16-year-old motive force will usually have considerably larger premiums in comparison to a 35-year-old motive force, different elements being equivalent.

This disparity is steadily observed as a vital measure to control the danger pool.

Gender and Insurance coverage Prices

Traditionally, there were minor variations in insurance coverage premiums between genders. Whilst gender-based distinctions are steadily challenged, some research recommend slight diversifications in riding conduct and coincidence charges that would possibly provide an explanation for those variations. Then again, those variations are most often now not important sufficient to warrant really extensive disparities in premiums in fashionable occasions.

Location inside of Michigan and Insurance coverage Premiums

Geographical location inside of Michigan too can have an effect on insurance coverage premiums. Spaces with larger charges of injuries or particular varieties of high-risk riding stipulations could have larger insurance coverage prices for drivers living in the ones spaces. As an example, densely populated city spaces with a excessive focus of intersections or high-speed roads would possibly revel in larger coincidence charges, which can result in larger insurance coverage premiums for drivers in the ones areas.

Conversely, drivers in rural spaces would possibly have decrease premiums.

Riding Revel in and Insurance coverage Prices

Riding revel in is a the most important determinant of insurance coverage premiums. Newly approved drivers, missing really extensive revel in at the highway, steadily face considerably larger premiums in comparison to drivers with a few years of secure riding historical past. That is a right away mirrored image of the diminished menace related to in depth riding revel in. Insurance coverage firms usually praise secure riding historical past with decrease premiums.

As an example, a motive force with a blank riding report of 10 years will most probably have decrease premiums than a brand new motive force with out a riding historical past.

Abstract Desk: Demographic Affect on Premiums

| Demographic Issue | Impact on Premiums | Instance |

|---|---|---|

| Age (more youthful) | Upper premiums | 16-year-old motive force vs. 50-year-old motive force |

| Gender | Minor distinction, steadily insignificant | No important distinction seen in fresh research |

| Location (high-accident space) | Upper premiums | City space with common injuries vs. rural space |

| Riding Revel in (new motive force) | Upper premiums | Lately approved motive force vs. skilled motive force |

Automobile Kind and Insurance coverage Premiums

Automobile sort considerably influences Michigan auto insurance coverage prices. Other cars provide various dangers, requiring other ranges of protection. Elements such because the automobile’s price, options, and historic coincidence records all give a contribution to the calculated menace profile. Insurance coverage firms use this menace evaluation to decide the fitting top class for every policyholder.Automobile options and price at once have an effect on insurance coverage premiums.

Luxurious cars, sports activities vehicles, and high-performance fashions steadily include larger premiums because of their larger menace of wear and tear and robbery. Conversely, economical and less-expensive cars most often have decrease premiums. The perceived price of a automobile, whether or not actual or perceived, is a key determinant in atmosphere insurance coverage charges.

Automobile Options and Top class Affect, Why is michigan automotive insurance coverage so costly

Automobile options at once affect insurance coverage prices. Options like anti-theft programs, complex airbags, and digital balance keep watch over are steadily related to diminished premiums. Those options mitigate the danger of injuries and robbery, resulting in decrease premiums for the insured. Conversely, cars missing those security features could have larger premiums because of a perceived larger menace.

Automobile Price and Insurance coverage Premiums

The worth of a automobile performs a the most important position in figuring out insurance coverage premiums. Prime-value cars are usually costlier to insure, reflecting the possible monetary loss in case of robbery or injury. This larger charge is because of the upper payout quantity required for insurance coverage claims. Conversely, lower-value cars have decrease premiums on account of the decrease payout related to attainable claims.

This courting is particularly glaring for more moderen fashions and cars provided with high-end options, the place the worth steadily justifies the upper insurance coverage top class.

Dating Between Automobile Kind and Premiums

The desk beneath illustrates the connection between automobile sort and the ensuing insurance coverage top class. You will need to word that those are illustrative examples and precise premiums might range according to person instances.

| Automobile Kind | Top class (Illustrative Instance) | Reasoning |

|---|---|---|

| Luxurious Sedan | $2,000 | Upper price and attainable for larger restore prices. |

| Compact Automotive | $1,200 | Decrease price and most often fewer security features, however nonetheless relying on type. |

| Sports activities Automotive | $1,800 | Upper functionality, doubtlessly larger menace of injuries. |

| SUV | $1,500 | Possible for larger restore prices because of higher measurement and extra options, however can range according to particular type. |

| Economic system Automotive | $800 | Decrease price and less options, thus a decrease attainable for loss. |

Insurance coverage Corporate Practices and Charges

Insurance coverage firms make use of numerous pricing methods to ascertain aggressive premiums within the Michigan auto insurance coverage marketplace. Those methods are influenced through more than a few elements, together with menace evaluation methodologies, operational prices, and marketplace festival. Working out those practices is the most important for shoppers to judge and evaluate to be had choices.

Pricing Methods of Other Insurance coverage Corporations

Michigan’s auto insurance coverage marketplace contains a number of primary and smaller insurance coverage suppliers. Each and every corporation makes use of distinct approaches to figuring out premiums, leading to various charges for equivalent insurance policies. Elements corresponding to underwriting requirements, claims dealing with procedures, and funding methods give a contribution to those variations. Corporations with decrease operational prices might be offering decrease premiums, whilst the ones with stringent underwriting necessities would possibly rate larger charges.

Elements Contributing to Charge Permutations Amongst Insurance coverage Corporations

A large number of elements give a contribution to the variations in charges between insurance coverage firms. Underwriting requirements, which overview person menace profiles, play a vital position. Corporations with stricter requirements for approving candidates or figuring out high-risk drivers generally tend to rate larger premiums. Claims dealing with practices additionally have an effect on charges. Corporations identified for swift and environment friendly claims processing might be offering extra aggressive premiums.

Funding methods affect monetary balance, doubtlessly affecting the pricing construction. Corporations with tough funding portfolios could have the monetary flexibility to provide decrease premiums. After all, company-specific operational prices and benefit margins impact the pricing methods.

Pageant within the Michigan Auto Insurance coverage Marketplace

Pageant amongst insurance coverage firms is a key part within the Michigan auto insurance coverage marketplace. This aggressive panorama drives firms to innovate and modify their pricing methods to draw shoppers. Corporations striving for marketplace percentage would possibly be offering aggressive premiums or adapted coverage choices to realize a bigger visitor base. The presence of more than one insurers out there promotes a extra numerous vary of goods and pricing choices, reaping rewards shoppers.

Pageant additionally encourages firms to strengthen provider high quality and potency to retain shoppers.

Abstract of Pricing Methods of Main Insurance coverage Suppliers

| Insurance coverage Corporate | Pricing Technique Review | Key Elements Affecting Charges |

|---|---|---|

| Modern | Incessantly emphasizes reductions for secure riding conduct and bundled products and services. Might make the most of a extra data-driven manner for menace evaluation. | Driving force protection ratings, automobile sort, claims historical past, location. |

| State Farm | Usually identified for a complete vary of services and products. Might emphasize group involvement and fiscal balance. | Riding historical past, automobile traits, coverage add-ons. |

| Allstate | Normally gives a vast vary of services and products with a focal point on customer support and claims dealing with. | Claims frequency, riding report, automobile sort. |

| Vacationers | Identified for a lot of insurance coverage choices and aggressive pricing. Can have a robust presence in particular geographic areas. | Geographic location, claims historical past, motive force profile. |

| Geico | Emphasizes a customer-centric manner with more than a few reductions. Incessantly makes use of generation and knowledge research to control menace. | Riding report, automobile sort, reductions and incentives. |

State Rules and Insurance coverage Prices

Michigan’s auto insurance coverage laws considerably affect coverage pricing. Those laws, whilst supposed to offer protection to shoppers and make sure a definite stage of economic duty, steadily give a contribution to the total charge of insurance coverage. Working out those laws is the most important to comprehending the criteria riding Michigan’s auto insurance coverage premiums.State laws dictate the minimal ranges of protection required for all drivers. Those mandated coverages, together with any further necessities imposed through the state, have an effect on the total charge of insurance coverage insurance policies.

Policyholders are legally obligated to care for those minimal coverages, making them a vital attention for insurers. Permutations within the particular laws amongst states can at once translate into variations in insurance coverage prices.

Necessary Coverages and their Affect

Michigan mandates particular varieties of auto insurance plans. Those obligatory coverages are designed to offer protection to drivers and different events inquisitive about injuries. The specified ranges of protection, in flip, affect the volume of menace insurers face and thus, the cost of premiums.

- Physically Damage Legal responsibility (BIL): This protection compensates folks injured in an coincidence led to through the policyholder. Michigan’s obligatory minimums for BIL are designed to supply a definite stage of economic coverage to coincidence sufferers. Upper minimums steadily correlate with larger premiums.

- Assets Injury Legal responsibility (PDL): This protection reimburses the price of damages to someone else’s assets if the policyholder is at fault. The required minimal for PDL in Michigan at once impacts the price of insurance coverage, as insurers want to account for the possible monetary burden related to paying for injury to quite a lot of cars and assets sorts.

- Uninsured Motorist Protection (UM): This protection safeguards the policyholder if they’re injured in an coincidence with an uninsured or hit-and-run motive force. Michigan’s UM necessities be certain some stage of coverage for drivers in such eventualities. The supply and extent of this protection, together with the required minimal, at once impacts top class prices.

State-Mandated Coverages Expanding Prices

Sure state-mandated coverages can carry insurance coverage premiums. Those mandates mirror the state’s dedication to making sure enough monetary coverage for all events inquisitive about an coincidence. Examples of such coverages and their attainable have an effect on on prices come with:

- Private Damage Coverage (PIP): This protection addresses scientific bills and misplaced wages for the policyholder and passengers in an coincidence. Michigan’s PIP necessities, together with the protection quantity and barriers, can have an effect on insurance coverage premiums because of the possible payouts related to this protection.

- Med-Pay: This protection covers scientific bills attributable to an coincidence, irrespective of fault. Michigan’s necessities for Med-Pay protection upload to the total charge of insurance coverage, reflecting the state’s dedication to making sure get entry to to scientific take care of coincidence sufferers.

Affect of Rules on Insurance coverage Corporate Practices

State laws considerably impact insurance coverage firms’ underwriting practices and top class calculations. The mandated coverages and their limits, together with every other state necessities, at once affect the danger evaluation performed through insurers. This evaluation performs a essential position in figuring out the fitting top class charges.

“Insurers should calculate the possible monetary burden related to more than a few coincidence eventualities, factoring within the obligatory coverages and their limits.”

The various ranges of required protection throughout other states at once affect the price of insurance coverage insurance policies. A state with larger minimal necessities for coverages will most probably result in larger premiums in comparison to a state with decrease minimums. Michigan’s particular necessities, subsequently, are a considerable issue within the total charge of car insurance coverage.

Protection Options and Insurance coverage Charges: Why Is Michigan Automotive Insurance coverage So Pricey

Automobile security features play a vital position in figuring out Michigan auto insurance coverage premiums. The presence and class of those options at once correlate with the possibility of an coincidence and the severity of attainable damages. Insurance coverage firms use this knowledge to evaluate menace and modify premiums accordingly. This courting is the most important for working out the total charge of insurance coverage within the state.Complex protection applied sciences, corresponding to airbags, anti-lock brakes (ABS), digital balance keep watch over (ESC), and lane departure caution programs, demonstrably cut back the possibility and severity of injuries.

This diminished menace is a key think about how insurance coverage firms calculate premiums. Via incorporating security features into their menace evaluation fashions, insurers can be offering extra aggressive charges to drivers who display a dedication to protection.

Affect of Protection Options on Twist of fate Possibility

Security measures in cars at once have an effect on the chance and severity of injuries. Research have constantly proven a correlation between the presence of complex protection applied sciences and a lower in coincidence frequency and severity. The inclusion of options like airbags, anti-lock brakes, and digital balance keep watch over reduces the possibility of collisions and, when injuries happen, steadily mitigate the have an effect on and resultant injury.

Protection Options and Their Affect on Top class Prices

| Protection Function | Affect on Top class Prices | Rationalization |

|---|---|---|

| Airbags | Normally decrease premiums | Airbags considerably cut back the danger of harm in a collision. |

| Anti-lock Braking Machine (ABS) | Doubtlessly decrease premiums | ABS lets in for higher keep watch over throughout braking maneuvers, lowering the possibility of skidding and collisions. |

| Digital Balance Keep an eye on (ESC) | Doubtlessly decrease premiums | ESC prevents lack of automobile keep watch over throughout evasive maneuvers, bettering balance and lowering the danger of injuries. |

| Lane Departure Caution Programs | Doubtlessly decrease premiums | Those programs can assist save you accidental lane adjustments and collisions through alerting the driving force to attainable dangers. |

| Adaptive Cruise Keep an eye on | Doubtlessly decrease premiums | Via keeping up a secure following distance and robotically adjusting velocity, this selection reduces the possibility of rear-end collisions. |

| Blind Spot Tracking | Doubtlessly decrease premiums | Supplies a caution when any other automobile is within the motive force’s blind spot, reducing the danger of lane adjustments that result in injuries. |

The desk above supplies a normal evaluate of the possible have an effect on of security features on insurance coverage premiums. The precise relief in prices can range relying at the particular options, the type yr of the automobile, and the insurance coverage corporation’s evaluation of menace.

Price-Saving Methods for Michigan Drivers

Prime auto insurance coverage premiums in Michigan are a priority for lots of drivers. Working out the criteria contributing to those prices, and enforcing tremendous cost-saving methods, can considerably cut back monetary burdens. Imposing those methods may end up in really extensive financial savings, permitting drivers to allocate price range to different monetary wishes.

Making improvements to Riding Behavior

Riding conduct play a vital position in insurance coverage premiums. Secure riding practices demonstrably decrease coincidence menace and, in consequence, insurance coverage prices. Keeping up a constant riding report, unfastened from visitors violations and injuries, is paramount.

- Defensive Riding Tactics: Training defensive riding tactics, corresponding to keeping up secure following distances, expecting attainable hazards, and averting competitive riding maneuvers, can dramatically cut back the danger of injuries. This proactive manner considerably reduces the possibility of claims, leading to decrease insurance coverage premiums.

- Secure Pace Practices: Adhering to hurry limits and averting rushing, in particular in congested spaces or throughout inclement climate, at once correlates with diminished coincidence menace. This adherence to secure velocity practices demonstrably reduces the chance of collisions and related insurance coverage claims.

- Averting Distracted Riding: Minimizing distractions whilst riding, corresponding to the usage of mobile phones, consuming, or adjusting the radio, can considerably decrease coincidence menace. The observe of getting rid of distractions throughout riding complements motive force focus and application, resulting in more secure riding stipulations and decrease insurance coverage prices.

Securing Inexpensive Insurance coverage Choices

Quite a lot of insurance coverage choices exist in Michigan. Via moderately evaluating quotes from more than a few insurance coverage suppliers, drivers can determine essentially the most cost-effective plan.

- Comparability Buying groceries: A essential step comes to evaluating quotes from other insurance coverage suppliers. Using on-line comparability gear and contacting more than one insurers is very important. Those gear be offering a streamlined procedure for evaluating protection choices and charges, facilitating knowledgeable decision-making.

- Bundling Insurance coverage Merchandise: Bundling auto insurance coverage with different insurance coverage merchandise, corresponding to householders or renters insurance coverage, can steadily result in discounted charges. This bundled manner may end up in important charge financial savings.

- Reductions: Investigating and leveraging to be had reductions, corresponding to the ones for secure riding data, anti-theft units, or scholar standing, is the most important. Profiting from to be had reductions may end up in really extensive financial savings on insurance coverage premiums.

Automobile Protection Options and Insurance coverage Prices

The presence of complex security features in a automobile can at once have an effect on insurance coverage premiums. Insurance coverage firms steadily be offering reductions for cars provided with options that make stronger protection and cut back coincidence menace.

- Protection Options: Automobiles provided with complex security features, corresponding to airbags, anti-lock brakes, digital balance keep watch over, and collision avoidance programs, steadily qualify for reductions. Those options demonstrably make stronger motive force protection and cut back the danger of collisions, thereby decreasing insurance coverage premiums.

Reviewing Protection Wishes

Cautious analysis of protection wishes is important. Insurance coverage insurance policies steadily come with not obligatory add-ons that will not be vital. Reviewing protection necessities and getting rid of pointless protection can result in charge discounts.

- Protection Analysis: Assessing the extent of protection required is the most important. Comparing present wishes and evaluating other protection ranges lets in drivers to optimize protection with out pointless bills. This analysis guarantees the selected coverage appropriately displays present wishes and avoids pointless premiums.

- Pointless Protection Removal: Figuring out and getting rid of pointless protection choices can result in really extensive charge discounts. Sparsely comparing not obligatory add-ons and pointless protection can considerably cut back premiums with out compromising very important coverage.

Finishing Remarks

In conclusion, Michigan’s auto insurance coverage prices are a results of a mixture of things. Those vary from state laws and motive force demographics to automobile sorts and insurance coverage corporation practices. Whilst the prices are undeniably excessive, working out the contributing components lets in for knowledgeable decision-making and doubtlessly the id of cost-saving methods. In the long run, the complexities of the Michigan auto insurance coverage marketplace spotlight the significance of thorough analysis and proactive measures to control insurance coverage bills.

Skilled Solutions

What’s the have an effect on of location inside of Michigan on insurance coverage premiums?

Geographic location inside of Michigan can affect insurance coverage charges because of elements like coincidence frequency and severity in particular spaces. Spaces with larger coincidence charges or publicity to difficult riding stipulations might lead to larger premiums.

How do claims historical past and coincidence data impact automotive insurance coverage prices in Michigan?

A historical past of claims and injuries considerably affects automotive insurance coverage premiums in Michigan. Each and every declare or coincidence most often ends up in a better top class, reflecting the danger related to the driving force’s previous habits.

What are the commonest varieties of automotive insurance plans in Michigan?

Commonplace coverages come with legal responsibility, collision, complete, and uninsured/underinsured motorist protection. The precise protection limits and necessities are established through Michigan regulation, and those have an effect on top class quantities.

Are there particular reductions to be had for Michigan drivers to decrease their insurance coverage prices?

A number of reductions could also be to be had to Michigan drivers, together with the ones for secure riding data, anti-theft units, and defensive riding lessons. Insurance coverage firms steadily publicize their to be had reductions to inspire cost-effective insurance coverage choices.